Risk in Investment Management and Financial Services Part 1 :Credit Risk

The objective of this series, Risk in Investment Management and Financial Services, is to provide a top-level introduction to risk in investment management and financial services. A broader and wider understanding of different types of risk faced in investment management and financial services is critical towards our understanding of different investment and financial products, services and strategies adopted in a growing risk-dynamic environment that we are experiencing today. The different types of risk include: credit risk, operational risk, market risk, investment risk, liquidity risk and model risk. The aim of this article is to focus on credit risk in investment management and financial services.

Credit risk is the probable risk of loss resulting from a borrower’s failure to repay a loan or meet contractual obligations. It is the risk of default on a debt that arises when a borrower fails to make required payment. This implies a lender does not receive the owed principal and interest. This leads to a negative disruption in the lender’s cash flows and increases costs of debt collection.

Three key components of credit risk are: counterparty risk, issuer risk and concentration risk. Counterparty risk is the risk associated with the risk that each party of a contract will not meet its contractual obligations. Issuer risk is the risk associated with the probability of loss resulting from the default of the issuer of the credit. Concentration risk is the risk arising from the concentration to a single counterparty, sector, country and/or industry. The key issues associated with credit risk includes: probability of default, loss given default, exposure at default, recovery rates, credit events, maturity, wrong way risk and non-performing credit asset.

Credit risk measurement and reporting plays a vital role in credit risk management. Three commonly used techniques for assessing credit risk are: credit exposure; credit risk premium and credit rating. Credit exposure measures the total amount of credit extended to a borrower by a lender. The higher the credit exposure of an investment firm or financial firm, the higher the likelihood of credit default. Credit risk premium is the return in excess of the risk-free rate of return on a credit-based investment is expected to yield. Credit risk premium rewards an investor who tolerates extra risk. High risk credit-based asset attracts a higher credit risk premium. Credit rating is a credit score that reflects the likelihood of payment by a borrower. The higher the credit rating, the higher the likelihood of payment. The big three credit rating agencies are: Moody’s, Standard & Poor and Fitch rating.

An effective credit risk policy is paramount and essential for modelling, controlling and managing credit risk. The key stages of credit risk policy development recommended by Basel are: development, validation, approval, implementation, review and post-implementation monitoring. Credit risk and credit risk policy can be effectively managed by using: a reliable credit scoring system; understanding financial, non-financial and extraordinary input factor to a firm; conducting robust stress testing, setting limits or caps to control risk; monitoring and tracking key risk statistics and key risk indicators and continuously carrying out internal and external credit audit. It is important to note that effective credit risk mitigation is also required. This involves having underwriting standards, guarantees, credit limits, netting, collateral, diversification, credit derivatives, credit default swaps, insurance and central counterparties.

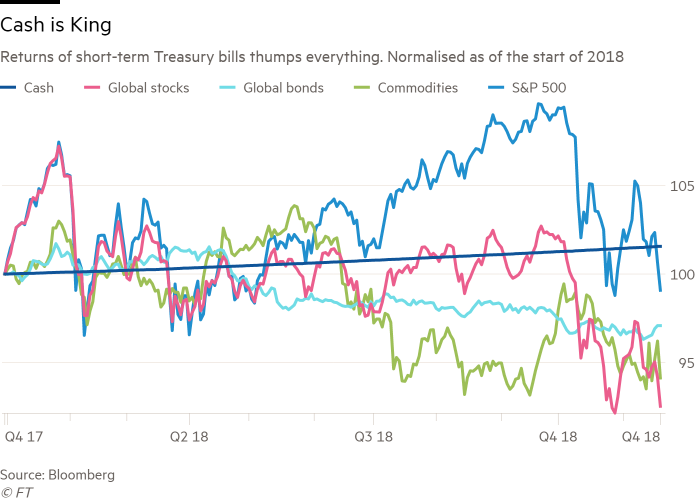

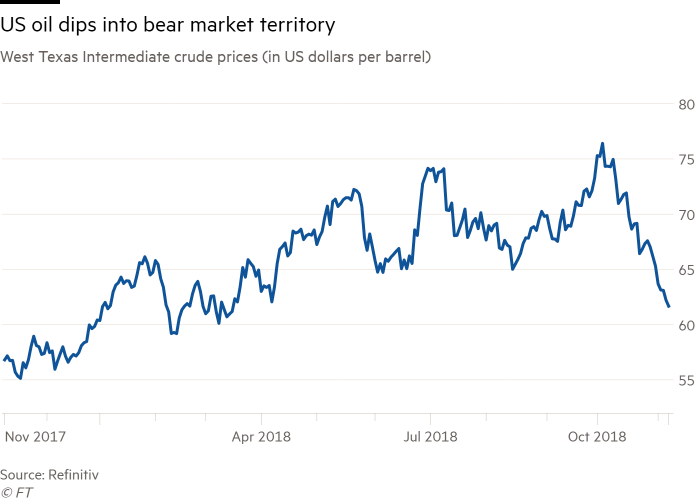

The 2008 financial crisis remains a prime example and a prime reminder of credit risk failure. There was a high default rate in the United States subprime home mortgages sector (mortgage-backed securities). On one hand, this was partly caused by deregulation in the financial industry which led banks to execute very risky derivates trades. On the other hand, the credit failure was due to an extremely large appetite for banks to increase their profit margin at all cost. The result of the credit risk failure can be highlighted as follows:

- Worst recession since the Great Depression

- House prices in the US fell by 31.8%

- 8 million jobs lost in the US

- $19.2 trillion lost household wealth

- Lehman Brothers filed for bankruptcy

- Global financial systems came to its knees

The role and sound practices of credit risk management and credit risk policy development in practice is complex and challenging. However, continuous and iterative credit risk management and credit risk policy development remains central and critical to the success of firms in investment management and financial services in an ever growing dynamic environment.