Which sector will prevail in the current market?

In an economically uncertain environment subject to policy-driven volatility, the underperformers would be high beta stocks such as the technology sector. The friction and tension surrounding the US-China trade war uncertainty has dampened the forecasted earnings of technology companies such as Apple who recently revised their first quarter earnings forecast. This redection in profitability has had its roots in the trade disruption which has had a direct impact on the operating costs of the company. The increased trade risks and risk premiums are reflected in the equity prices of technology stocks.

Nevertheless, the two main economic indicators of recessions – rising unemployment and yield curve inversion - are still absent with the yield curve remaining flat and unemployment falling, it is reasonable to assume that the U.S. economy will not, barring any major eventualities go into recession in 2019. Despite the current market conditions, investors are vulnerable to fears of an impending downturn and often turn to equity with a record of strong performance in terms of sustainable growth, clean balance sheets and good cash flows. One sector which may meet these conditions may be the Telecomm sector. Firstly, the Telecomm sector has an increase in growth potential due to the 5G data plan which Telecomm giants such as AT&T and Verizons are investing heavily in. Beyond that, the consistently high dividend yields (5.5%) in 2018 attract investors who are looking for stability and sustainable returns amidst increasingly chaotic economic conditions.

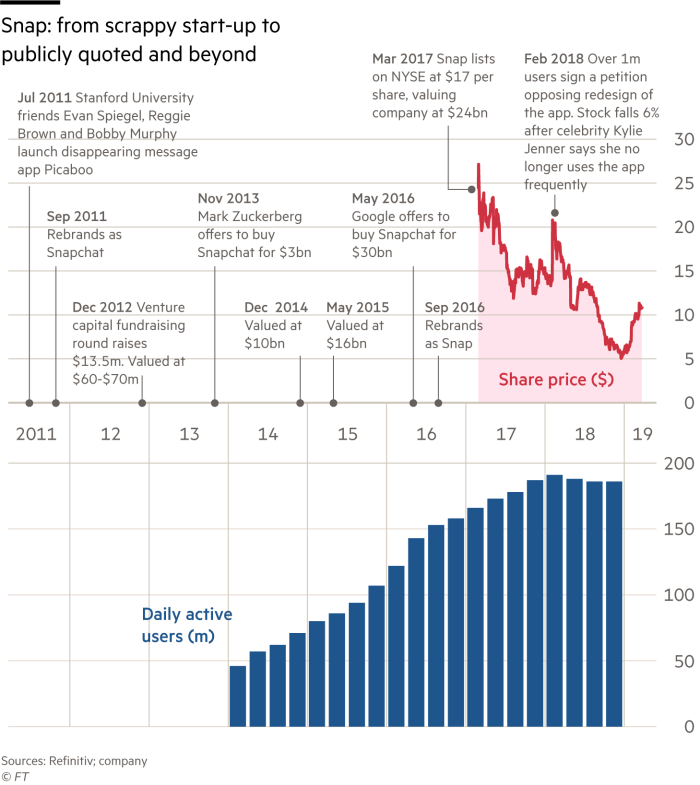

In June 2018, I did a stock pitch on AAPL (Apple stock) during which I proposed shorting the AAPL stock due to how overvalued it was. Taking the results from a Discounted Cash Flow (DCF) analysis and a Canonical Correspondence Analysis (CCA), along with the lowered sales figure for the latest iPhone and iPad models, I concluded that AAPL was likely to underperform and drop in valuation in a Next Twelve Month (NTM) outlook. This stock pitch held true in the Oct 18 stock sell-off, during which there was an equity self-off of technology stocks, with the tech heavy NASDAQ benchmark having its worst quarterly loss since the 08-09 Global financial Crisis.

I would like to talk further about the highly volatile Technology sector. Let us use the Tech-heavy NASDAQ index as a benchmark to measure the aggregated performance for the Tech sector.

Observing the NASDAQ index, you will see three major equity sell-off periods – Feb, October and December. Comparing this with the VIX index, you will observe that the same 3 periods stood out as periods of high volatility and high market fear.

Overall, the performance of the Tech sector suffered, particularly due to the existing trade war between the U.S. and China, where tariffs have been enforced on tech goods.

The February sell-off originated from increasing wage pressures (inflation), where investors expected the Fed to raise interest rates. The fact that the seemingly positive news of rising wages would be treated as bad news, is a sign of a late-stage bull market. Investors began suspecting that the financial conditions would tighten and this led to a harsh equity sell-off, particularly for tech stocks due to the commonly held view that tech stocks are overvalued.

The October Tech-stock stemmed from the Fed increasing its funds rate (conversely interest rates). Coupled with lowered earnings due to the trade war between U.S. and China, where operating profits of tech companies took a hit. Similarly, the Dec sell-off stemmed from the rise in Fed fund target rates. This sell-off may have been due a change in investor’s views regarding the U.S. economy (i.e. it has reached a peak).

The 2019 outlook for technology company stock will likely be turbulent, depending on which part of the tech sector a company is involved in. The performance of tech stocks will depend on their innovation and their ability to keep up with investor’s expectations of high earnings.