Electronic and Algorithmic Trading: Fixed Income Securities

Electronic trading has become an increasingly important part of the fixed income market landscape in recent years. The rise of electronic trading has enabled a pickup of automated trading (including algorithmic and high-frequency trading) in fixed income futures and parts of cash bond markets. These recent changes have resulted in a transformation of the fixed income market structure, the process of price discovery and the nature of liquidity provision. Electronic trading’s advance and structural consequences will have implications for market quality and functioning that are yet to be fully explored. This article provides a view of the rising use of electronic and automated trading in fixed income and related derivatives markets – a process we refer to as “electronification”.

Algorithmic trading is a process of buying or selling a security based on some pre-defined set of rules which are backtested on historical data. These rules can be based on technical analysis, charts, indicators or even stock fundamentals. For example, suppose you have a trading plan that would buy a particular stock if it closes in red for 5 consecutive days. You can formulate this rule into an algorithmic trading system and even automate it so that a buy order is placed automatically when your condition is met. You may even define your stop loss, target and position sizing in the algorithm which would make your trading life easier.

Algorithmic trading strategies can be roughly grouped in three categories: Trade Execution; Market-aking; and Directional, Relative Value and Arbitrage Strategies. Trade Execution is when execution algorithms are often concerned with minimising the price impact of a transaction. Market-making is to profit from the bid-ask spread, while ensuring tight risk control over inventory positions and minimising the risk of transacting with an informed counterparty. Directional, Relative Value and Arbitrage Strategies are strategies that attempt to exploit systematic short-term patterns in asset prices or arbitrages; may also implement strategies identifying arbitrage opportunities in markets with fragmented liquidity.

The impact of electronic trading in fixed income markets and the resulting shift in various aspects of market structure have had a noticeable impact on market quality and its optimal measurement. Electronic trading is having a significant impact on the structure of fixed income markets and the interplay of various participants in the market ecosystem. Electronic trading has also contributed to changes in market-making business models, a growing presence of firms employing automated trading, and greater weight being placed by investors on improving execution.

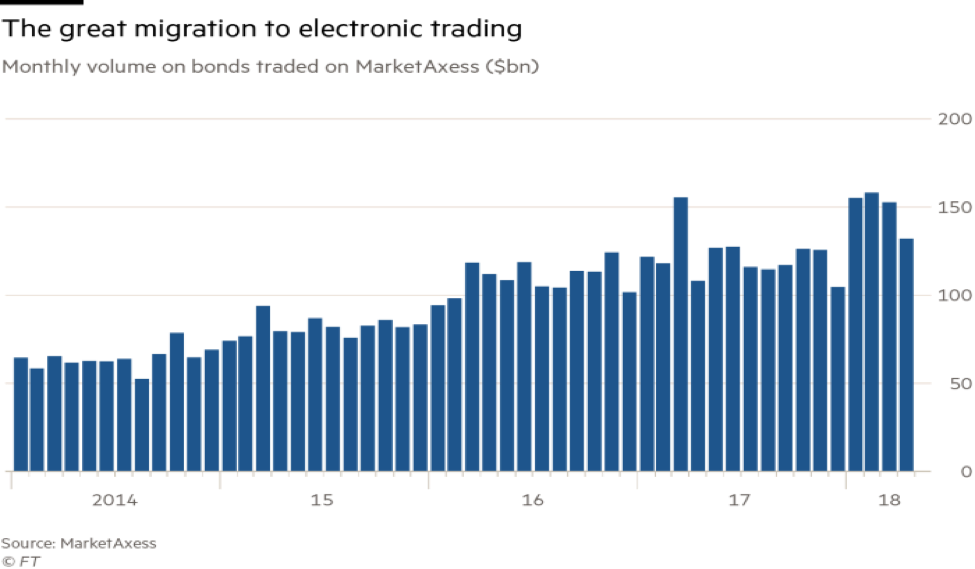

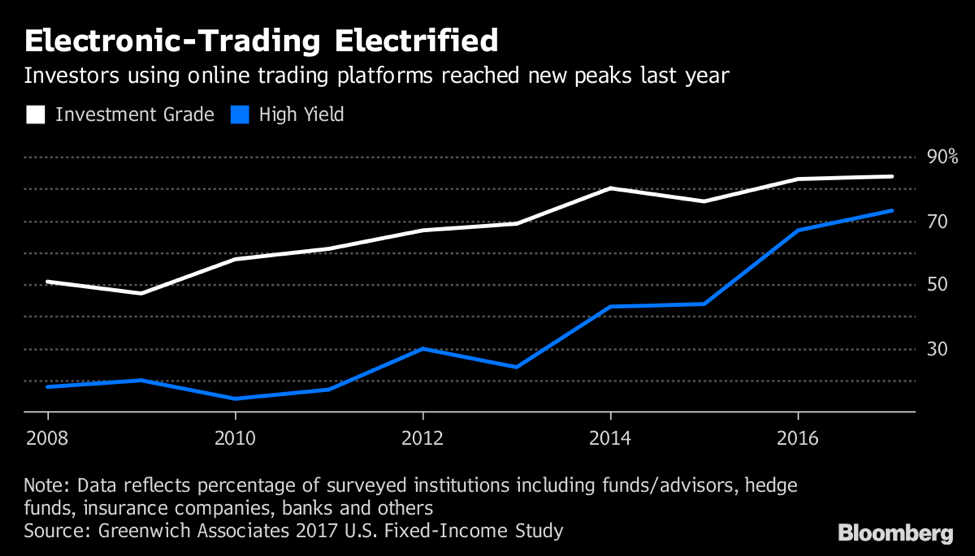

The extent of electronic trading in fixed income markets varies significantly but has been growing over time globally as shown in Fig. 1 and Fig. 2.

Despite the phenomenon’s growing importance, policymakers direct access to continuous and comprehensive data on electronic trading in fixed income markets is so far limited. It also presents the results of an ad hoc survey of over 30 platform providers conducted by the Markets Committee Study Group. In some fixed income segments, electronification is now nearly as developed as in cash equities and foreign exchange.

In some markets, an increase in electronic trading has been driven directly by technological improvements that have facilitated a reduction of the marginal cost of providing intermediation services and lowered the barriers to entry for companies with a technology advantage. Electronic trading is most advanced in those markets in which assets are most standardised and highly liquid – in particular, futures and the inter-dealer on-the-run US Treasury market.

In conclusion, it is clear that electronic trading in fixed income markets is advancing and that this is creating efficiencies for many market participants, improving transparency and reducing market segmentation. It is important to note that the appropriate responses may differ across jurisdictions because of the heterogeneous nature of fixed income markets as well as the varying degrees of “electronification”. Four core areas for further policy assessment include: data, disclosure and monitoring; market quality and stability; risks and risk management; and trading practices and regulation.