Tobacco, oil, and arms – where Imperial is investing its money

An analysis of Imperial's investments reveals significant holdings in tobacco, arms, oil and gas, and pharmaceuticals.

An analysis of Imperial College London’s endowment fund has revealed significant direct and indirect investments in the tobacco, fossil fuel, weapons, and pharmaceutical industries.

As of September 2017, the College was investing £3.5 million in the tobacco industry, nearly £9 million in the fossil fuel industry, £3.1 million in the arms industry, and over £16 million in pharmaceuticals, out of a total fund of over £266 million.

These investments include those where the College has directly invested within a company – for example, their £496,000 investment in Exxon Mobil – and those where they have placed money in an investment portfolio containing said companies. These holdings make up almost half of all the money the College has invested.

In response, Rhidian Thomas, Imperial College Union’s Ethics and Environment Officer, told Felix: “I’d like to congratulate Imperial on succeeding in bringing together a comprehensive selection of some of the most ethically dubious companies around, all in one portfolio. It’s staggering that anyone in College thinks it appropriate for a university – a charity even – to give so much money to the arms and extraction industries. Even College’s commitment to avoid investing in tobacco seems paper-thin, now that it’s clear that it has millions invested in it through third-party funds; so much for “smoke-free Imperial”.

Tobacco

Imperial has around £3.5 million invested indirectly in the tobacco industry, through investment funds. Their investments include some of the major worldwide brands: through their largest two contributions to investment funds, Imperial have over £650,000 invested in Philip Morris, the maker of Marlboro cigarettes, which previously threatened to sue the UK government for “billions of pounds” of compensation if plain packaging was introduced.

Imperial also has £400,000 in Imperial Brands, and over £370,000 in Reynolds American, a subsidiary of British American Tobacco – the largest publicly traded tobacco company in the world.

The investments seem at odds with Imperial’s medical research, particularly that into cancer prevention and treatment. Smoking is linked to at least a dozen forms of cancer, and tobacco smoke contains more than 50 chemicals that can cause cancer. Smoking also has a number of other effects on health, particularly on the cardiovascular and respiratory systems, increasing the risk of strokes, heart attacks, and lung disease. Smoking is estimated to cause 6 million deaths each year, with 600,000 of those down to secondhand smoke inhalation.

Imperial has a number of research projects looking into preventing cancer in the future. The Department for Cancer and Surgery, part of Imperial’s Faculty of Medicine, states “one of our major objectives is to enhance cancer prevention”. The department currently has 29 research groups working on cancer prevention, detection, and treatment.

In a statement, ICSM Heart – an Imperial College Union society for those interested in cardiology or cardiothoracic surgery – told Felix: "It has been well-established that both first- and second-hand smoking are damaging to one’s general health, and in particular to your cardiovascular system. There is no level at which smoking is safe and it kills a great number of people worldwide every year. In our view, an institution committed to fighting diseases should do so on all possible fronts and should consider its corporate social responsibility. There are plenty of other ways to invest money sensibly.”

“Further investigation showed some of the investment funds had included tobacco since 2013”

Tobacco companies have also been indicted in manipulating scientific research. A 2007 study found tobacco companies funded and used scientific studies to undermine the link between secondhand smoke and health problems. One of the authors of the paper, which was published in Cardiology, said: “The tobacco industry’s efforts at manipulating scientific literature as a way to serve their economic and political needs continues to this day.”

A College spokesperson told Felix it was “College policy not to undertake research to develop or promote tobacco products or to directly invest in tobacco companies”. While fund managers are “instructed not to directly invest in tobacco companies, some investments are in managed funds. The College and its external fund managers have no control over the composition of those funds, which change on a continual basis.”

However, further investigation by Felix showed a number of these funds have consistently included tobacco in their portfolio. Fundsmith Equity Fund, for example, into which Imperial has invested since at least 2013, has had significant holdings in tobacco since its establishment in 2010. Imperial currently has over £11 million invested in the fund, more than double what it had invested four years ago.

Fossil Fuels

Imperial was also found to have nearly £9 million invested in the fossil fuel industry. £6 million of this was directly invested in companies supporting and undertaking coal, oil, and gas extraction; £3 million was through investment funds.

Currently, the College has over £1.5 million directly invested in Royal Dutch Shell, the 7th largest producer of oil and gas worldwide. Shell has previously been accused of collaborating with the Nigerian government in the torture and execution of activists, and crimes against humanity. A report by Amnesty International, published last year, concluded Shell’s conduct in Nigeria “amounts to encouraging, and, at times, facilitating the horrific crimes and abuses committed by the Nigerian security forces”.

