A deep dive on tech

In this week’s issue, we take a closer look at how major stock indexes have been affected worldwide due to a variety of drivers, in particular with what is going on in the European and US markets but we also have an opinion on Chinese indexes following suspension of the Ant Group IPO, due to have been the record-breaking IPO with $37 billion USD raised from institutional investors. Here is a look at technology in global markets through the lens of stock indices.

Europe

As for some recent especially recent news, STOXX Europe 600 (a European stock index) fell almost 6% this week. This pushed the index to its lowest point since May this year. We can likely attribute this to the fact that investors reacted to the further lockdown measures being announced due to the second wave of COVID-19 in countries like Spain and Italy, and now also the England national lockdown, as well as the upcoming presidential election.

The negative impact to European markets was especially prominent in the software giant’s, SAP SE’s, 20% drop in share price last week. This cloud based business operations company saw a far worse-than-expected third-quarter earnings update. Its shift from license software (with a one-time upfront payment) to the more typical subscription based cloud infrastructure means that profits will flow in less quickly. Furthermore, the German company said “Lockdowns have been reintroduced in some regions, recovery is uneven and companies are facing more business uncertainty.” Its mid-sized (businesses) clients were, as a result of COVID-19, moving towards cloud causing a need to improve on their services. Christian Klein, one of the two new CEOs of the firm, said “We will speed up the modernisation of our cloud delivery infrastructure, this will require additional investments in 2021 and 2022, but it sets us up for a cloud cost margin of approximately 80 percent by 2025.” This added investment into the software combined with the reduced revenues shot down SAP’s share price. However, Jefferies analysts say that the subscription services could make up to 85% of turnover by 2025; so it’s not all doom and gloom!

The reason we dive into SAP SE is that it is Europe’s largest software company, and the STOXX Europe 600 Technology Index (an analog of NASDAQ for Europe) fell 10.5% over the past week. Looking at the companies and contributors of a stock index can help us more easily understand the movements of the index itself as these trends can often apply to similar companies.

US

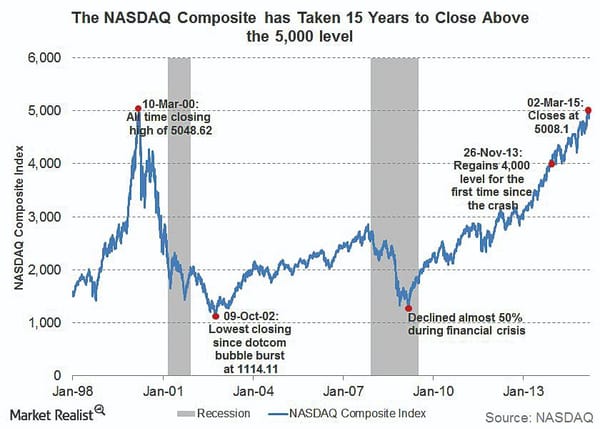

Again looking at technology, the USbased tech heavy NASDAQ index was down 5.5% this week despite the big tech companies doing well after revealing their Q3 earnings reports. As I mentioned above, it is important to look at the actual companies which contribute to a stock index; 49% of the NASDAQ 100 is governed by Apple, Microsoft, Amazon, Facebook, Alphabet (AKA Google), and Tesla. These companies have been through a lot over the past 2 weeks, from growing pains related to the pandemic, to antitrust issues, the Section 230 hearing and electoral politics. Despite this, they are booming due to the rising market for online advertising and the obvious increase in screen time. “All of these companies have just returned an absolute killer of a quarter,” said Youssef Squali, an internet analyst at Truist. “The recovery curve is just a lot sharper than any of us expected. Online is taking a tonne of market share from offline.”

The contentious hearing on Wednesday was truly a roller coaster. Roger Wicker, a Republican senator, opened the hearing by accusing Twitter and the other platforms of “selective censorship . . . in the midst of the 2020 election cycle”. (continued on the next page) This is because a New York Post tweet was taken down as it looked like a hacked tweet. On the other hand, Tammy Baldwin, Wisconsin Democrat senator, said “I believe the Republicans have called this hearing in order to support a false narrative fabricated by the president to help his re-election prospects, the tech companies here today need to take more action, not less.” Outside of political debate, the hearing served as an evaluation of Section 230 of the 1996 Communications Decency Act, a law that gives tech platforms immunity from being sued over user-generated content. Speaking to Section 230, Mark Zuckerberg called on Congress to “update the law to make sure it’s working as intended”. On the other hand Jack Dorsey said that eroding the foundation of Section 230 could collapse how we communicate on the internet, leaving only a small number of giant and well-funded technology companies.” This would be a terrible situation for tech companies worldwide if not dealt with carefully. Furthermore, the hearing could result in additional pressure on companies to more carefully censor political ads which could have an impact on the election. However, the latest polling average puts Biden ahead of Trrrrrrrrump nationally but again this does not guarantee a Democrat victory.