Debt and Equity: 2 sides of the same coin

Just as a plant needs water for growth, so does a business require capital to expand. Debt and equity are two sides of the same coin. A company may choose to finance itself with debt or equity or a combination of the two. The company approaches banks or investors for a loan and/or to sell a stake of the company to raise capital.

Debt in simple terms, refers to the amount of money borrowed by the borrower from the lender. The debt agreement usually involves the repayment of the amount borrowed plus interest to the lender. Interest is charged on debt as compensation to the lender for taking on the risk of the loan while also incentivizing quicker repayments to reduce the borrower’s overall interest expense. The risk of a debt refers to the probability of the borrower defaulting, i.e., the borrower being unable to repay the loan and/or its interest payments. We are familiar with debt in the form of student loans, auto loans, mortgages and credit card debt. Businesses also use debt to finance the acquisition of assets, e.g., machinery, real-estate and raw materials. In both cases, the business and the individual issue debt while the bank takes on the (carries the risk of) debt in return for interest payments.

Individuals, banks and other institutions can also take on the debt of a business by purchasing its bonds. Bonds are loans issued by companies, municipalities, states and sovereign governments to finance operations. They have variable or fixed interest payments. They are an asset class known as fixed-income securities as they provide periodic interest payments at pre-determined interest rates. Bonds can be traded (bought and sold) publicly on a stock exchange or privately between private parties.

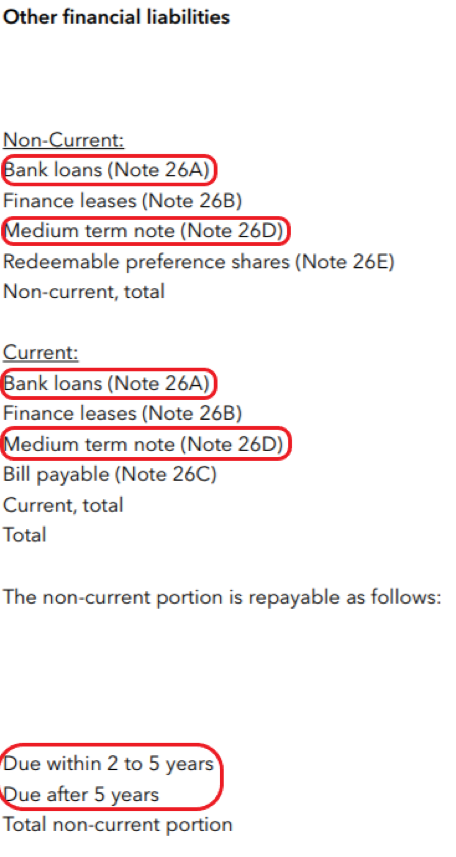

Debt is found on a company’s balance sheet under the section of liabilities. Liabilities are split between current and non-current, differing in their settlement date. Those due to be settled within a year or less are classified as current while those due later are non-current. Current liabilities are useful for gauging a company’s short-term liquidity. Debt can be found in a plethora of vehicles as such bank loans, notes (short, medium and long term), bond payables and lease agreements on assets the company is utilising but does not own. These are listed and elaborated upon in quarterly and annual reports to allow investors to gauge a company’s short and long-term financial health.

Like how one is wary of lending money to a consistently indebted friend, a company with too much debt is seen as risky and financially unhealthy and are termed highly leveraged as debt is leveraged to finance operations. While not every highly leveraged company is a bad one, leveraging makes future debt more expensive as potential investors will expect a higher return in exchange for lending money to a risky company.

Instead of issuing debt, a company may choose instead to sell a portion of the company in return for capital. Equity often refers to a share or any other form of investment vehicle that represents an ownership interest. If one purchases a single share in a company that splits and sells 100% of its ownership into 100 shares, one owns 1% of the company. While debt represents an obligation to repay a loan, equity represents ownership. This definition differentiates holders of debt as the debtors of the company while holders of equity as the owners. Holders of equity are entitled to a portion of profits as well as voting rights on matters pertaining to the company. Shareholders are eligible for dividend issuances and voting rights at general meetings. Dividends are excess profits distributed as cash-handouts per share to reward shareholders and incentivize their continued vested interest in the company.

