Staff to potentially strike over changes to pension schemes

The University and College Union called the changes a "bolt from the blue", and said staff would be worse off.

Staff across a number of UK universities may launch strike action next year, following changes to pensions schemes.

Universities UK (UUK), the representative group for UK’s universities, announced the changes earlier this week, in what Sally Hunt, University and College Union’s (UCU) secretary general, called “a bolt from the blue”.

A ballot to consult UCU members on industrial action will open on the 29th November. If successful, strike action could be underway next February across 50 of the UK’s largest universities, including Imperial, Oxford, Cambridge, and Manchester. As well as strikes, union members could refuse to cover or reschedule classes, or cover for sick colleagues. The current principal pensions scheme used in higher education is the University Superannuation Scheme (USS). It is a defined benefit pension scheme, in which the employer is responsible for contributions, up to a salary of £55,550, after which it switched over to a defined contribution scheme, in which the employee pays into the scheme.

UUK proposes to end the USS, and switch over to a fully defined contribution scheme. UCU argues this will make pensions dependent on market returns. Hunt said it was “the worst proposal I have received in twenty years of representing university staff”, saying UCU “needs to fight it”.

Times Higher Education previously reported a number of universities, including Imperial, were unwilling to cover the increased cost of pensions, and supported a move to a defined contribution scheme. In 2015-16, Imperial spent more than £80 million on pension provisions, but also made a profit of £78 million over the same time period.

“Imperial stated that the current pension scheme was 'not likely to be sustainable'”

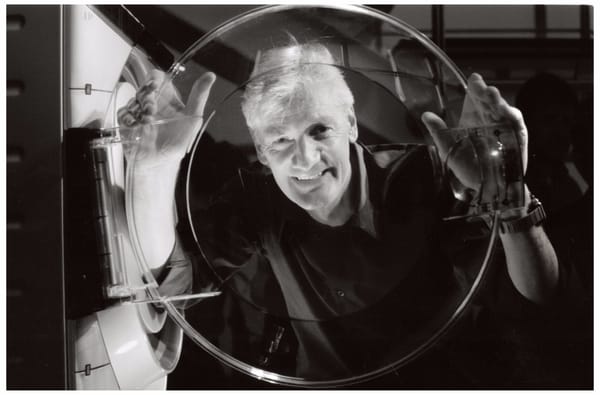

In an email to staff, Imperial’s Provost, Professor James Stirling, recognised that “current uncertainty regarding the (USS) is unsettling for colleagues”. He went on to say that while “we have said that our preference would be to maintain a defined benefit structure for USS” that current information suggests it “is not likely to be sustainable at the moment”, and that “a move to a defined contribution scheme, at least temporarily, would be necessary”.

UUK chief executive Alistair Jarvis said: “Most universities can’t afford to pay more into pensions without diverting money from other central areas, such as teaching and research, reducing their positive impact.” USS argues the scheme currently has a deficit of £7.5 billion.

Dr Michael McGarvey, President of Imperial College UCU, said in a statement that "independent bodies have challenged (UUK's) claims as being partisan and based on unrealistically negative assumptions." He went on to state that "Imperial has spent nearly £500 million of its own money over the last three years on its estate. The employers cannot plead poverty, and any claim that fees will have to be raised to pay for staff pensions has no basis in fact."

The UCU claims universities have reduced spending on staff as a proportion of expenditure by 5% over the last ten years, and argued the decision to switch from the USS was not inevitable. She called the move “another slap in the face for people already facing casual contracts and poor promotion prospects”.

A consultative ballot was launched by UCU last month, which found 87% of members would be willing to walk out over the pension changes. The ballot had a turnout of 56%. The USS is one of the largest private pension schemes in the UK, with around 190,000 staff involved. Discussions over the changes are expected to continue next month.