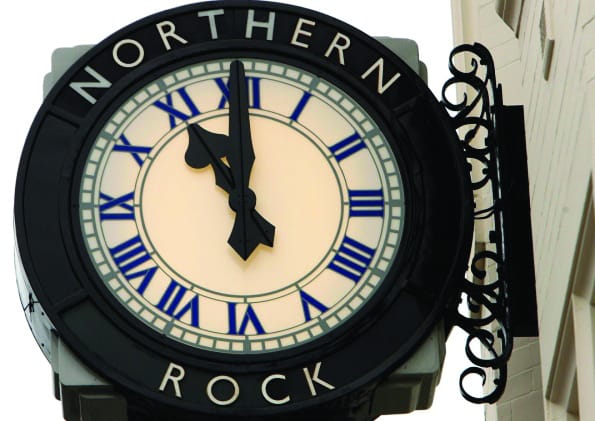

The Virgin of the Rock*

Rajvinder Virdee comments on some of the political and social ramifications of the sale of Northern Rock plc to Richard Branson’s Virgin Money

Last Thursday the Government announced that Northern Rock was to be bought by Virgin Money. Northern Rock was famously nationalised in February 2008 as the Credit Crunch took its first victim this side of the Atlantic. The deal that has just been negotiated says that Virgin will pay £747m upfront with approximately another £250m in further possible payments, valuing the deal at about £1 billion. This is well short of the £1.4 billion of taxpayers’ money it cost to keep the bank afloat, so even though on the face of it a £400m loss (about 28%) looks terrible, it may still represent a good deal for us.

The Northern Rock sold last Thursday is not the same Northern Rock that was bought in 2008

Ed Balls, the shadow chancellor, expressed the view “[Northern Rock plc] is being sold off at a loss, and I think there is a question as to whether or not this is the best time, with the markets in turmoil, to get the best deal. George Osborne will need to explain that”. The response from George Osborne, Chancellor of the Exchequer, was to reveal that the deal that nationalised Northern Rock contained a clause stating the bank had to be privatised by 2013, hence the timing of the sale – and the consequent loss – might be somewhat justified.

Regarding market turmoil, with the exception of the sovereign bond market, the stock exchange seems to have done reasonably well in the last year; however, bank shares specifically plummeted with the crisis, posing the question of just how long could the state hold on to Northern Rock? Its nationalisation was always supposed to be a temporary one, with pledges being made that it would be sold as soon as possible. The problem is, the markets (especially banks) do not look like they are going to get much better any time soon, especially not by 2013. Banking stocks have fallen dramatically over the past 5 years (Barclays: –75%, Lloyds: –95%, RBS: –96%, HSBC: –50%), and have all remained pretty much flat for the last three, with perhaps a slight further decrease in value. If banks are losing value, it could be argued there is no point in waiting any longer.

Lastly the Northern Rock sold last Thursday is not the same Northern Rock that was bought in 2008. The bank currently has just 45% of the staff on its books as it did when nationalised. It has been gutted of all the risky parts of the business, and now has a more stable financial structure meaning it is actually quite a good bank. In terms of its loan to deposit ratio (now standing at 73%) it holds more in deposits than it lends out in loans, making it a safe bank. Also banks are almost never sold at 100% of their held asset values, there is always some discount.

If banks are losing value ... there is no point in waiting any longer

With banks losing value there is no guarantee that waiting until 2013 would have helped the Northern Rock situation, and at least now there is someone willing to buy. The most important thing this deal will achieve is competition. Virgin Money has always wanted to buy Northern Rock – in 2008 they made an offer for a 30% stake in the bank that was ultimately unsuccessful. They seem to have the ambition to expand the bank onto more high streets and try and break the stranglehold of Barclays, RBS, Lloyds and HSBC, and that can only be a good thing. Perhaps if Virgin can make a success of the bank, the additional £400m could be earned back in the form of taxes. If this means a better service and better products for customers going to the Bank, they should be pretty happy.

_*After coining this headline the Business Editors became aware that a BBC article by Robert Peston was recently published under the same title, however having thought of it independently from Peston, and feeling rather pleased with themselves for this bout of creativity, they have decided to go ahead with it anyway. _