Investment banks relish in hawkish environment

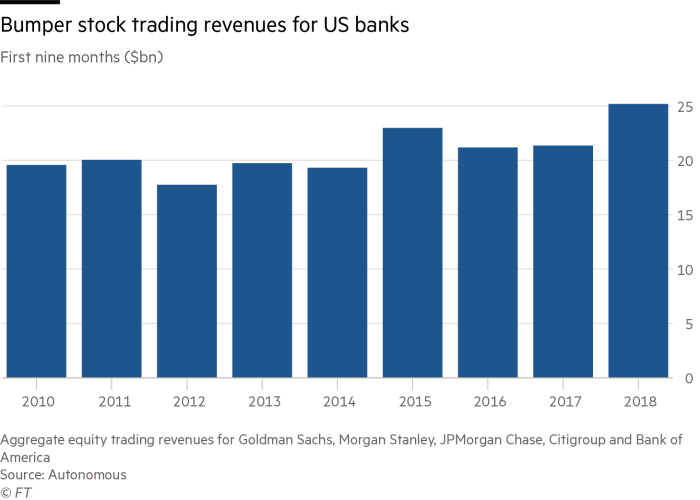

It is a well-known fact that when interest rates are hiked, investment banks increase their profitability due to their massive cash holdings. Increasing the interest rates directly increases the yield on the cash it holds, and the proceeds go directly into the income statement. Furthermore, interest rate hikes tend to occur in environments where economic growth is strong and consumer and corporate demand for loans spikes. It is not surprising that with the current strong economic climate in the USA, powered by the tax cuts imposed by the Trump administration in addition to the recent rate hike by the Fed, that bulge bracket banks are starting to reap the rewards. One clear example of this is Goldman Sachs. The bank reported $6.28 earnings per share (EPS) exceeding the $5.38 analyst estimate, with revenue exceeding $8.4 billion estimate coming in at $8.65 billion. The business had benefited strongly from high demand for initial public offerings (IPO), where revenues for equities underwriting had more than doubled and fears that fixed-income would be hit were cushioned by higher revenues from FX and commodity trading. David Solomon, CEO who took over on 1 Oct, is also broadening the banking and trading client base, finding growth in smaller markets including pushing into retail banking. Marcus, the new retail banking arm of Goldman Sachs, hit the UK high streets earlier last month and it has been announced that it will merge with its investment management unit. Solomon claims the new division will launch a “broader wealth-management offering combining Marcus’ digital capabilities with the more established sales channels and products currently housed within the investment management division”.

On the other side of the Atlantic, European banks have also recorded strong growth. Barclays published third quarter results with revenues from equities and fixed-income trading up by almost a fifth. Jes Staley, Barclays Chief Executive, said “There has been a comment that European investment banks can’t compete with the US, and I would just point out that for four quarters in a row we have gained market share”. The strong performance of Barclay’s trading desks compared well with the larger banks like Goldman and Morgan Stanley, but its revenues are still dwarfed by its US rivals. However, it looks like European private banks are the highlight. Selling lucrative products and services to the world’s growing number of millionaires generated record profits of €15.4 billion for 111 private banks in western Europe, with an annual increase of 14.1% according to McKinsey the consultancy. UBS, the main player globally in private wealth management, reported that adjusted pre-tax profits for its non-US wealth operations rose by 15%. Compare this to BlackRock (the world’s largest asset manager with more than $6 trillion of assets under management based in the States) whose shares plummeted after its long-term net flows- a measure of how much money investors are handing it, excluding more short term volatile cash management vehicles- have hit a two year low. BlackRock CEO Larry Fink, laid the blame on choppier financial conditions, which have caused investors to scale back their exposure to the market saying, “Divergence in monetary policy and macro and geopolitical uncertainty continues to impact investor sentiment and our financial markets, leading clients to reduce risk in their portfolios”. However, BlackRock is facing a seismic longer-term shift in the investment industry. The global asset management industry is facing intensifying pressure from cheap, index tracking funds, which have drawn hundreds of billions of dollars since the financial crisis.

I think, however, this shows what all investors are worried about at the moment. The business cycle peaking. Despite strong growth results there is an underlying realisation that this is no longer sustainable, and that this is as good as it gets. What is worrying is that the debt load for US corporations has reached a record $6.3 trillion, with increasing yields and what looks like choppy waters ahead will everyone be able to meet their liabilities?