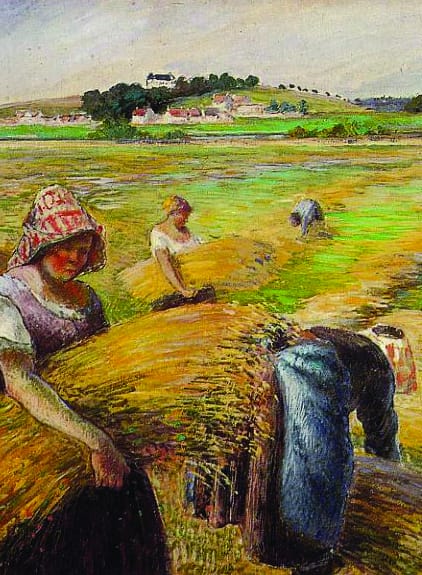

Autumn harvest?

Rajvinder Virdee discusses what we might reap from Osborne’s offerings in the Autumn Statement

On Tuesday, George Osborne, Chancellor of the Exchequer, updated Parliament on the current economic situation of our nation, and what the government plans to do about it. The Autumn Statement is seen as an important event in government, as it offers an opportunity to reflect on pledges made in the main budget, and adjust policy depending on recent events. The Chancellor and his team take the Office of Budget Responsibility’s published report on growth and borrowing forecasts and use these to adjust the official government position accordingly.

One of the pivotal moments of Osborne’s address to Parliament was when he admitted the Government’s failure to eliminate the budget deficit by the end of this Parliament. This was one of the tories’ main pledges during the election campaign of 2010, and signals a major blow to the Conservatives.

The general economic outlook is far bleaker now than it was 24 months ago; it seems that the austerity measures and the weakness of our public finances, combined with the international economic situations have lead our economy back to recession. Whether or not Osborne’s policies are the main responsible is a question of opinion. On the one side, the government is arguing that the stagnation is mainly due to external factors such as commodity prices and the Eurozone crisis; on the other hand, Labour argues that it is the way the extensive spending cuts were implemented – without giving time for the economy to recover, and relying too much on the private sector – that is the problem.

In any case, the economic situation is bleak, and it is going to be so for far longer than expected. This has led the opposition and many international commentators to consider Osborne’s plans as doomed. However, the Conservatives do not appear to be ready to acknowledge failure. Thus, during his address, the Chancellor pointed out that the cost of our debt had become extraordinary low cost.

Indeed, this week British bond prices dropped below the price of German debt. That is very significant; German debt is seen as extremely safe, and is usually used as a benchmark to measure your debt against. Although Osborne’s failure to tackle budget deficit within this Parliament will mean that the UK will have to borrow more, this will cost less than expected. Whether or not this is due to the austerity measures is not clear; analysts such as David Blanchflower believe that the only reason for this is that, our economic growth being so low, investors think the Bank of England will not dare to increase the interest rates in the next few years. Conservatives claim it is due to the success of the austerity measures.

Talking about state pensions and public sector pay could lead to novels worth of material, but once again Osborne’s message seems to be that we are going to have to start contributing more (especially if you work in the public sector) for our welfare. But the increase in the basic state pension should help alleviate issues such as dropping many into poverty at the same time. The fuel duty increase that was planned for January has been postponed till August, but lobbyists would prefer it to be scrapped altogether, under the claim that energy and petrol companies will just increase their prices and make consumers duty.

Finally, Osborne made pledges concerning spending on infrastructure, building and community projects. However, he also acknowledged that the extra expenditure in those sectors would be compensated by further cuts in other areas, probably firing more civil servants and freezing their pay further. Credit easing is planned to start soon, helping SMEs borrow at lower interest rates. We will also see a large investment in infrastructure, with rail and motorway upgrades amongst many others and £400m to be spent on new building projects. The 6-month work placement idea looks good on the surface, but looks remarkably similar to the Future Jobs Fund that was scrapped when the coalition came into office. But at the same time, any scheme that tries to help youth unemployment cannot be too harshly criticised.

The main message from the Autumn Statement is that everything is worse than before. Thus, the Conservatives are now on the defensive, starting to make pledges promising plans for the economy to start growing again. However, what Osborne offered this week seemed to be a lot about small policy, still too obsessed with keeping an austerity plan that seems to be slowly sinking. With these promises of action, at least they seem to discard the option of just sitting tight, crossing our fingers, and hoping we all get out of this intact.

The Autumn Statement: 10 Key Conclusions

- Economic growth forecast downgraded

- An extra £111bn of government borrowing over the next 5 years

- 1% cap on public sector pay rise (after 2 year pay freeze is over)

- Rise in state-pension age to 67 brought forward to 2026 (from 2034)

- Basic State pension to increase to £107.45 p/w

- January’s 3p increase in fuel duty delayed until August

- Credit easing of £20bn (but possibly up to £40bn) to start helping SMEs borrow

- £1bn to subsidise 6-month work placements for 410,000 young people

- £5bn new spending on infrastructure (another £20bn to be unlocked from pension funds)

- £400m to kick start construction projects