Will the dollar determine markets in 2019?

After a volatile end to 2018, investors are now looking at what the new year can bring. Despite rising 7% against a broad basket of currencies in 2018, many now deem the dollar overvalued. Drawing parallels from both physics and Forex trading, it is well known that whatever goes up must eventually go down. The bear case for the dollar is formed on the expectation that GDP growth in America will slow down. The stimulus provided by Trump’s tax cuts last year will fade, and increasing Fed Funds rates will begin to bite. Suffering oil prices, that is hurting investment in America’s shale regions, is another factor as low crude prices becomes beneficial for oil importing regions such as Europe and Asia. America’s tech giants are also coming under pressure, losing their invulnerability allure they had at the beginning of last year. In short, the recent bull run on America’s economy is coming to end and so should the rise of the dollar.

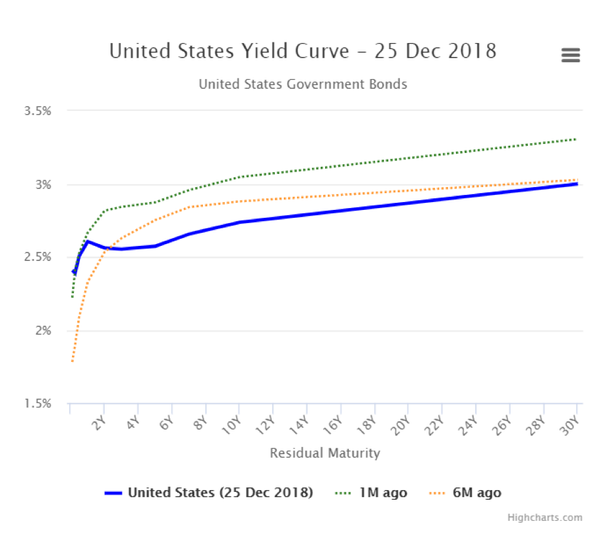

Mansoor Mohi-uddin of Natwest Markets has set out three pre-conditions for a turn in the dollar: a “pause” by the Fed, an end to the China-America trade war and a pickup in the eurozone economy. The first looks like it’s on the horizon. Jerome Powell, chairman of the Federal Reserve, hinted at the beginning of the new year that it might postpone any further rate hikes. Furthermore, whilst interest rates in America may not rise they are still higher than in Japan or the Eurozone, making owning the dollar more rewarding. Will this change in 2019? Many see the path of the new year laid out by two scenarios. The first entails tax cuts and looser monetary policy in China, caused by dispersed trade tensions, stimulating private sector spending. Consequently, this stirs other Asian economies which will increase activity in the euro zone, which relies heavily on emerging market demand. Hence bond yields rise in the expectation that interest rates will increase, making US debt less favourable, as spreads between US and Euro bonds decrease, causing the dollar to drift down against the Euro. Evidence of this has been seen in recent turbulent markets, causing strain on the American fixed income front. JPMorgan recorded a sharp fall in bond and currency trading revenue as CEO Jamie Dimon warned that US government shutdown is creating more challenges by bringing the economy to a standstill. However, this scenario also suggests a softish Brexit boosting the pound, causing a capital influx into emerging markets in the search of higher returns. However, after Tuesday’s vote, the probability of this remains uncertain as it sunk the pound to a six session low of $1.2668.

The second scenario, the trade dispute between China and America escalates. This continued uncertainty means China’s tax cuts are saved rather than spent. Weakness in China’s economy brings down other emerging economies. Evidence of this can be seen in the fact that export orders for the large trading as well as manufacturing economies of Asia and Europe are signalling a trade recession. Europe has been suffering from declining demand in China, the primary drivers being policy and regulatory efforts to rein in the economies credit independence, as China’s economy gets to grip with underperformance of domestically oriented Chinese equities. A rise in emerging markets risk assets would only happen if there was a reversal of the Chinese protectionist rhetoric. Since this remains improbable and would indicate that the stuttering eurozone economy is not temporary but a reflection of weak export demand, there would likely be a sell off of risk assets across the board. Consequently, the dollar falls sharply against the yen and swiss franc (euro remains weak). Investors rush towards safe-harbour currencies, as JPMorgan strategists advise clients to take some insurance, leading to a surge in the price of gold. Goldman Sachs now expects the price of gold to rise to $1,425 over the next year. “To take a view on gold, you have to first take a view on broader markets”, said Tom Holl, BlackRock portfolio manager. He added, “If we continue to see elevated levels of macroeconomic uncertainty and risk adversity, then gold will probably continue its positive momentum”.