“Should the Greek Economy be allowed to fail?”

IC Debating Society are always up for an argument. Unfortunately, this week, they got sidetracked for two hours debating the meaning of debates. Then they started arguing about if they were even really there or not. Luckily, they got round to debating Greece as well.

Yes – James Clough

Greece has serious problems. Essentially they have run out of money, and lending any to them is seen as a very risky business. As such, the lenders are only willing to offer high interest loans; this worsens the problem as Greece’s interest repayments increase and their budget deficit gets ever bigger.

How did they get into this mess? It’s this simple: the Greek government spent too much money. “But we’re in a recession,” you say. “Keynes says that we need to spend our way out! Increase government spending – boost aggregate demand” you cry. Keynes does say this, but he also says that you must save during the good times, during the boom, so that you can afford to spend your way out of the bust.

Greece didn’t do this – they even managed to lose money during the boom years. And thus, the seeds of disaster were planted. Because they didn’t save when they had the money, and because they have been borrowing too much for too long, Greece simply can’t just borrow and spend their way out of this mess.

Let Greece have its own currency, let them devalue it, and let them sort out their problems

What normally happens in this situation? Well, usually governments have another trick up their sleeve. They print more money; they devalue their currency, and their debts are worth less. It doesn’t do the country much good, but it helps get rid of the debt. But Greece can’t do this because they are part of the Euro.

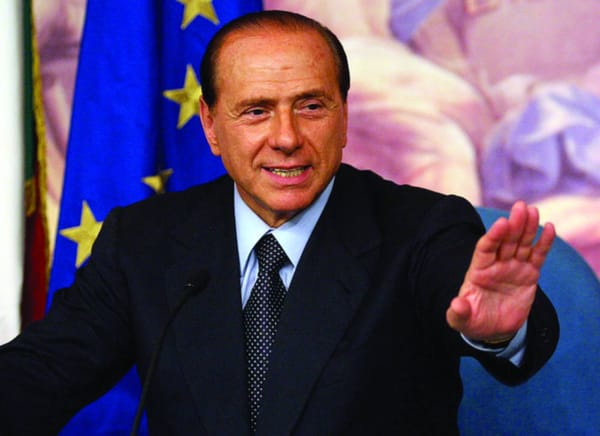

They don’t get to choose when their own currency is devalued. Political problems arise, because the rest of Europe, who still have money and are still trusted to borrow (mainly Germany and France) have to bail them out. These countries promise that they will guarantee the Greek debt. And of course, Greece has to cut its spending to ensure they don’t get into the same mess twice. There will be years and years of harsh austerity as future Greek taxpayers are forced to bear the burdens of older generations who earned too little and spent too much. And what of the next in line: Italy? Too big to fail, but also too big to bail. Italy’s debts would swallow up the entire bailout fund, and maybe more. Not to mention the fact that Italy is supposed to be one of the three countries who are guaranteeing the bailout fund. We can’t afford to bail out big-spenders forever.

There is another way, though. Let Greece fail and let the Greeks accept that the Euro has failed them. Having one currency for multiple governments has meant that they could not fully control their own financial system and deal with the crisis. Getting help from Germany means surrendering political freedom: Greece will have to do whatever its masters tell it.

If they leave the Euro and return to their old currency, the Drachma, they can recover. Yes, it will lose a lot of its value at first. Many Greek civil servants, once part of a bloated bureaucracy, will have to get private sector jobs. But weak currencies can be the catalyst for future growth. Greeks will struggle to afford the import of foreign goods, but they will be able to sell products for lower prices. Imports fall but exports rise. Money will flow back into the country. Slowly but surely the tide will turn and Greece can experience true growth, unlike the dangerous debt-filled bubble they resided in before.

Let Greece have its own currency, let them devalue it, and let them sort out their problems. It is the only way to save Greece and save Europe. Bailing out the countries which spend all of their money may seem like a good idea now, but one day Germany will run out of money to help with these bailouts, or its voters will just say no. And when that happens, this crisis will look very, very small in comparison.

No – Ed Middleton

When, in 2001, Greece joined the Eurozone, it signed a treaty that certified its membership of this group indefinitely. There was no clause that permitted the secession or expulsion of a state from this particular community. This would make it very difficult for Greece to decide to leave or, equally likely, to be thrown out. Granted, it would not be impossible to create a pathway by which states may leave the Eurozone, but this would become problematic in the future. The same problems would form that drove Abraham Lincoln to declare war with, and reunite, the confederacy of the United States in 1860. If members of a group are free to come and go whenever they please, the authority of the community is undermined; without unanimity, it is very difficult to achieve anything. If a state feels that a policy is not in their interest, they can simply leave. This makes it impossible for strong community-based governance to occur and makes the community indecisive, stagnant and slow to implement change. It also adds an internal political element to the decision, where leaders of member countries can gain political capital by threatening to exit the Eurozone unless their state’s demands are satisfied. This would be in nobody’s interests, since it makes it very difficult for the community to fulfil its goals and aid co-operation of member states.

it is practically important that Greece... continue as a functioning, participating member of the Eurozone

The main danger with Greece is that of disorderly default. This would occur if Greece could not meet its financial obligations and so decided to simply give up. In this instance, there would be huge losses for investors, not just within Greece but across the world. Many French banks would be heavily hit, as they hold large numbers of Greek Government bonds. This would generate a wave of instability that would threaten to shatter both fragile and more secure economies in Europe. Even if it wasn’t possible to prevent a default in Greece and the levels of bailout were not sufficient for Greece to meet all of its obligations, a public attempt is important. If other European nations make a clear and public demonstration to Greece that they are supporting it in its hour of need and attempting to shore-up its fragile economy, Greece will be much less likely to turn around and give up on Europe and its payments. A strong partnership between Greece with the rest of Europe is likely to mean that Greece can be kept on track and any default, should it occur, can be rigidly controlled to minimize the damage and risk of spread.

This element of contagion is also important with respect to global investor confidence. Many foreign investors have been wary of investing in Southern European economies – as well as Western European economies to some extent – since Greek financial woes came to the fore. If Europe is seen as being decisive and clear in its support of Greece, investor confidence in other European countries will be sounder. This is important as it has consequences in terms of borrowing for government bonds, such as interest rates. An amputation of Greece from Europe would mean a long period of instability in Greece (see Argentina from 1999 onwards) and likely a disastrous return for foreign investors: who, if they feel that countries will be allowed to fail and then jettisoned from the community, will be much more wary of Europe as a whole.

To conclude, it is practically important that Greece be bailed out and allowed to continue as a functioning, participating member of the Eurozone. Precedent for secession would cripple any executive fiscal power of the Eurozone, reducing it to a meaningless association. Unmanageable debts would also increase the likelihood of disorderly default, a catastrophic global economic event. More importantly, however, is the need for Europe to be seen to publicly support Greece for reasons of global confidence and internal feelings of security and community by Eurozone nations.