Rising Fed rates puts pressure on markets

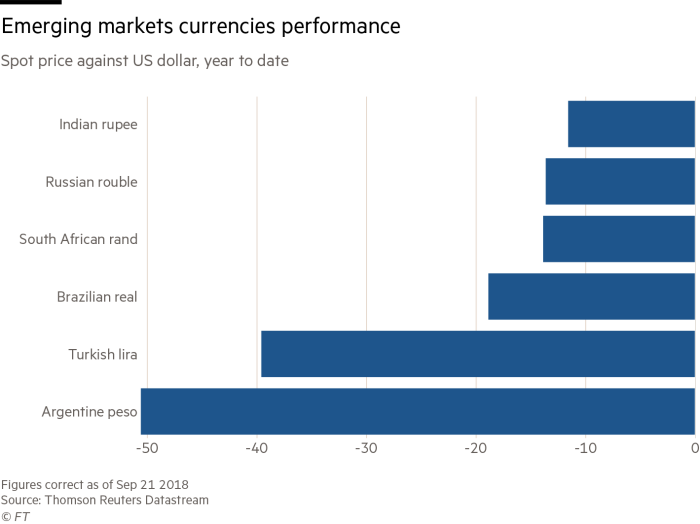

Since the fiscal stimulus of tax cuts that the Trump administration has implemented this year, the US economy on the surface has been doing great. It has notched a 4.1% annualized growth rate for Q2, which is considerably faster than the 2% growth rate that has been standard since 2001. Then in mid-August US stocks hit an all-time high as the S&P 500 broke its longest Bull run in history. Naturally then, the Federal Reserve and many investors became sceptical that this growth was sustainable, and that the US economy was ‘overheating’. So, it didn’t come as a surprise when The Federal Open Market Committee increased the Fed funds rate by 25 basis points to 2.25%. However, the dawning realisation that the Fed could increase rates further was met with anxiety. A ferocious government sell off of sovereign bonds that started at the beginning of this month, has started to pinch at the equity markets as investors are worried about the implications of higher treasury yields. Last week what began as a gradual sell-off escalated into a violent dive causing brutal losses in Asia, in particular the tech-heavy Taiwanese market, trickling through to Europe and then coming back to the US market again. At the market close last Thursday $1.7trn had been wiped off the S&P 500. Curiously, the emerging markets remained un-affected which is surprising as they have been battered by the rising strength of the dollar and US economy. EM fared well after the financial crisis when record low treasury and Eurobond yields as well as programmes such as quantitative easing caused investors to flood money into EM economies as they sought higher returns. However, recent tightening of US monetary policy and the subsequent rise in the dollar has caused money to flood out. Furthermore, with the majority of EM’s having debt denominated in dollars rather than the local currency, means that as the dollar strengthens it becomes harder and more expensive to pay back their debt. This has caused EM with large current account deficits [a high dependency of foreign investment] and high external debt like South Africa, Turkey, Brazil and Argentina to suffer considerably. So far this year the Argentine peso is down 50% against the dollar, the Turkish lira is down almost 40% after President Erdogan raised economic tensions after his controversial comments on interest rates which he called a ‘tool of exploitation’ making the central bank wait months to raise rates, despite double digit increases in inflation. Despite this this doesn’t mean investors should completely exit their positions in EM economies. Prices for EM stocks are plummeting to fresh lows and the brave investor could find a bargain. Equity valuations are trading in excess of 40% discount to the US market in term of P/E ratios according to Mobius Capital Partners. This may be the time as well with the European bond market looking precarious with the Italian yield crisis. The European Commission and Rome are currently in a spat and the new Italian populist government plans to run a higher budget deficit. After officials agreed a deficit target of 2.4%, busting the 2 % maximum that Finance minister Giovanni Tria said he’d accept, yields on the Italian bond soared a whopping 40 basis points to 3.3%. Consequently, Investor’s negative bets on Italian government debt have peaked, indicating that these new budget proposals have fuelled concern. Filippo Lanza, chief investment officer at London based hedge fund Numen Capital, said ‘Italian bonds are already discounting downgrades from Moody’s and S&P… The market believes that the government has set a spread of 400bp as a target, but at 3235bp to 350bp we expect to see short covering as the market discounts the game plan and we think eventually a comprise will be found between government and the European Commission’.

So is an economic downturn approaching. Yes. Inevitably there will be a market correction at some point, whether that triggered by the growing liabilities of governments or the effect of struggling emerging markets slumping world growth. However, currently I think the market is strong. Central banks have started to increase policy rates and we are beginning to reduce our dependence of quantitative easing, but the greatest threats to the global economy is political. Ironically, the Trump administration is not only the cause of the booming economy but also its biggest threat. By imposing tariffs not only on China but on its strongest allies it threatens to break up global cohesion that is needed to maintain a stable economy.