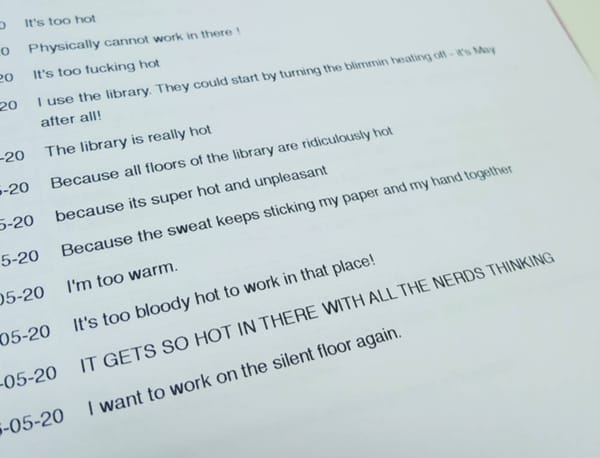

Imperial has £2.3 million invested in tobacco firms via endowment

Investments are indirect but clash with college’s cancer research efforts

This week FELIX revealed that the college has significant investments in several tobacco firms, as part of its endowment portfolio.

Overall, Imperial has invested just under £2.4 million across several tobacco firms, via several equity and hedge funds.

Our findings, made via a Freedom of Information request, show that although Imperial was not investing directly in any tobacco firms, three funds it was paying significant amounts of money into did have tobacco firms in their top ten holdings.

This is somewhat surprising considering Imperial’s long term partnership with Cancer Research UK, the college’s substantial research department dedicated to lung cancer and the fact that eighteen different Imperial departments form part of Imperial’s cancer network, aiming to research and cure the disease.

The firms we’re indirectly investing in include Imperial Brands, who make Camel cigarettes, British American, who produce Lucky Strikes, and Philip Morris, who manufacture the world’s most smoked cigarette – Malboros.

Imperial is investing just over £18 million across three investment funds that have holdings in the tobacco industry, and those are just the ones who were open with where their money goes. FELIX looked at the percentage these funds were investing in tobacco to work out how much of our cash has gone to the controversial corporations.

The £2,384,327.09 that FELIX calculated Imperial is investing in these firms is just a fraction of the £201 million or so the college has invested as part of its total endowment.

Other universities, such as Edinburgh, have divested from tobacco firms, after it was pointed out that the university’s research efforts clashed with such investments.

A college spokesperson told FELIX: “It is College policy to neither undertake research to develop or promote tobacco products, nor to directly invest in tobacco companies.”

“Where the College delegates investment decisions to its external fund managers, they are instructed not to directly invest in tobacco companies.”

“Some of their investments are, however, in managed funds. The College and its external fund managers have no control over the composition of those funds, which change on a continual basis. The College Endowment Board has a responsibility to optimise investment return to support Imperial’s academic mission but continues to keep its policies under review, which includes looking at ways to avoid even indirect investment in tobacco.”

The full investigation can be read on the opposite page.