Staff consulted over pensions in bid to avoid "undeniable threat to jobs"

Lecturers are once again being consulted about the future of their pensions as universities prepare for a planned increase in employer and employee contributions that is set to come into force later this year.

With the 2017 valuation of the Universities Superannuation Scheme (USS) concluded, universities have until 14th March to respond to the 2018 valuation of the pension scheme to which most lecturers belong. Imperial will circulate its proposed response to staff on Monday, with a final meeting to be held on Tuesday. A formal response from the USS is expected in early April.

USS is offering two possibilities to overhaul previous planned changes that resulted in strikes and industrial action at more than 60 universities across the country. The “upper bookend” approach would require total contributions of 33.7% to maintain the current benefits; 23% of this would be paid by employers and the remaining 10.7% paid by employees. Universities UK, which represents the country’s higher education institutions, has claimed that this would be “unsustainable” and an “undeniable threat to investment and to jobs”.

The “lower bookend” approach would see contributions set at 29.7% (20.4% from employers and 9.3% from employees). However, the USS is only willing to adopt this lower bookend approach if additional contingent contributions can be guaranteed in the event that “market events caused a further deterioration in the recovery of the deficit” (i.e. contribution levels would increase if funding for the scheme significantly decreased). As of March 2018, the pension scheme was operating with a deficit of £3.6 billion.

Employers are now being asked for their views on these proposals, as well as on the eleven principles set out by the USS under which it would be “prepared to consider” contingent contributions. These include the requirement for an objective “trigger metric” that will only bring contingent contributions into force in the event of an “adverse scenario” (as opposed to normal market fluctuations); contingent contributions to be set at levels that will “substantially improve the funding position”; and a guarantee that contingent contributions will be paid in full if invoked. A letter to USS chair Sir David Eastwood from The Pensions Regulator confirmed that any decision to move away from the proposals that arose from the 2017 valuation would need to be “fully backed by additional, tangible, and realisable contingent support from the employers”.

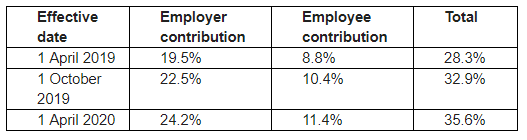

If no agreement is reached between USS and UUK, contributions will increase in accordance with results from the 2017 valuation. This would mean a phased increase in employer and employee contributions beginning in April this year. By April 2020, contributions would total 35.6%, with 24.2% coming from employers and employee contributions making up the remaining 11.4%. Imperial recognises that these rises would be “unsustainable” for many staff.

If – as UUK hopes – the USS does adopt the lower bookend approach, the arrangements will be time-limited. A report on the long-term sustainability of the USS is due in autumn; its findings are likely to impact the next valuation (currently scheduled for 2021) and could effectively “reset” any decisions made regarding contingent contributions.