The College also has £470,000 in Exxon Mobil, the 4th largest oil and gas producer. The company was previously headed by Rex Tillerson, who is now Donald Trump’s secretary of state. As with Shell, Exxon has been accused of facilitating human rights abuses across the world. The oil company was sued by eleven Indonesian villagers in 2001, who claimed the company hired security forces to protect their pipelines. One complainant said the forces had “tortured him for several hours”, during which time they “broke his kneecap, smashed his skull, and burned him with cigarettes.”

Imperial has a further £280,000 in BP, £221,000 in Phillips 66, and £100,000 in Cairn, as well as £3 million in other fossil fuel companies through investment funds.

“Imperial has £1.5 million invested in Shell, who have been accused of crimes against humanity”

These findings come a few months after Imperial dramatically dropped in the People and Planet University League Tables, which rank higher education institutions based on their ethical record. This year Imperial slipped to 141st out of 154 universities, making it bottom of the Russell Group. Imperial received a score of zero for ethical investment, and People and Planet reported Imperial had accepted nearly £24 million in donations from the fossil fuel industry between 2009-2014.

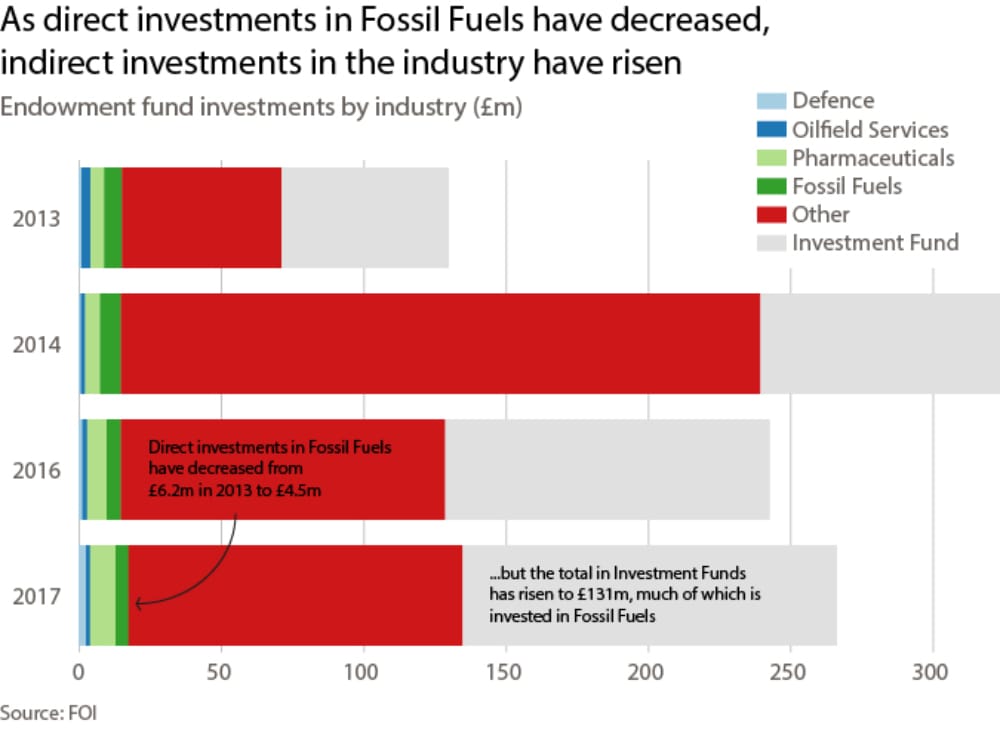

While the overall amount of direct funding into fossil fuels has dropped by nearly £400,000 since last year, the amount Imperial has in investment portfolios has increased by over £15 million. A significant number of these funds include fossil fuel companies within their portfolios, meaning indirect investments are likely to have risen over the past twelve months.

The issue of investments within the fossil fuel industry has come under increasing scrutiny recently, as more universities divest from fossil fuels. Divest Imperial, which recently presented a petition to College signed by 1,700 individuals calling on Imperial to divest, said: “It's a scandal that Imperial puts so much money into the pockets of the planet's biggest carbon emitters. We will not stop pressuring college until it cleans up its act, divests from fossil fuels, and invests in the zero-carbon future we all want to see”

Imperial also has a number of departments dedicated to sustainability and climate change, including the Centre for Environmental Policy and the Grantham Institute for Climate Change. On its website, College claims it “recognises the effect that (our) opportunities and activities have on the environment”, and “seeks to establish an ethos at all levels and in all departments towards protecting and improving the environment.”

