An Insight into ETFs - The Future of Investing

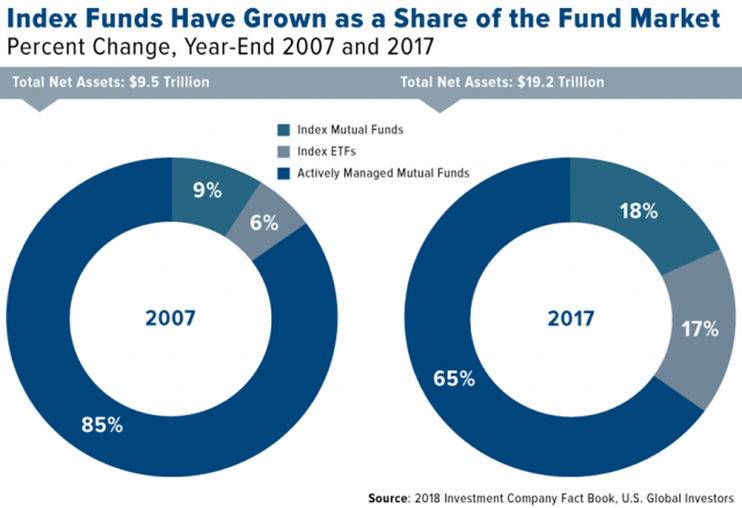

Index funds refer to a mutual fund or Exchange Traded Fund (ETF) that track a specified basket of underlying securities (tradable financial assets). Moreover, ETFs are becoming an increasingly popular investment vehicle amongst both retail and institutional investors. More than 4,500 ETFs managed over 4.46 trillion USD worth of assets in 2017. ETFs, in essence, are securities that are listed on stock exchanges and can be traded just like stocks. An ETF tracks a basket of securities that could range from indexes, stocks, bonds, to even commodities. Popular ETFs include the SPDR S&P 500 ETF (SPY) that tracks the S&P500 Index, Vanguard Total Stock Market ETF (VTI) that tracks the market-capitalisation weighted index of the entire U.S. equities market, and the United States Oil Fund (USO) that tracks the price of West Texas Intermediate (WTI) light, sweet crude oil.

Since ETFs are traded on the stock exchange, they are priced and traded continuously throughout a trading day. Moreover, ETFs can be sold short or bought long and are traded just like stocks. One main advantage that ETFs offer is the low-cost diversification to minimise unsystematic risk during investing. For instance, mutual funds – professionally managed investment funds which pool small sums of money from various retail investors to buy a basket of securities – charge higher fees (average of 0.51% expense ratio) relative to ETFs (average of 0.21% expense ratio, with some brokers even offering commission-free ETFs).

Moreover, the passive investing nature of ETFs aims to track the performance of major indexes (e.g. S&P500 or FTSE100), that provides returns that are similar to that of active fund managers that own a diversified market portfolio. According to Jack Bogle, the founder of the Vanguard Group and one of the pioneers of the index funds movement, who believes in the cost-matters hypothesis that posits why index funds are so successful: The net return to an investor is equal to the gross return in the market as a whole, less the costs of obtaining that return. (Surprisingly, Jack Bogle is not a staunch supporter of the efficient market hypothesis that postulates the best way to beat the market would be to invest solely in the indexes.) Given that passive index funds provide a similar return to active fund managers at a much lower administrative cost, the net return for a passive index fund would be higher than the net returns for active investing with fund managers in the long run.

With the rising popularity of ETFs, a multitude of niche ETFs targeted at niche areas of the market such as the biotech and healthcare sector e.g. HealthShares Emerging Cancer ETF or even socially responsible ETFs catered towards ESG investors.

Since ETFs are generally more passive and track a basket of securities, this has led to the emergence of ETFs with high leverages. Leveraged ETFs increases exposure to a certain index or asset class and an example would be triple-leveraged ETFs that triple the exposure for an investor. Some popular triple-leveraged ETFs would be Direxion Daily Financial Bull 3X share (Ticker: FAS) or ProShares UltraPro Short S&P500 (Ticker: SPXU), with FAS holding a long position for financial sector stocks and SPXU holding a short position for S&P500 index.

Nevertheless, leveraged ETFs have a multitude of flaws and inherent riskiness associated with them. Naïve investors would believe that triple-leveraged ETFs would produce triple the daily return for the underlying investment (i.e. triple the return of the index in the long term). However, in the long term, such leveraged ETFs have a negative bias and would rarely match triple the underlying investment performance. Let’s demonstrate this in the following example: suppose we are tracking an index that starts at $100 and increases by 30% on the first day ($130) and falls 10% on the second day ($117) and falls another 20% on the last day ($93.6) with an overall net loss of 6.4% over the 3 day period. The triple-leveraged index increases the exposure by 3 times, i.e. a loss of 20% is magnified to 60%. Suppose the triple-leveraged index starts at $100, at the end of the first day, it increases by 90% ($190), decreases by 30% on the second day ($133) and decreases by 60% on the last day ($53.2). Overall, the net loss to an investor would be 46.8%. This demonstrates the negative bias of a triple-leveraged index which does not simply match triple the underlying investment performance.

The magnified exposure, volatility and negative bias inherent to leveraged ETFs dictates that such ETFs should not be held as a long-term investments but should be used instead by professional traders who use them as a hedge against big market moves in the short term. Jack Bogle criticised leveraged or inverse ETFs investors as “Fruitcakes, Nut Cases and Lunatic Fringes”. While broad-based ETFs can act to diversify risk, retail investors need to be wary of exotic ETFs that tend to suffer from higher volatility.