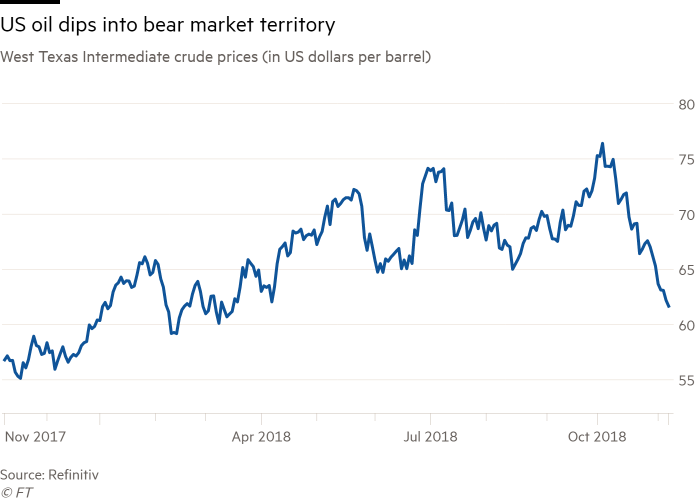

Crude oil enters bear market

US crude oil prices entered a bear market [defined as a 20% drop from a recent high] on Thursday as concerns of tight global supplies eased. This follows Washington allowing eight countries to continue buying Iranian crude, softening the blow of new international sanctions on the nation. In addition to this the US Energy Information Administration’s weekly inventory report last Wednesday showed that US domestic crude stockpiles have increased for a seventh week to 432m barrels, the most since June. Consequently, many investors see this as a sign that concerns over abundancy of oil reserves diminishing and the buying pressure of this commodity reducing. As a result of this, commodity traders such as Warren Patterson of IGN, believe “Price weakness has raised the prospect of OPEC reversing their recent policy of producing as much as they can, to one where they show more restraint”. As expected, on Monday Saudi Arabia opened the door to cutting crude production (despite Russia saying that an excess of supply is short term, putting these two big oil producers at odds), causing a jump in oil by 2%. Khalid al Falih, the kingdoms energy minister, said the state energy giant Saudi Aramco would supply 500,000 fewer barrels a day in December compared with November due to lower demand. It was only earlier this year that Saudi Arabia targeted an increase in production of 1 million barrels a day because of the pressure of the Trump administration, who called on the OPEC nations to fill the void after Iranian sanctions depleted world supply. However, as Trump granted waivers to big customers of Iran such as India and China, fears arose about oversupply. Despite what analysts at consultancy FGE forecasting a drop in Iranian oil supply of 1.3 million barrels per day in the next six months, as Brian Hook, US special representative for Iran, said on Monday that there would be further sanctions as “our goal remains getting countries to zero over time”. One key metric is the fact that hedge funds have gone from being bullish on crude oil earlier in 2018 to sharply reducing their positions in the past few weeks, indicating that many are betting that the cycle has turned, although some analysts believe that if more barrels are cut from Iran than currently expected, funds will rush back into the market adding fuel to any rally.

What is also important to note as a direct consequence of falling crude prices is that it caused a sell-off in high yield energy bonds. The last sell-off in 2014 with a 14% decline in oil prices, more than 100 energy companies went bankrupt. It is true though that the forces driving the oil prices lower are different in 2018 than 2014 and more importantly the fundamental quality of high yield issuers has improved, making the recent drop in oil prices less troubling. The fact is that energy is one of the most attractive sectors for high income investors, due to the fact that spreads have yet to reflect the fundamental problems of the industry. The spread on energy bonds on November 8th was 432 basis points, compared to 335 basis points for the rest of the high-yield market.