The New Worlds Conference

Marco Aliprandi and Henri Sartorius share with Felix an attendant’s first-hand view of the Finance Society’s conference and flagship event of the year.

On Saturday 5th February, the Imperial College Finance Society organised a landmark event – the first financial conference in its history. The aim of this conference was to present students with the opportunity to listen to experienced industry professionals about issues that have concerned the financial markets in the recent and not-so-recent past, as well as to provide them with a set of insights into the much debated world of finance; hopefully enabling them to make up their own mind as to where the industry is heading. This, along with the networking opportunities available during the breaks with the Finance Society’s illustrious list of sponsors represented a unique experience for all students, many of whom are looking to enter a career in the financial markets and the banking industry in general. The conference has been fathered and nurtured by Vishnu Aggarwal, whom we wish to thank and congratulate with particular emphasis; its success is a direct result of his professionalism, leadership and organisational skills and of the motivation and attention to detail of the team that supported and surrounded him. The marketing and advertising of the event was crucial as the attendance was the gauge by which the success or failure of this first conference would be measured. A very dedicated marketing team did a fantastic job, which included setting up a website, sifting through dozens and dozens of CVs and applications as well as actively spamming and hunting down the chosen few in order to get them to pay the £24 fee sooner rather than later (we would like to stress that it is a very reasonable price tag considering that other conferences charge upwards of £75). The efforts of the marketing team did not go unanswered and many of the 250 delegates were drafted from a wide range of top universities such as LSE, Warwick, UCL and Imperial College itself.

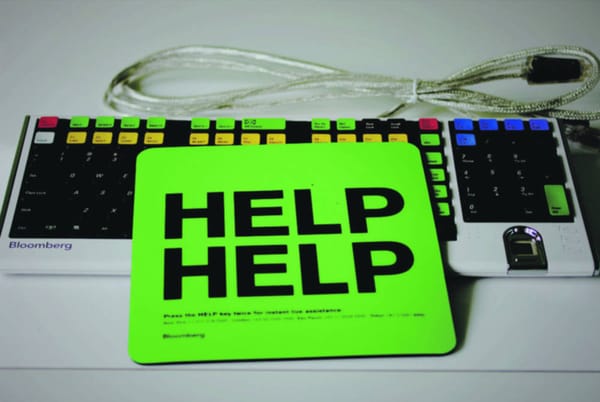

It is, however, worth noticing that the organisation of this event was no picnic; rather it was a lengthy, difficult and slightly painful funeral luncheon. Selecting a venue in central London was the first challenge, but the society managed to secure a very prestigious location, the Bloomberg headquarters. Its most remarkable trademarks are the many fish tanks and modern art exhibits scattered around the building as well as the wide selection of complimentary food and drinks available throughout the day, of which delegates and speakers alike took advantage quite unceremoniously. The selection of speakers was next on the to-do list; thanks to the extensive network of corporate sponsors of the Finance Society, Vishnu and his acolytes would contact various senior professionals currently working in the City or otherwise employed (or unemployed). The speakers were selected from a wide range of backgrounds and their contributions were very varied; from a renowned maths Professor dishing out formulae, to a former investment banker revealing inside stories of a credit-crunch-struck bank; from a gloomy perspective of an inevitable financial doomsday, to an optimistic view on junk bonds, there was something for everybody.

The day kicked off with a very interesting, albeit challenging talk on high yield bonds by Teo Lasarte of Bank of America Merrill Lynch, followed by a very engaging viewpoint on the broad themes in commodities given by the lively Morgan Stanley duo Michael Brennan & Russell Dyk. The attendees then got told how to deal with risk by Professor Lane Hughston and were made aware that society as we know it may cease to exist due to a deadly cocktail of debt, population growth, ageing, climate change and peak oil production by Dr. Mike Haywood. After a well deserved break, guests were able to attend three different workshops organised by Amplify Trading; the first two dealt with market analysis where a video of frantic trading around the major news flow of the non-farms payroll data, while the third dealt with trading psychology. The feedback on these workshops was extremely positive and everybody was very enthusiastic about it. The afternoon was kick-started with a valuable talk on what sparked the financial crisis by the very experienced former Societe Generale’s Global Head of Fixed income and FX, Mr. Desclaux, followed by talks from Mr. Simmonds, the Global Head of Strategy and Research at RBS as well as Mrs. Flax, the EMEA CEO of Commodities at JP Morgan about their respective industry sectors. The day ended with a panel discussion mediated by Philip Alexander, a journalist at ‘The Banker’ magazine. The panel discussing the future of banking included Kiri Vijayarajah, the European Banks analyst at Barclays Capital among other figures. It was then time to head for some well-deserved complimentary drinks for organisers and guests at a bar near Liverpool Street; details of that part of the day are unworthy of a newspaper of this stature and are probably quite hazy for most participants anyway.

Overall, the conference has achieved the aims it was designed for; it has been informative without being boring, factual, as jargon-free as possible, interactive and challenging. The feedback from both speakers and delegates has been overwhelmingly positive and both parties found that a real exchange took place, especially during the lunch break and during the Q&A sessions after each talk. The Finance Society intends to hold such an event next year as well; the very wide appeal this conference has had, combined with its quality and affordability, will ensure that it will grow and become more successful every year and eventually overtake in fame and glory other, more established, equivalents.