An insight into consumer goods equities...

CG stocks tend to be low-innovation, mature companies that rely on big brands and timeless products and pay regular dividends. As defensive stocks, CG stocks are more likely to outperform in bear markets than in bull markets. In recent years, CG stocks have widely underperformed in the broader market for several reasons. Investors have become enamored with tech stocks, such as the FAANG group, that have consistently outperformed. Rising interest rates have also made bonds more appealing to conservative, income-seeking investors, leading them to take some money out of dividend- paying consumer staples. Finally, higher input costs have threatened some CG stocks. Most of the CG ETFs* have underperformed the S&P 500 over the past five years.

But the past is no guide to the future. Over the coming decade, upheavals in global market will likely to produce as many losers as winners. Asia will overtake the West as the main consumer market, and it will demand new levels of value and innovation from companies. Rising Internet penetration could upend traditional sales models. Change is nothing new for the retail sector; those that adapt to customers’ evolving needs and demands around technology and service will be ones that thrive. It is worth thinking about how company can unlock the value-creation potential and individuals can seek for investment opportunities in these following trends that are highly likely to shape the future of the CG sector. Let’s now consider each trend in turn.

A billion new consumers in emerging markets

In the coming years, the growth of emerging markets will continue to outstrip that of the developed world by a wide margin. The emerging countries in Asia—most notably China, India, and Indonesia, had a significant share of global growth (18%) in the last decade. The global middle class will expand dramatically: by 2020, it is expected that more than a billion new consumers spending between $10 and $100 per day.

Companies that understand and meet these new consumers’ needs will earn tremendous competitive advantage. Success factors include the selection of categories, markets and segmenting the billion new consumers and innovating to meet their needs. Consider the example of Wrigley chewing gum in China: the company has captured 40 percent of a fast-growing category worth $2 billion. Its tactics include regular launches of products tailored to Chinese consumers, including gum flavored with herbal essences and grapefruit; intensive consumer education emphasizing the health benefits of chewing gum; and building a presence in the millions of small outlets where Chinese consumers typically shop.

The rise of digital consumers

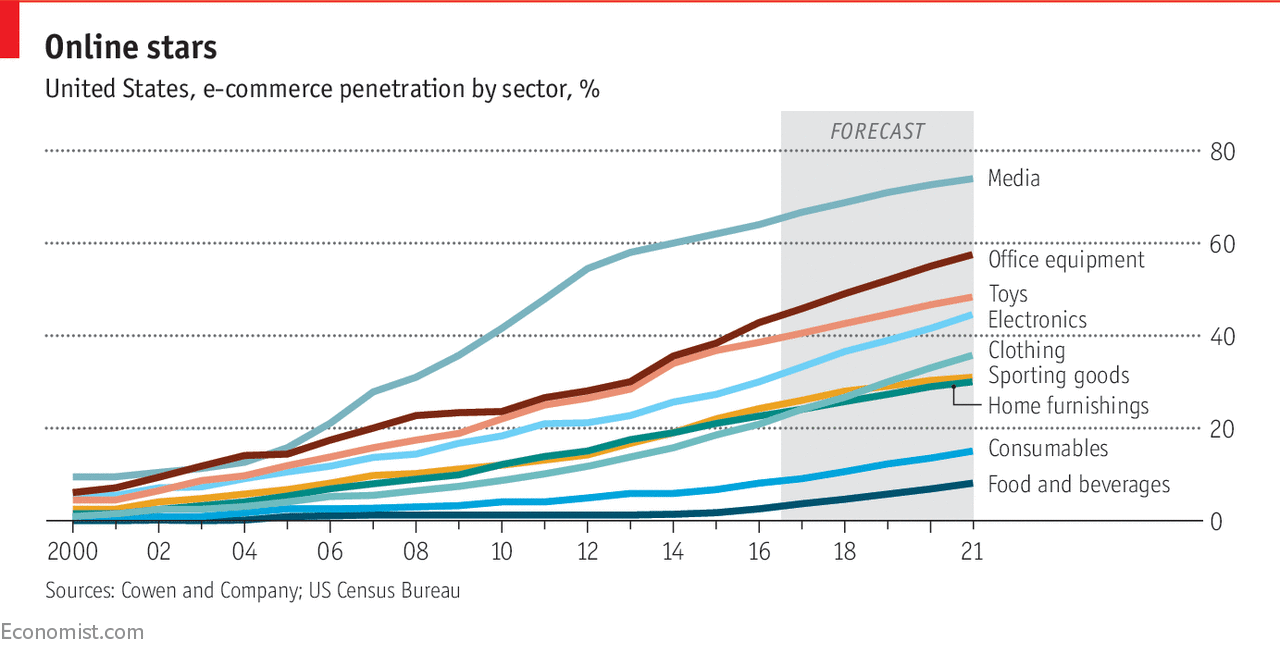

In the United Kingdom, over 80 percent of UK internet users online shop. In China, the online retail market has soared past $1.1 trillion in 2018. While technology has played a key role in the consumer goods industry’s growth, it will be truly disruptive in the coming decade. But while retailers are under increasing pressure, the picture is not bleak for all. Grocery retailers are experiencing robust growth in an inflationary environment, while the nimbler, pure-online players continue to grow market share. In figuring out how to win in this new digital world, companies face some major strategic questions - including how to build a successful business through online retail channels, how to build brands and categories in a socially networked world, and how to understand consumers more deeply and connect with them more often.

Moreover, digital marketing is no longer a one-way communication to consumers. Social media provides an important channel for companies to “listen” to consumers without biases. For example, Unilever used co-creation with its online community to develop Axe Twist, a fragrance that changes throughout the day.

The shift of value

The global financial crisis has driven consumers to value offerings, and it is a trend that is likely to stick. The shift to value has major implications for the CG industry’s profit formula. Not least, it could erode the pricing power of brands. Private-label players are riding the value trend, accounting for more than 40 percent of supermarket sales in the United Kingdom. For example, a major chocolate company reduced its pack size in the UK from 150 grams to 125 grams in order to keep the £1 pack price on the shelf, a key concern for retailers. However, consumers, millennials in particular, increasingly favour smaller, niche brands with environmentally sustainable products. E-commerce has also opened up new selling and advertising channels for upstart brands, which have challenged traditional leaders such as P&G’s Gillette. Such companies are also threatened by rising private-label sales from retail giants such as Amazon.

[* Investment funds that bundle a set of stocks and trades as a stock, that investors looking for exposure across the sector can choose from.]