Books for intellectual City type sellouts

A review of some classic and pertinent finance titles

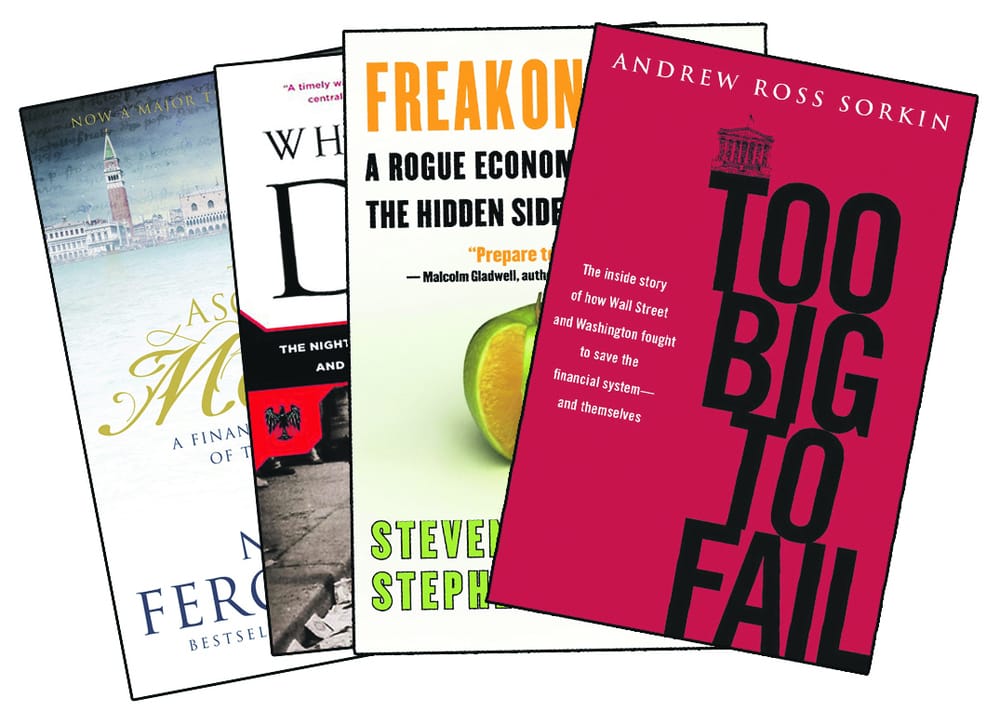

The only function of economic forecasting is to make astrology look respectable” said Ezra Solomon. For more funny lines from ivory tower economists, the fantastic ‘Freakonomics’ and ‘Superfreakonomics’ books by Steven Levitt and Stephen Dubner (both £5.30 from Amazon, £7,99 for kindle) show the power of economics in real world situations. With chapter titles such as “Why are Street Prostitutes like Department Store Santas,” you can be sure it’s very irreverent in tone. They’re written for a general, wide audience and are delightful introduction books to the field of economics in general.

Another brilliant book for beginners is ‘The Ascent of Money’ by Niall Ferguson (£5.69) that came out to accompany an equally brilliant television series of the same name. Ferguson is a professor of history at Harvard, and his book describes the history of money from the ancient Middle East, through to gold rushes, to the new world in the late medieval ages, the mighty renaissance power houses of Italy, and right up to the fascinating story of Long Term Capital Management and then the big bad Credit Crunch. Furthermore it also offers beginners-guide level explanations to bonds, shares and monetary theory, and does so well enough to be useful as a reference (I always forget what bond yields are) The TV series is easy to find online for either streaming or downloading, and makes for brilliant viewing.

‘Too Big to Fail’ (£8.49, £9.99 on Kindle) is a book of War and Peace proportions, in fact if you own a Kindle, this is probably the time to use it. Charting the entire Credit Crunch beginning with the aftermath of the fire sale of Bear Stearns, it tells the entire saga of Lehman Brothers’ ungainly toppling over, Merrill Lynch’s sale to Bank of America, the near explosion of AIG and the international response from governments and regulators, focusing mainly on the New York Fed and the Treasury. Written by the New York Times financial columnist Andrew Ross Sorkin, the foreword claims to have been written off the back of over 500 hours of interviews with over 200 people close to the events, and it certainly feels like it. Paced like any good thriller, this expansive novel of an historic account really keeps you turning the pages, although frequently back to the front of the book where there is an 8 page list of characters. Personalities really shine through this story, although as it’s about investment bankers who managed to drive huge companies into the ground, the personalities are usually those of total dickheads. The biggest dick of all, Dick Fuld Jr, the CEO of Lehman at the time of the bankruptcy is especially good to laugh at as it all comes crashing down. There is clearly some artistic license used in this book, especially in the setting of the scene, but the comprehensive lists of notes and sources makes sure that it doesn’t get too into the flight of fiction. If that doesn’t convince you, it even has some pictures, including a photocopy of the absolutely ridiculous cheque for $9 billion written by Mitsubishi UFJ to Morgan Stanley. If they ever make Credit Crunch: The Movie, this book would be a good place to start for the script.

Recently re-issued in light of the Credit Crunch and following age of austerity ‘When Money Dies’ (£6.88) by Adam Fergusson originally published in 1975, is an historic account of the hyperinflation experienced in Weimar Germany. If you’ve been reading this article thinking for Christmas present ideas, don’t be put off by the grim subject, this book has a totally sweet cover that makes it a cool present anyway. Fergusson strikes the tone just right in describing the sheer destruction wrought on the population without over doing it and becoming hysterical, as well as providing criticisms of the politicians in charge at the time without being too ideological. In a time when we once again find countries with colossal sovereign debts and widespread angst and anger at government cuts, this book serves as an excellent reminder why we have to turn the printing presses off.