Has MiFID II demolished the research industry?

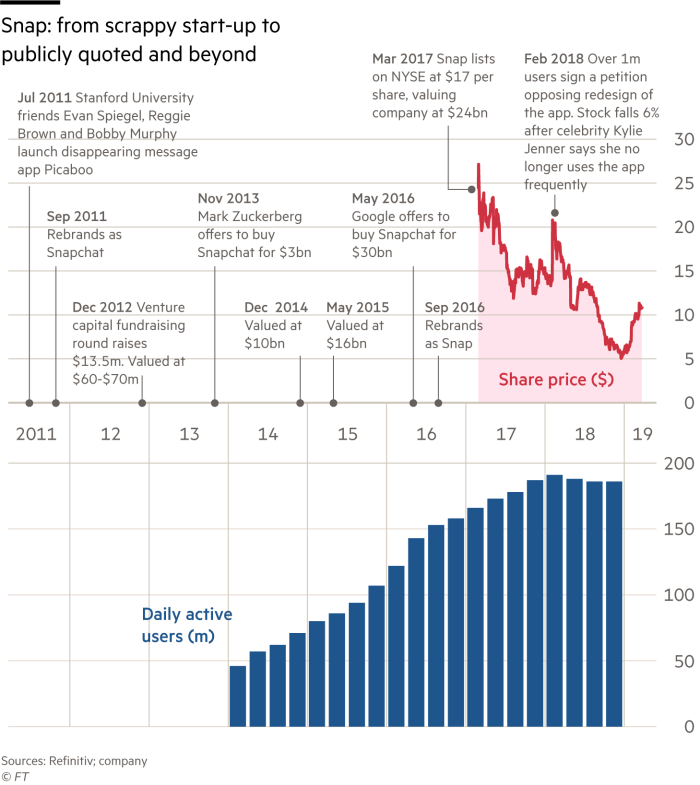

At the beginning of last year MiFID II was introduced to make the financial industry more transparent. One key aspect of this is the move from bundled to unbundled products brokerage firms provide. Previously, a fund manager buying a security through a broker would pay a hefty commission. This would cover the cost of putting the buyer and seller parties together as well as the research that the brokerage firm provided to the fund to educate it on which security to buy. The research and transaction were bundled under one cost, hence, the firms provided bundled products. This research would include access to analysts who specialise in specific asset classes and industries, libraries of thousands of research papers as well as of meetings with executives. However, this provides a dark cloud under which these brokerage firms operate. Who do they represent and are they providing the best deal for their customers? This is where MiFID II is supposed to shake up the industry. Under this legislation brokerage firms are now obliged to separate the charges for operating the transaction and providing research and additionally show how they acted optimally for their client. Consequently, the two services must be offered separately as an unbundled product. This leads to some very important questions. How do you value financial research? Does this mean the end for brokerage firms? How will this affect the global financial industry? Specialised Firms Before the implementation of MiFID II, with the financial industry travelling in such an ambiguous direction, uncertainty was ripe. Brokerage and research firms knew there was a rocky road ahead. As Bloomberg Intelligence analysts Alison Williams and Sarah Jane Mahmud report in their article at the end of last year, MiFID II: Financial industry’s disruption on a global scale, “Investor relations may need to scale up activities with fewer analysts covering fewer companies.” Essentially, they highlight that research firms will need to refine and specialise their research to remain unique and competitive following the introduction of the legislation. So have their radical expectations been met? It has certainly had a global effect. A recent report from Greenwich Associates found that many US investment managers are contemplating, under pressure from their clients, unbundling. This is thought to be due not only to the fact that any fund manager moving money for European clients has to comply with MiFID II but also the increase in transparency is seen as the way forward in financial legislation. MiFID II is also reshaping the industry. With research firms having to offer more bespoke services to clients, meaning fewer analysts covering a specific niche in the market, many analysts fear the security of their career. With decreasing demand and increasing competition, as fund managers decrease their dependency on larger all round brokerage firms, many will perish in the struggle to come out on top. A clear indication of this shift is the comment Richard Buxton, Cheif Executive of Old Mutual Global Investors Cheif, makes in the Financial Times article MiFID II leads to an exodus of sell-side analysts, in which he states his firm has become “inundated with CVs”. Who would blame them when JP Morgan is offering access to its equity research for as little as $10,000 yearly. Fear not though, for it is not all doom and gloom. MiFID II has paved a way for a brighter future, especially for smaller brokerage firms. Their ability to provided very detailed analysis on a market niche gives them the edge over their larger dominant counterparts. As Mahesh Narayan at Thomson Reuters states in an interview with Finextra, smaller firms can “distinguish themselves by the quality of their research”. While MiFID II has certainly transformed the European financial industry it has restored client confidence in an out-dated sector, in terms of the legislature, by providing transparency and fairness for all involved.