One academic told Felix: “It is no secret that Imperial has many financial connections with the fossil fuel industry, some of which support valuable teaching and research necessary for a low carbon transition. However, the College should place stronger emphasis on research and teaching orientated on mitigating and adapting to environmental challenges like climate change, air and water pollution, and rising sea levels rather than prolonging the use of damaging fossil fuels. The world looks to us to set the agenda of research; how can we lead from the front when our eyes are still squarely focused on the past and its former cash cows – fossil fuels.”

Like the tobacco industry, a number of fossil fuel companies have been accused of propagating misleading science and data to install “uncertainty” in public debate on climate change. Exxon in particular knew about the contribution of carbon dioxide to global warming since the 1970s, and instead “worked at the forefront of climate denial”.

A College spokesperson told Felix: “We share the concern that climate change is one of society’s most important global challenges. That’s why we are urgently working to find ways to mitigate the impact of fossil fuels while seeking viable alternative sources of energy. We believe that we can have the greatest effect by carefully optimising our endowment to invest in ground-breaking research and education.”

Weapons

The analysis also revealed the College is currently investing over £3 million in arms companies, the majority through direct investments. Imperial has invested £2.2 million in Lockheed Martin, which is the largest arms company in the world, with over $35 billion in sales. The money Imperial has been investing in Lockheed Martin has dramatically increased since 2016, and now stands at nearly double what it was a year ago.

“The amount invested in Lockheed Martin has doubled since last year”

Lockheed Martin developed the missiles used in the Trident nuclear deterrent system, whose lifetime replacement costs have been estimated to be as high as £205 billion. Lockheed Martin is also responsible for production of the Javelin and Hellfire missiles, both of which were heavily used during the 2003 invasion of Iraq.

The university has a further £500,000 invested in Mitsubishi Heavy Industries, which is the largest arms company in Japan, responsible for over $3 billion worth of arms sales. The university also has around £500,000 in indirect investments, including funding to BAE Systems and Rolls Royce, two of the UK’s largest arms companies.

Pharmaceuticals

Finally, the analysis revealed Imperial currently has over £16 million invested in pharmaceutical companies, including some of the largest in the world. £9 million is direct investments, while £7.3 million is invested through investment portfolios.

The amount of direct investment has nearly doubled since 2013, and includes £2 million in Novartis, which last year made $6.6 billion in profits. Imperial also has £1.25 million invested directly in Pfizer, and nearly one million pounds invested in GlaxoSmithKline (GSK). In 2012, GSK was made to pay $3 billion in charges after they were found guilty of failing to report safety data and promoting drugs for unapproved uses.

While these pharmaceutical companies are responsible for the development of new drugs, there is concern about the role public funding plays in funding drug creation that disproportionately benefits companies’ profits.

“Some students were concerned about public funding being used for big pharma research”

A 2017 report by STOP AIDS and Global Justice Now found the UK government was the second largest funder country, after the USA, for research and development into diseases predominantly affecting poor countries. However, they pointed out “there is no guarantee that patients in the UK and beyond will be able to access the medicines at an affordable price,” and argued that “in many cases the UK taxpayer pays twice for medicines: first through investing in R&D, and then by paying high prices for the resulting medicine once ownership has been transferred to a private company”. In 2016/17, Imperial received £143 million in public funding grants.

Felix spoke to Universities Allied for Essential Medicines (UAEM), a student-led organisation that lobbies to improve access to medicines globally: “If public institutions are to make investments in the stock market, it is obvious that this should be done transparently, and with robust safeguards against these financial interests influencing what research is done, how research is done, and what is done with the research.”

“The research agenda – decisions on where research funding and efforts should be focussed – should be guided by the public interest and a spirit of scientific inquiry. Students, scientists, and the public should be wary of profit motives guiding research decisions.”

“It is difficult to see how conflict of interest can be avoided by Imperial if it invests in the same pharmaceutical companies that contribute to Imperial’s research funding, and companies that may make profitable products out of Imperial’s discoveries.”

“Lastly, Imperial lacks a strong, public policy that would ensure that any medicines developed using the College’s discoveries must be made accessible and affordable.”

When asked about the makeup of the endowment fund, a College representative told Felix: ““As an organisation with charitable status, we have a responsibility to carefully manage our assets to maximise their long term contribution to our academic mission. This includes optimising investment return to support the College’s research and teaching activities.”