Equity and Bonds: Two Different Ways of Raising Capital

Raising capital is essential to the long-term health of every company and organisation.

Fresh capital is required for hiring more personnel, investing in new technologies, and expanding operations, among other purposes.

Equity constitutes one way of raising the sum of money necessary. In general, equity is the measure of ownership in a particular asset after all debts associated with that asset have been subtracted. An asset is defined as any resource which provides or is expected to provide economic value. When discussing equity, most people are focused on firms and are hence referring to shareholder equity. A shareholder’s equity in a company is determined by the amount of money that individual contributes in comparison with the rest of the stockholders. The more money they contribute, the higher their ownership share in the firm. The combined shareholder equity, i.e. how much external investors own of the company, is calculated by deducting the total liabilities from the total assets. Liabilities are the exact opposite of assets; the term includes all of the firm’s debts and costs of operation. A company’s balance sheet will always include assets and liabilities, which means equity can be easily calculated. If the total equity is positive, this means the business’ assets generate enough value to cover the costs of its liabilities. In case of negative equity, liabilities exceed the value of the assets. Should that trend continue for an extended period of time, the firm will be facing insolvency. A company is deemed insolvent when it can no longer pay off its debts. Insolvency should not be confused with bankruptcy, which is a court order specifying how the debts will be settled and what assets will probably have to be sold for that purpose.