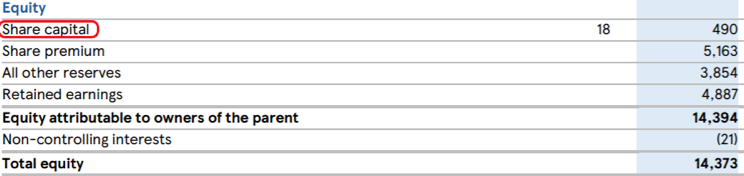

The characteristics mentioned above are those of common shares. Companies can also issue a form of equity known as preferred shares. Preferred shares also represent ownership of the company. However, preferred share-holders are entitled to a fixed dividend payment whilst common share-holder dividends are subject to the company’s performance and approval by the board of directors. Dividends on preferred shares are pre-determined and often larger than those of common shares. In times of insolvency, the proceeds from the liquidation of the company first go to bondholders, followed by preferred shareholders and finally to common shareholders. Hence, preferred shares represent a greater claim to a company’s assets and earnings. As such, preferred shareholders, like bond holders, are not given voting rights as they are viewed as “less risky” investments. The primary means of issuing equity is through an Initial Public Offering (IPO). The shares of the company are listed and traded on a stock exchange for the first time, representing the initial “offering” of shares for sale to the public, also known as a primary offering. The proceeds of the sales go to the company, which will be recorded as an asset known as “share capital” on the balance sheet. Companies will employ the services of an investment bank to structure the intricacies of the IPO, including pricing, size and even its timing.

Companies may also re-purchase their own shares from the market for a multitude of reasons. It is viewed favourably by investors as a sign of “future value” of the company, i.e., the board of directors by virtue of running the company, expect the future value of the shares to be higher and purchases them for re-issuance at a higher market value in the future via a secondary offering. This allows the company to increase its share capital without having to dilute shareholder ownership by issuing more shares.

The big question remains, which is better for financing a company, debt or equity? The general rule is; debt is cheaper than equity. This is best understood with an example. If a company requires £30,000 pounds to finance its business operation, it could issue £30,000 in bonds paying an annual 5% interest or it could sell a 10% stake in its business. If the company performs well and makes £100,000 in profit in a year, the bond interest will be £1,500 while the 10% stake will represent £10,000 of profit owed to shareholders. The company will have saved £8500 in profit by issuing debt instead of equity. In this situation, the cost of equity is more than the cost of debt.

The key idea is; debt repayments represent a fixed-expense liability, that is removed once the debt is paid but equity is a long-term obligation to the shareholders and a dilution of ownership as the company is split amongst more shareholders. These could represent a boon or a curse depending on the company. Start-ups, small players in large industries, highly leveraged firms and other young companies with unstable cash flows will find accessing cheap debt, i.e., issuing debt at low interest rates, near impossible as investors are not willing to part with their money for a risky company without a proportionately higher return. As a result, most turn to venture capital for financing, selling stakes in their company in return for capital. Larger, more established firms have predictable and reliable cashflows that grant them access to cheap debt and are unlikely to issue new equity.

Another aspect that influences a company’s method of financing are the wider market forces. A roaring bull market, where equity (stock) markets are achieving new highs makes issuing equity via an IPO attractive. If the companies in question are creating a buzz on the street, the like of ubiquitous companies like Snapchat or Uber, the public will be clamouring to get a piece of their equity. As the saying goes, a rising tide lifts all boats; even if the company isn’t generating hype or has uncertain prospects, the general “good mood” of the stock markets provides a base for the IPO to perform well. Bull markets are therefore synonymous with an increased appetite for risk amongst investor, where issuing equity is attractive.

Discount rates of the central bank will influence the use of debt. The central bank requires financial institutions to hold a portion of money in the reserves at the end of each business day. This reserve requirements ensures banks have enough money tucked away to meet customer withdrawals. The discount rate is the interest rate central banks charge banks and other financial institutions for loans to meet the overnight requirements. Fluctuations in the discount rate will affect the interest rates bank charge on loans to companies. If the economy requires stimulation, the central bank will lower the discount rate. Since banks can now loan money from the central bank at a lower rate, it encourages them to lower their own rates for customers, making the debt market more appealing. During times of inflation, when the economy needs to “slow down”, the reverse is true and a company may find the interest rates on their debt increase, thereby increasing their cost of debt.

Debt and equity, representing capital obtained from different means, form the capital structure of a company. The optimal capital structure is one that achieves the lowest Weighted-Average-Cost-of-Capital.. Capital structures vary largely by industry. Cyclical industries such as mining and airlines are unsuited for high amounts of debt as the unstable revenue streams creates uncertainty surrounding debt repayment. Banking and insurance, however require large amounts of leverage, hence hight debt is the norm. The role of monitoring and optimisng the capital structure falls on the Chief Financial Officer. This role is often used interchangebly with the title Chief Invesment Officer, though responsibilities may differ across companies, industries and countries. It falls on this individual to strike a delicate balance between each side, taking into account internal and external factors, to finance a company throughout its life time.