Big Daddy Oil outearns Apple and Google, wants more

The month of April marked a historic moment for the financial markets. The Saudi Arabian Oil Company (Saudi Aramco) had its debut international bond issuance. A titan in the world of oil and gas, whose pulse is closely monitored by financial markets as a proxy to the health of one the world’s favourite commodities, Saudi Aramco has raised $12bn from the $100bn received in orders, the largest amount ever seen in an emerging market bond deal. Investment banks JP Morgan and Morgan Stanley were the joint global coordinators for the deal.

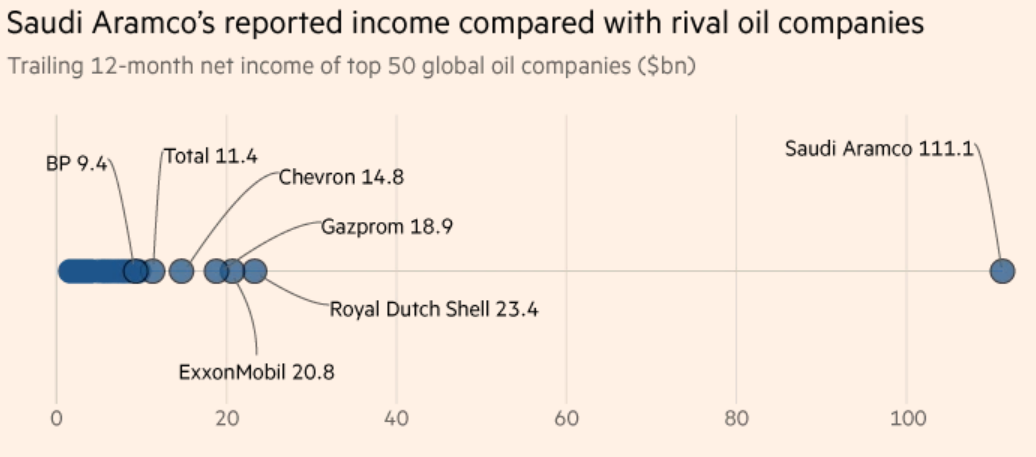

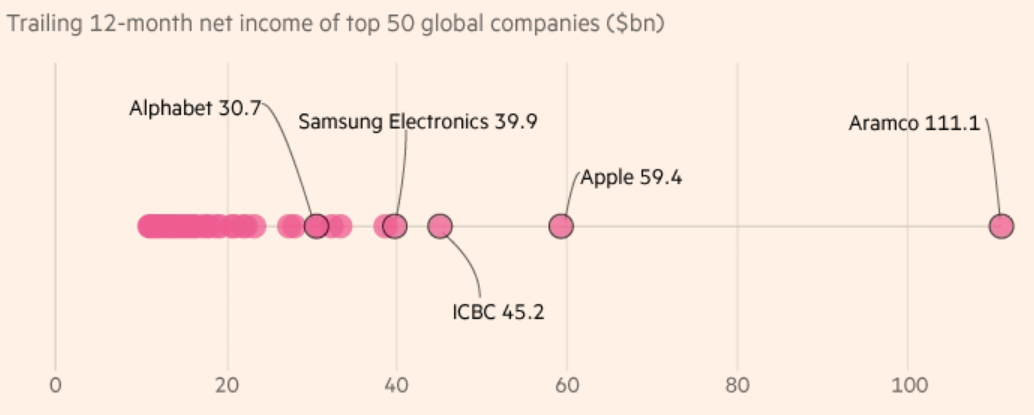

On April 10th, 2019, the secretive state-backed corporation released a 469-page prospectus, giving investors a glimpse into the finances of the oil giant, which have previously been kept secret for three-quarters of the century. The numbers confirmed rumours of the corporation’s profitability. The year of 2018 brought in a net income of $111.1bn, dwarfing that of rival Royal Dutch Shell five-fold and double that of Apple, leading some new sites to tout it as the world’s most profitable company.

The proceeds from the bond issuance will fund Aramco’s recent purchase of a majority stake in Sabic, a local petrochemicals company from the Saudi Arabian Public Investment Fund (PIF). The transaction represents a 70% majority stake that is worth $69bn. As Aramco has a refining and petrochemical product line, this aligns the strategies and interest s of 2 major players in the sector. The fresh injection of capital into the PIF forms part of Crown Prince Mohammed bin Salman’s Vision 2030 plan to diversify the kingdoms economy away from oil via the strategic diversion of oil income into non-oil assets through the sovereign wealth fund.

While many are familiar with bonds as debt instruments, where entities in need of capital promise a percentage return on a given loan, this deal has less to do with funding than might be thought. The bond prospectus revealed Aramco’s strong balance sheet and healthy cash flows, with operating cashflows standing at 4.5 × larger than gross debt. Most energy rivals have a ratio of less than 1. The issuance follows the Crown Prince’s desire for Aramco to take on a larger presence in the global financial markets and leverage its robust balance sheet to fuel the PIF. An eagerly awaited initial public offering (IPO) of a 5% stake in Aramco was delayed indefinitely last year, after disagreements surrounding its $2tn valuation. The IPO would have seen $100bn flowing into the PIF’s coffers. With the kingdom still reeling from controversy over the killing of journalist Jamal Khashoggi, an article by the Financial Times considered the political implications of the deal, framing it as a way for the kingdom to reingratiate itself with global investors. This comes at a time when global scrutiny of some of the kingdoms more controversial actions , which have left allies and investors nervous, is at a high.

Aramco’s financial health, low debt to cash flows, geographic advantage and market leading position has earned it credit worthiness ratings of A1 and A+ by rating agencies Moody’s and Fitch respectively, falling short of the coveted triple AAA rating awarded to the highest quality of debt issuers. An entity’s credit worthiness determines the likelihood of the debtor defaulting on the loan obligation, i.e., the likelihood of Aramco being unable to repay the holders of its bonds. The reason being, the corporation’s close ties with the sovereign and the government’s reliance on oil taxes to fund its expenditure. Despite the impressive net income, Financial Times reported a profit of $26/barrel for Aramco (after deducting the governments share), falling short of Royal Dutch Shells $31/barrel. Fitch commented on the ability of the state to interfere in key decision concerning production, dividend policies and taxation as barriers to obtaining a higher credit rating.