Bond Curve Yield Inversion

Yield curve inversions have traditionally been a foretelling sign of impending recessions. To explain the idea of a yield curve, one needs to understand what exactly a yield is. A yield to maturity, or simply bond yield has multiple interpretation, the simplest being – it is the return an investor realises on a bond. For instance, a yield of 4.5% on a bond implies that an investor would get a return equivalent to a 4.5% annual interest rate in a bank account. Bond yields are inversely related to bond prices, when bond prices are low, the yields are high, vice versa.

However, high yields are not always ideal. During the Greek debt crisis and Greek bond default, Greek government bond yields (10Y) reached yield as high as 48.60 before the Greek government defaulted. Bond yields, while giving a yardstick for retail investors to compare the returns on their investment between different bonds, does not account for the risk of default – hence astronomically high yields implies that investors are valuing the bonds very low prices to account for the likelihood of default.

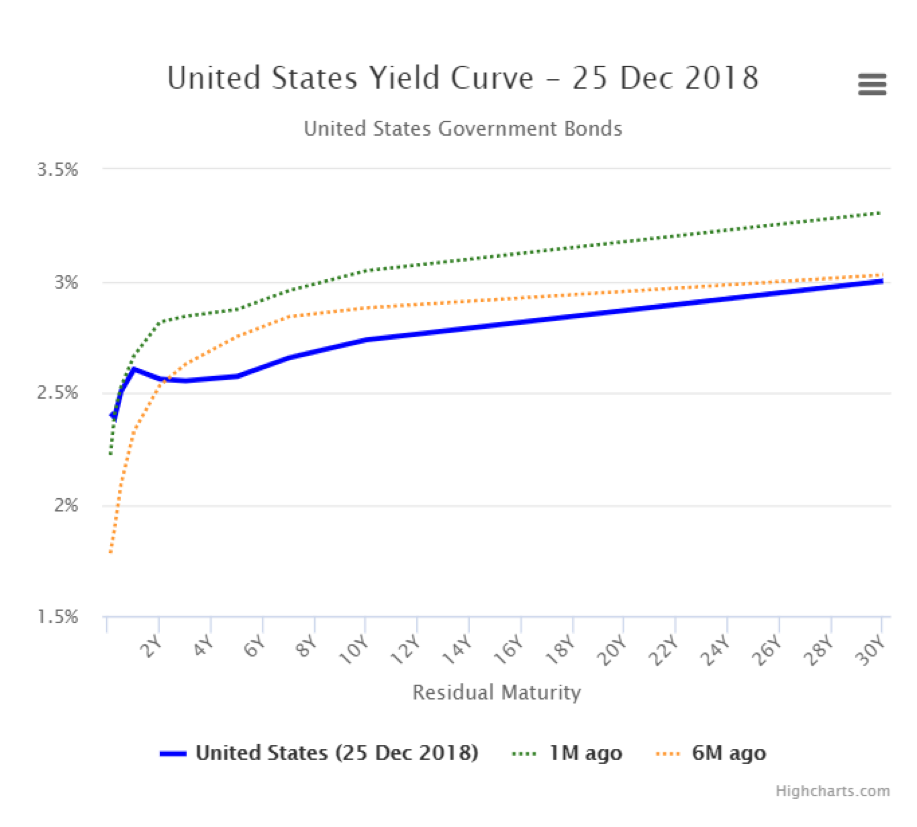

Moving on, a yield curve simply illustrates the yields of a type of bond against the maturity of the same bond (e.g. yield of 10Y U.S. bond against the maturity of 10 Years). A standard yield curve is shown below. There are 3 crucial things to understand about the yield curve:

- Short-term government bonds (<2 Years) typically has a lower yield relative to long-maturity government bonds because long-maturity bonds tend to have a higher default risk (hence the prices of 10 year maturity bonds tend to be lower and their yields tend to be higher). i.e. the Yield curve is upward sloping in a normal scenario.

- Short-term government bond yields are controlled by the central bank via monetary policy. In the U.S. context, this is done by adjusting the Federal Funds Rate or by carrying out Open Market Operations (Sale or purchase of government bonds). When the U.S. Central Bank (the FED) raises the Fed funds rate, this increases the cost of borrowing for overnight loans by commercial bank and commercial banks would raise their interest rates conversely. In times of inflations (high economic growth/Overheating), the FED would raise interest rates to relieve the inflationary pressure while during times of deflations (recessions), the FED would lower interest rates.

- The long-term government bond yields are controlled by bond traders and reflects the sentiments of bond traders. For instance, when the market is performing well, bond traders would expect that the FED would raise interest rates, and conversely, this would lower the price of bonds and increases yields. Bond traders in turn, would start selling the long-term bonds in anticipation of this rate hike (and decrease in bond prices), leading to high yields for the long-term government bonds. In this sense, an upward sloping yield curve reflects a healthy economy.

However, when bond traders suspect that the FED would lower interest rates in light of an impending recession, bond traders would began buying long-term government bonds as the price of long-term government bonds would rise when the FED lower interest rates. Hence bond traders would begin buying long-term government bonds and this would lower the yield of long-term government bonds. This reflects a pessimistic investor sentiment towards the market, and it is a strong warning sign of an impending recession.

Overall, it can be observed that a yield curve inversion – when the yields of long-term government bonds becomes lower than the yields of short-term government bond, it is a strong warning sign of an impending recession. Historically, the bond curve has inverted 7 times since the 1980s, out of which, 6 times the bond curve inversion has predicted and preceded recession. The 6 times were: the two 1970s oil crisis, the 1980s recession, the 1990s recession, the early 2000s dotcom burst, and the 2008 Global Financial Crisis. Each time, the bond curve inversion happened less than 2 years prior to each recession.

In recent times, the spread between the 3-year and 5-year U.S. government bond has turned negative (i.e. one segment of the yield curve has inverted). Moreover, the spread between the 2-year and 10-year U.S. government bond lies at 17.6bp (or 0.176% point spread). While the current yield curve has yet to be fully inverted, it can be seen that the yield curve is flattening Given the hawkish stance the FED has been assuming (hawkish refers to the FED closely watching inflation and would likely raise rates), the flattening of the yield curve implies that bond traders suspect that the FED would assume a dovish position in the near future. Ironically, the Fed still chose to raise interest rates in Dec 2018 despite the foretelling signs of yield curve inversion – a harbinger of recession.

Nevertheless, it is imperative to keep in mind that the timeline between yield curve inversion and economic recessions are not instantaneous. The yield between the three to five year maturity bonds dipped below zero during August 2005, two years prior to the start of the Global Financial Crisis.