Student Finance

James Tsim drives a hard bargain with your moneyz

Hopefully anyone who is eligible has already applied for Student Finance England. SFE offers student loans and grants which help cover university fees and living costs. Imperial College London also offers bursaries/scholarships which can be applied for.

Why open a student account?

With the start of university, the most important preparation you should be doing is to ‘Sort out your finances’. The first step to achieve this is to open a student account at the right bank. There are many banks out there, each and every one of them offering a variety of different services and freebies. The most important thing you should be considering is cost-free borrowing (interest free overdraft). This is the crucial difference between student accounts and standard accounts. Student accounts also offer the same functions such as internet/mobile banking, direct debit facilities, contactless etc. These accounts are designed for people who are attending higher education, so open your account now!

Interest Free Overdraft:

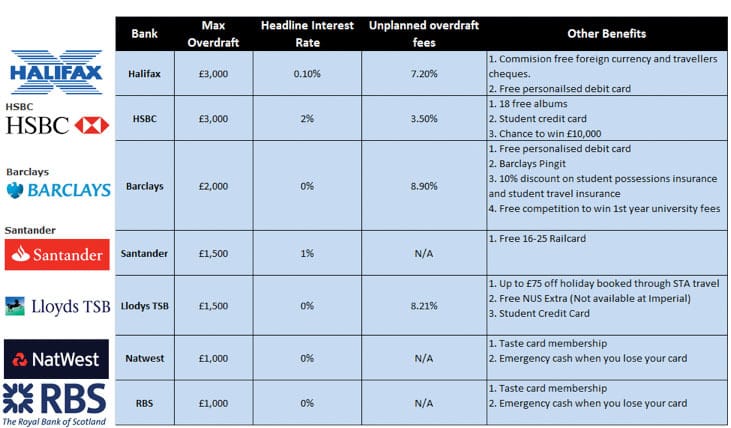

This is the most important factor you should be considering, as you may be feeling financial constraints later on in the year. The larger the Interest Free Overdraft the better, as some banks could charge you more to increase your borrowing. Many students also use overdraft to add funds to an ISA, this is a savings account with a favourable tax status, thereby earning you interest on free borrowed money. Currently the banks which offer the best interest free overdrafts with up to £3000 are HSBC and Halifax. Beware that borrowing past the free overdraft limit will incur you heavy charges, along with interest rates of up to 24% AER.

Branches situated near campus:

Having a bank branch near campus is very important for any problems with your account, or lost cards after a wild night out. There is a Santander branch on campus, with Barclays, RBS, HSBC, Llodys TSB and Natwest within the South Kensington area.

16 – 25 Student Railcard

This offer entitles you to a student 16-25 railcard available for up to 4 years, which offers 1/3 off rail fares. These cards normally cost £30 per year, but some banks give this for free when you open a student account. This is useful for example when taking weekend trips away to Brighton Pleasure Beach or when visiting friends in Manchester (£76.30 without railcard; £51 with railcard). These railcards can also be added to your oyster cards to give a 34% discount of tube fares (off-peak) and 34% off the daily cap. This card is an amazing deal and I would recommend you purchase one if the bank you choose does not offer it for free.

Taste Card

No doubt after coming to London as a student you will be doing a lot of cooking as a first year student. However for those of you who are looking to try the various different chain restaurants and cuisines in London, some banks offer a free taste card for every year of study when you set up an account with them. This card worth £80 is offered by Natwest and RBS, and offers 50% off or 2 for 1 deals at thousands of UK restaurants (e.g GBK, Pizza Express, Zizzi Restaurant). I personally have never had a taste card, but in case you want to try it out, they are currently offering a 30 day free trial card.

Headline Interest Rate

This is the highest interest rate (gross/AER) paid on balances held in the accounts. Most of the student accounts offer 0% headline interest, however some banks do offer it, such as HSBC (2%), Halifax (0.1%), Santander (1%) and Bank of Ireland (0.5%). My recommendation is that if you do have spare cash in your account, transfer it to a high interest savings account. Other

HSBC has teamed up with Sony to offer up to 18 music albums to download for free.

LLodys TSB offers free NUS Card and £75 off a holiday booked through STA travel.

Whichever bank account you , find one that suits YOU. Setting up a student account at a bank does not mean you must stick with it for life; you can change bank accounts every year.

Finally let’s get down to business: we’re looking for talented, sexy, funny writers. If you think you’re like a muzzle for a duck and fit the bill, get in touch! Email business.felix@imperial.ac.uk to find out more now!