Discussing Bonds

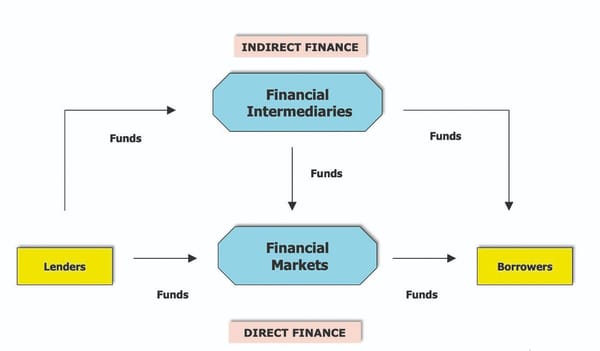

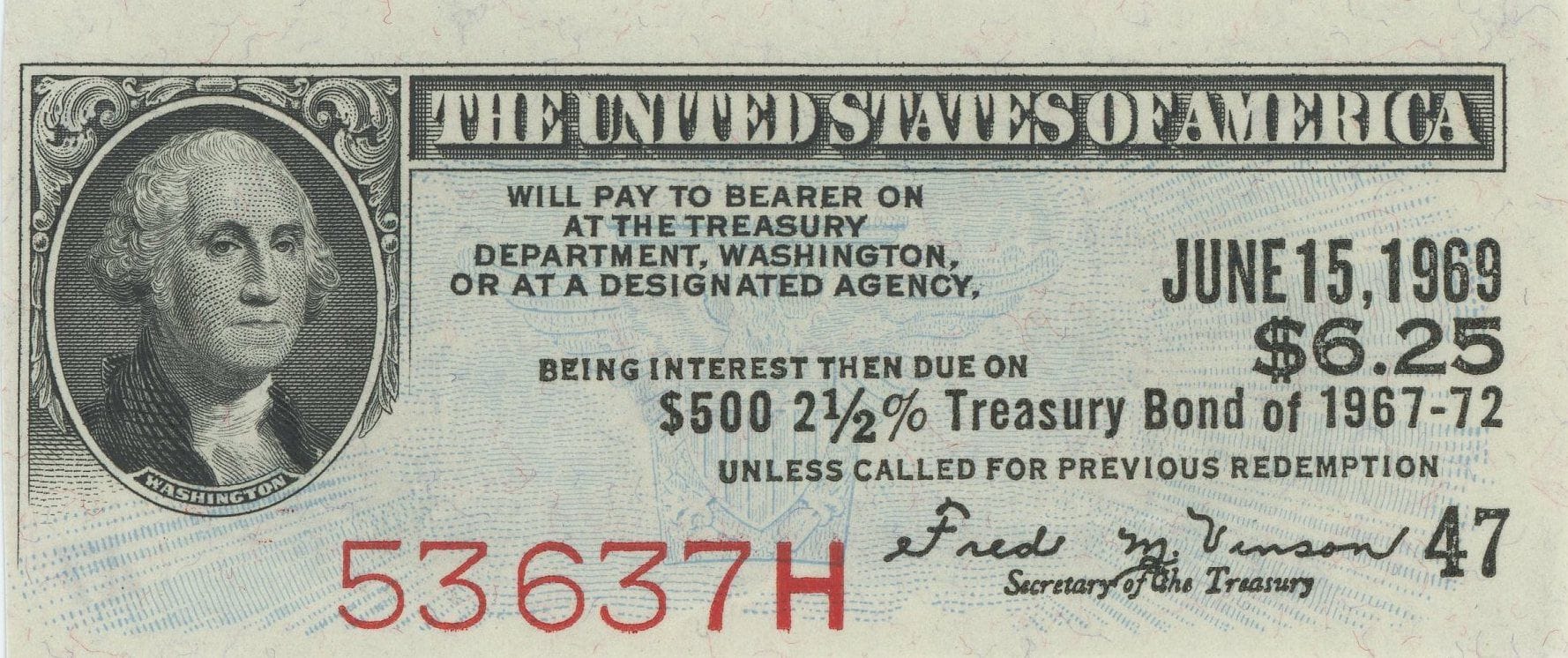

A bond constitutes an entirely different method of fundraising. Bonds can be thought of as financial instruments which include the sum of money borrowed and when that amount has to be repaid by the borrower. Particularly, every bond contains a deadline for paying off the principal of the loan, i.e. the original amount borrowed, as well as a fixed interest repayment schedule. This fixed interest is known as the coupon rate of the bond. The question is, how do bonds work?

Initially, an entity that wants to raise capital issues a bond. Governments, local authorities and corporations are some of the main examples of bond issuers. Afterwards, an individual investor, or more frequently, a group of investors, buy the bond and hence lending money to the issuer for a specified period of time. The agreement between lender and borrower lists the sum to be provided along with the interest rate. The latter is determined by the credit rating of the borrower. An entity that is viewed more likely to default on its debts has a low credit rating, while the opposite holds for an institution with a high credit rating. It is worth mentioning that lenders tend to sell bonds to other investors in the bond market. A bond which has been resold multiple times indicates the market is confident in the issuer’s ability to repay the bond. Therefore, the credit rating reflects investors confidence in the particular organisation.

Equity vs. Bonds: A comparison

Should an investor focus on equity or bonds? The answer is both. As a general principle, investors want to build a diverse portfolio, which will inevitably include equity as well as bonds, among a plethora of asset types. Equity attracts an investor’s attention since the company’s share value may increase over time and can therefore be sold for a higher price. The difference between the price that stock was sold for and its initial value at the time of purchase equals the investor’s profit. However, investing in shares is inherently risky since no guarantee exists that the firm’s value will appreciate over time. Historically, the stockmarket has been volatile, going through periods of substantial losses followed by intervals of profitability. On the other hand, bonds provide stable income at specific dates and are thus viewed as less risky compared to equity. Furthermore, bond holders are prioritised over shareholders with regards to repayment; holders of company stock are paid dividends from the profits on a regular basis, usually every quarter. In contrast, shareholders influence the firm’s direction to a large degree because they are granted voting rights and can thus decide which people sit on the board of directors.

The Last Word

It has become evident that equity and bonds serve the same purpose but in very different ways. The first provides corporations with access to capital in exchange for an ownership stake, while the latter serves as a direct method of raising funds, usually needed for large amounts of capital that banks cannot lend. Given how they differ in terms of the profit they may yield and how risky they can be, investors typically choose to include both in their portfolios.