A new tech bubble

Alexandru Podgurschi sees history repeating itself

You might have still been running around your primary school grounds in the late 1990s, but the Internet was about to witness its largest market revolution. While Silicon Valley has seen its fair share of bubbles over the last decade, the dot-com bubble that marked the turn of the century was probably the most significant. Now economists warn us that a new bubble may threaten the stability of Internet-based companies: the initial public offering (IPO) bubble. And the first company to define it is LinkedIn.

LinkedIn has been known amongst businessmen as a professional Facebook, a tool to make new connections and expand their professional network. Launched in 2003, LinkedIn has become the global tool for professional networking, now claiming over 100 million members. That is several times less than what facebook can boast about, but there are no 12 year-olds thinking the whole world needs to know they just had a snack on LinkedIn. It keeps you in touch with people you have worked with or met at a networking event, lets you track a company, look for and advertise a job or simply find others interested in a business idea you have in mind.

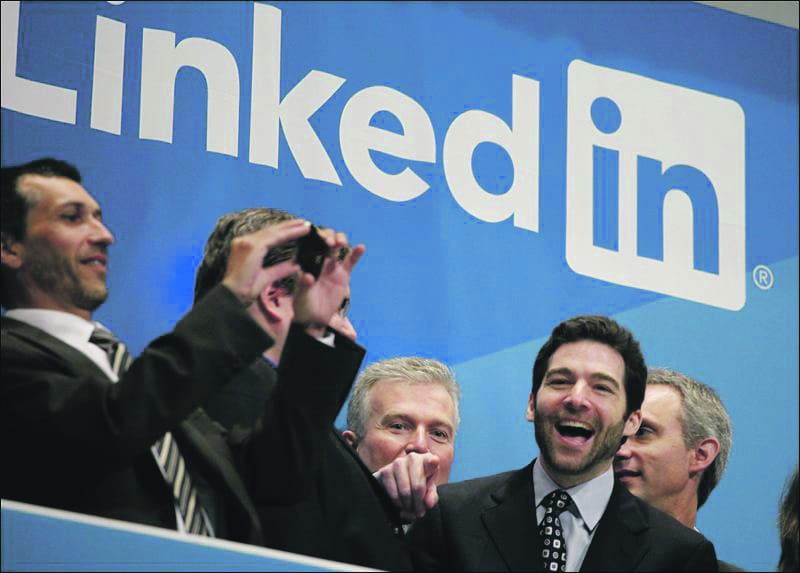

The company went public on the 19th of May and sent investors into a frenzy. The stock price skyrocketed from $45 per share to over $94 within a day, thus evaluating the company at approximately $8.9billion. While that sure led to a lot of champagne being drunk at the LinkedIn offices in Mountain View, California, it prompted market analysts to consider whether the new wave of IT companies to go public are considerably overvalued.

LinkedIn is the first major social networking website to go public and therefore became the first indicator of just how much social media is worth in the modern world. What sets it apart from other social networking websites is the fact that it has a clearly defined revenue source that is not limited to online advertisement. Users can choose from a selection of account types, ranging from the free one to the Executive one. While Executive does sound cool, it will leave you $74.95 poorer per month.

Groupon now seems determined to follow. The company was founded less than three years ago and is often referred to as the fastest growing company ever. Despite that claim, it still managed to lose about $400 million last year by pursuing long-term goals regardless of short-term consequences. Its latest ambition seems to be achieving global coverage, as it expands in other markets such as Japan, Russia and most recently China. What everyone is anxiously waiting for is the day Facebook will finally file for an IPO, despite the fact that everyone at Facebook avoids announcing a date at all cost.

Investors are clearly willing to provide the funds, putting significantly more emphasis on the brand value of the companies than on the revenue and profit generated. What has been sold in the market so far has been the potential rather than the actual profit that these websites present.

Whether the surge in share prices of hot new internet companies is another bubble like the one that shook the tech world in the late 1990s remains to be seen, but economists maintain their usual scepticism. California has once fallen for the dot-com bubble and this new one seems remarkably similar. If you happen to have a revolutionary and popular social network to sell though, now would be a good time to head up to Silicon Valley and do it.