Augar review: what does the future hold for tuition fees?

Suggestions include lower fees and shorter courses.

Tuition fees could be cut to £6,500 per year as part of the latest government review into higher education. The government is also urging shorter degrees to keep overall costs down.

The year-long Augar review will examine whether or not the current funding situation provides good value for money for students and taxpayers. The panel, chaired by Philip Augar, has also been charged with looking at the accessibility of further and higher education, incentivising competition across the sector, and how to provide students with “the skills that we need as a country”.

The universities minister, Sam Gyimah, has also called on universities to provide two-year “fast-track” degrees, which could charge £11,150 per year. Overall, this works out as £5,450 cheaper than a standard three year degree, as well as saving on a year of accommodation and living costs. However, this plan would require a vote in parliament to lift the £9,250 fee cap. Lecturers are also reluctant to provide classes during the summer holidays, which would be necessary to avoid compromising on quality and content. As one university leader told The Times: “In the summer holidays academics write their books. They do not want to spend their summer vacations teaching undergraduates.”

Birkbeck, University of London is focusing on longer degrees, not shorter ones. Following "heartbreaking" increases in students applying for hardship funds, the university intends to halve tuition fees for its four-year part-time courses. The plan to reduce fees from £7,000 to £3,500 is intended to increase support for part-time degrees, which are popular among mature students and those in work. The master of Birkbeck, David Latchman, believes the government would be able to subsidise the cuts at “no – or minimal – additional cost”.

As Felix has previously reported, any move to lower tuition fees would predominantly benefit wealthy students. Students from poorer backgrounds are less likely to pay off the full amount of their student loans than their well-off peers. Lowering tuition fees would not – for most low-earning graduates – make any difference to the total amount repaid before the debt is written off. For graduates with salaries above the current £25,000 repayment threshold, however, the amount they pay back will reduce in line with tuition fees (interest rate changes notwithstanding). An analysis by The Times suggests that low-earning graduates would save an average of £1 each year. Those on higher salaries could save £500 each year. Some critics suggest any reduction in tuition fees will actively harm students from less affluent backgrounds.

If the decrease in universities’ incomes from tuition fees is not covered by the Treasury (which would be forced to find an extra £3 billion each year from an already over-stretched budget), caps on student numbers may be reintroduced. Grants for disadvantaged students may also be reduced, making higher education inaccessible for students from low-income backgrounds. As Felix wrote earlier this year, Imperial is one of the worst universities when it comes to recruiting students from lower socioeconomic backgrounds, with just 63.5% of entrants in 2016/17 coming from state schools.

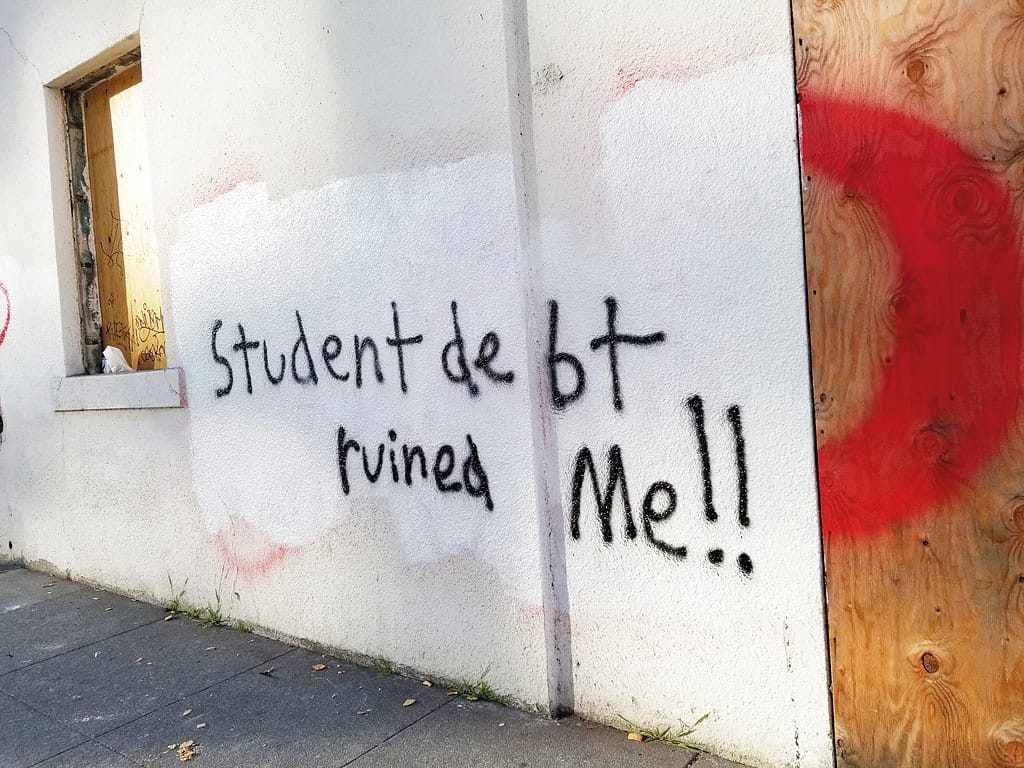

These considerations are not likely to deter students. Recent years have seen countless politicians trying to win the student vote with promises about maintaining or improving the affordability of higher education. And – as cases of mental illness among young people rise – the prospect of graduating with £50,000 of debt exacts an incalculable cost in terms of student well-being and adds further strain to health and social care services.

Still, the general feeling is that something must be done. If not lower tuition fees, then what?

One alternative would be the re-introduction of maintenance grants, rather than loans. Almost half of students struggled to pay their rent, and their mental health suffered as a result, according to a recent Save the Student survey. A third of respondents also believed that difficulties in meeting their living costs adversely affected their studies. While a return to maintenance grants would put a drain on Treasury resources, the £500 million cost estimated by the Institute for Fiscal Studies is considerably less than the potential cost of lowering tuition fees.

Many universities would find ways to operate without a third of their tuition fee income. The first cost-cutting measure would likely be outreach schemes to disadvantaged communities, which universities are obligated to fund with a proportion of their tuition fee income. This could be avoided if universities reined in excessive spending on senior staff, which has been well-documented by Felix and other media outlets following the scandal of vice-chancellors’ salaries.

The Augar review is not due to report until early 2019 and much may change before then, but students should not bank on a reduction in tuition fees any time soon.