Lecturers to strike

National walkout to hit Imperial unless pensions dispute is resolved

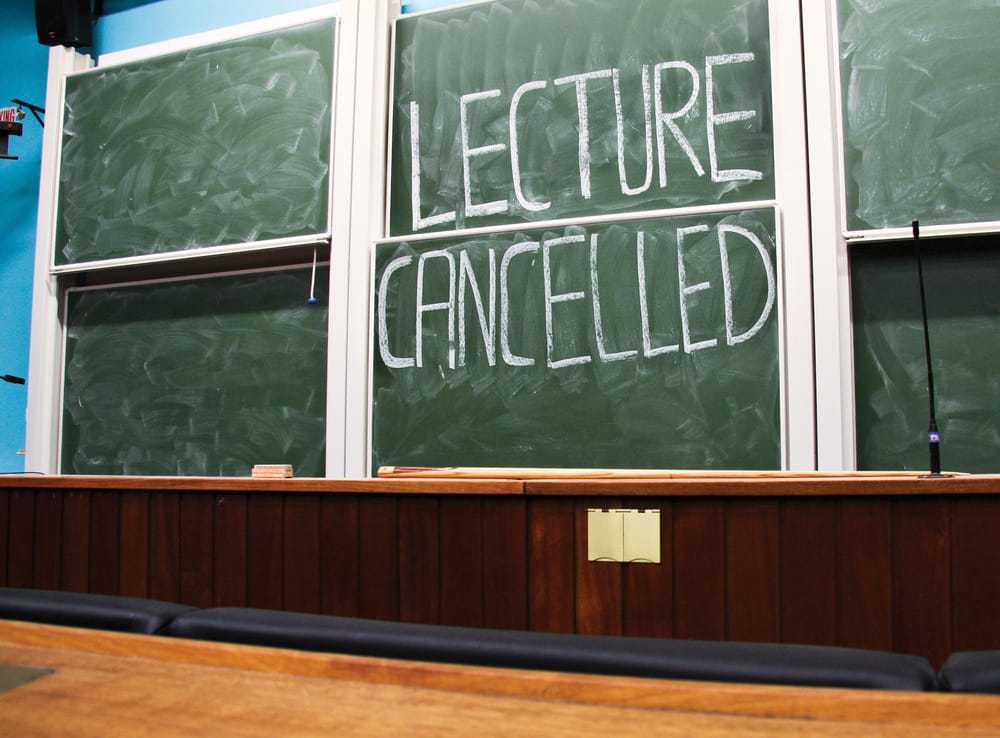

The University and College Union (UCU) has scheduled strikes over changes to pension schemes of university staff, with English universities due to be affected on the 22nd and 24th of March. Falling in the last week of term, the strikes could have a damaging effect on lecture courses across many departments, if employers and unions don’t come to an agreement.

The changes include an increase in employee contributions, an increase in the pension age and reduced pensions for staff who are made redundant.

Undergraduate students could suffer significantly from strike action

With no time to reschedule lectures, and many exams falling straight after the Easter break, undergraduate students could suffer significantly from strike action. The UCU represents thousands of Imperial staff for collective bargaining purposes, but according to the College, of the 520 UCU members at Imperial, only around 290 are academics and lecturers. The President of the UCU at Imperial, Dr Michael McGarvey, declined to confirm or deny these figures. However, it is unclear as to how many members of staff would walk out; although Dr McGarvey says that the expectation is that UCU members will strike, he said that they do not “dictate” to members and that it will be up to individuals to decide whether to participate in the strike. Imperial College UCU members were balloted on Wednesday the 3rd of March about strike action: 84 of the 132 that returned ballots voted in favour of the strike.

Although preparations are being made for the strike action, the UCU has yet to give formal notice, which legally must be given at least seven days in advance of any action. An Imperial College spokesman said that once notice has been given, they will “ask any staff intending to participate in industrial action to declare this.” Following this they will assess the possible disruption to teaching and “take steps to minimise the impact”

Postgraduates such as taught masters students are thought to be less vulnerable to possible strike action, since there is more flexibility in rescheduling their classes. However, the Divisional Administrator for Biology and Cell and Molecular Biology, Pat Evans, said that rescheduling undergraduate classes would be “more tricky.”

Dr McGarvey said that any disruption to students’ courses would be “unfortunate”. He argued that it was not the union’s intention to negatively affect their studies and claimed that the strike was necessary to protect university education in the long-term.

Dr McGarvey said that any disruption to students’ courses would be “unfortunate”

UCU General Secretary Sally Hunt has called on employers to return to the negotiating table but the Employers’ Pension Forum (EPF), who are representing universities in the dispute, have rejected calls for further talks, saying “we are not persuaded that it is appropriate to re-open formal negotiations”. Sally Hunt accused the EPF of engaging in “a macho stand-off” and said that although striking was a “last resort”, UCU members “feel they have been left with no [other] choice”.

Criticising the UCU’s decision to strike, Brian Cantor, chair of the EPF, said: “We do not believe that industrial action is an appropriate step for UCU to take. We do not agree that students and their parents will share your view that there is ‘no choice’ but to strike.”

The dispute originated in late 2008, when the Universities Superannuation Scheme (USS), the central pension fund which covers the majority of university pensions, set up a committee to review the pension arrangements of its members. A consultation period on the proposals ran from October to December last year and the final proposals, including changes following the consultation, are due to be implemented on the 1st of April. The changes, which amongst other things would see employees making increased contributions to their pensions, were called “the most radical” in the history of the scheme by a USS spokesman. At present, employees must annually pay 6.25% of their total salary into the fund, whilst employers pay 16%. Under the new proposals, employees would see their contributions increase to 7.5%.

Other changes include raising the pension age to 65 and introducing a cap on inflationary increases to pension payments at 5%. Following the consultation period, during which concerns were raised about this proposal, the cap has been raised to 10%. Additionally, new members joining the scheme would be have a career-average pension rather than a final-salary pension, which would leave them significantly worse off.

Perhaps one of the most contentious proposals would see staff who are made redundant after the 31st of March 2013 receive a reduced pension. The proposals would leave it up to universities to decide whether or not to offer a full pension as part of a redundancy package.

Employers say that the current pension arrangement is unsustainable in the long term. They argue that people are living longer (therefore drawing their pensions for longer) and that salaries have risen faster than previously anticipated. Therefore, they say, the scheme is in “danger of becoming unaffordable”.

The changes are aimed at reducing employers’ long-term liabilities. The consultation document readily admits that “the scheme is not in crisis” and the USS’s annual report for 09/10 shows an £8.5 million positive return after pensions have been paid. Dr Michael McGarvey said that the Union do not wish to jeopardise the scheme, but argued that the proposals “are more extreme than are required.” A USS spokesman told Felix that the dispute has arisen, partly, because employers want to mitigate future risk now, while the UCU is reluctant to increase the burden on employees based on predicted trends.