The Economy in History

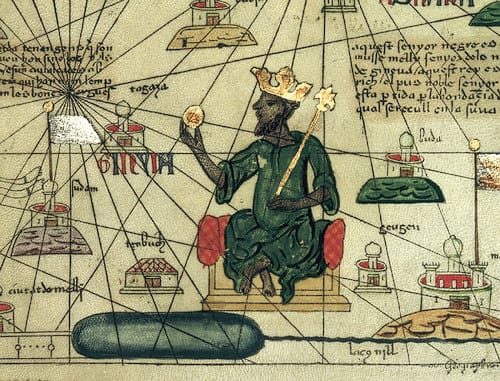

The Cautionary Tale of Mansa Musa of Mali – by Beñat Gurrutxaga-Lerma and Nina Kearsey

Legend has it that, as for all faithful Muslims, the day came when the good King Musa of Mali announced to his people that he would be leaving Mali for the Hajj, the pilgrimage to Mecca. The announcement, though praised by the wise and respected by all his subjects, came with fear, as the trip from Niani to Mecca was long and perilous.

Wishing to ease their king’s trip, the people of Mali helped with the arrangements of the royal caravan. When it finally departed, the royal party was something to be seen: more than a thousand courtiers attended King Musa, accompanied by their servants and belongings and carried on myriads of camels in a procession so long it was said to take more than two days to see it pass by. Among their effects, King Musa had taken with him the royal treasury of Mali, which, according to the legend, consisted in such a wealth in gold that it required no less than a hundred elephants to be carried.

After a peaceful journey through the Sahara, the royal party reached Egypt, where caliph Al-Nasir received King Musa warily in Cairo; his spies had told him that the king’s wealth was so fabulous he could have bought the whole of Egypt. However, the Caliph needn’t have feared, as Cairo’s most capable merchants were on his side.

According to the legend, whilst Al-Nasir and Musa entertained themselves in staring contests to determine who should vow to whom first, Musa’s royal household visited Cairo’s bazaar to buy for their master all the luxuries on offer. Upon realizing that the fabled wealthof King Musa was no tale, the merchants promptly discovered that what no Egyptian would have paid more than 3 dinar for, Musa’s subjects would buy for 30. They increased their prices by so much for the Malians that upon leaving Cairo towards Mecca the king’s wealth had all but vanished, left in hands of the happy few bazaar merchants.

These merchants, suddenly rich and lacking of any good incentive to save or bury their new fortunes, simply increased their consumption proportionally. But their interests clashed: they all wanted to buy then same fine things and the market became saturated with demand. They discovered that they could not get all they wanted without bidding up the prices and soon Cairo’s real estate, food and commodity market prices had doubled, reaching levels hitherto unknown. Such are the risks of QE.

Panta rei; money too

In 1752 the Scottish Philosopher David Hume came up with an explanation for the mechanism by which the Egyptian economy could have equilibriated following this cash injection: Hume’s price-specie-flow mechanism.

Crucially, medieval Egypt was not an isolated community, but traded actively with countries in Europe, Asia and Africa. After King Musa left, it found itself flooded with gold, and this lead to internal inflation. However, foreign goods were still as cheap as before, and having more gold, Egypt could steeply increase its imports. Concurrently, Egyptian goods being so expensive, exports would have ceased. This would then lead to a decrease in the gold income due to exports, and, imports being paid in gold, to an effective export of Egypt’s gold; the balance of payments would thus become (very) negative.

Then, as more and more gold was taken abroad, Egytian inflation would have to come to an end and bazaar merchants would begin to feel their pockets empty. Unable to bid up their prices internally, price deflation would follow. However, Hume continued, since Egyptian prices were then set to deflate, at some point their goods would again become attractive exports that foreigners would pay for in gold. So, after a time, an equilibrium would be reached, and the balance of payments be restored.

Incidentally, a great deal of king Musa’s gold ended up in Italian merchants hands, where it helped finance the early Italian Renaissance.