Educational: Monetary and Fiscal Policy

Monetary and Fiscal Policy are the two most widely used tools governments and central banks use to control a nation’s economy. You may have read in FT about how the Federal Reserve, the US Central Bank has become “dovish”, due to its overly “hawkish” stance last year due to Trump’s fiscal policy. In this educational article we will try and understand what this means.

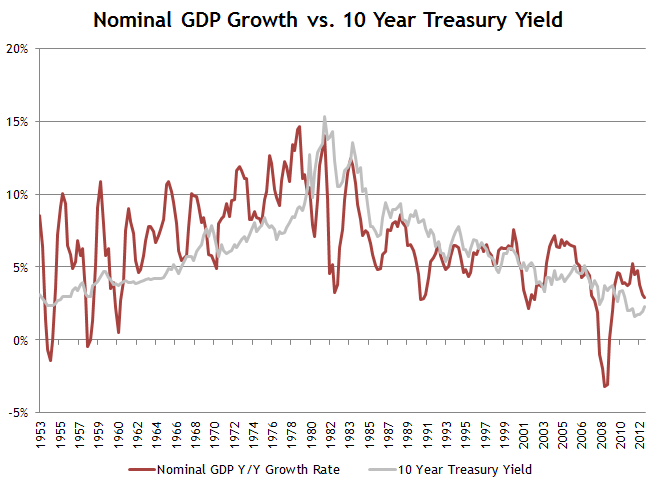

Monetary policy is a central bank’s action that influences the country’s money supply. It is generally used for the fine tuning of the economy and is often very effective. The aim is to try and make the money supply grow neither too quickly, which would cause excessive inflation, nor too slowly, which would hamper economic growth. Ideally, inflation (a quantitative measure of the rate at which the average price level of a basket of selected goods increase over time) is kept in the 2-3% range, and unemployment level of around 5% and stable exchange rate. There are multiple techniques of monetary control. The first is changing interest rates. Raising or lowering interest rates is called being hawkish and dovish respectively. If a central bank has a hawkish stance this has a positive effect on the country’s currency, and prevents excessive inflation but slows economic growth. This is because increasing interest rates increases the cost of borrowing, increasing the incentive to save rather than spend. A dovish stance has a negative effect on the country’s currency but stimulates economic growth and prevents deflation.

Another tool a central bank might use is open market operations. OMO refers to a central bank buying and selling of government securities in the open market in order to expand or contract the amount of money in the banking system. Securities purchases inject money into the banking system and stimulate growth while sales of securities do the opposite and contract the economy. This is a controversial method is generally only used for expansionary monetary policy when interest rates approach zero and central banks have fewer tools to influence economic growth, such a case occurred in the chaos after the 2008 financial crash.

Fiscal policy is largely based on the ideas of the British economist Keynes and involves the government changing the levels of taxation and government spending in order to influence Aggregate Demand and the level of economic activity. Keynes argued that governments could stabilize the business cycle and regulate economic output by adjusting spending and tax policies. Expansionary fiscal policy involves lowering taxes, giving people more money to spend and invest. Firms will hire more people, decreasing unemployment and causing labour competition, thus raising wages. This has the same effect as injecting money into the economy. Increasing government spending means increased investment in infrastructure, again increasing employment. However, this will lead to a deficit and often inflation and asset bubbles. Furthermore, while the effects of fiscal policy are usually profound, the trickle-down time for the general consumer is long and government spending is inefficient. Free market economists argue that higher government spending will tend to be wasted on inefficient spending projects.

On Tuesday the White House released Trump’s Fiscal Year 2020 Budget Request. It follows previous budget plans in lower regulation and tax on the financial industry and increasing government spending. The record $4.7 trn annual budget that boosts military spending and includes $8.6bn for US-Mexico border wall. Economists said the projections for the budget of economic growth of 3.2% were highly optimistic. “The US economy is definitely slowing down. The data we have seen so far for the first quarter has been pretty awful”, said Megan Greene, chief economist at Manulife. Mrs Greene said that the US could hit the target if it underwent significant fiscal stimulus, but that remains unlikely. She argues that the Trump administration enacted a big tax cut in 2017- reducing individual and corporate income tax rates- but failed to implement any big reforms on important matters such as social security, the US government pension scheme, and Medicare.