A Story of Pork Belly: Overview of the Commodities Market

Above: Figure 1: The increasing demand for pork belly has led to large gyrations in prices

Pork bellies – yes, the pork that comes from the belly of a pig, was an iconic commodity for the futures market’s representation in pop-culture.

While it might be surprising that the financial market involves pork bellies, it made sense. The bellies were frozen and set aside, then used to make bacon during the summers when the demand for it (think BLT sandwiches) rose. Therefore, consumers hedged against inflation by locking the price of the belly through the use of a futures contract (a contract for assets bought at agreed prices but delivered and paid for later). Pork belly futures reached its peak of popularity in the early 1980s. It became well-known to the general public after being referenced in magazines and movies – Eddie Murphy’s character even used pork bellies to explain how a market works in a 1983 film titled “Trading Places”. (See Youtube: Trading Places – Bookies). However, the landscape of the business changed when pork bellies were consumed all year round rather than being a seasonal product. With bacon accompanying salads, hamburgers, and even milkshakes (think Five Guy’s free bacon topping), it removed the demand for frozen bellies. In 2011, trading pork belly futures came to an end on the Chicago Mercantile Exchange (CME) – it was not a shock as the volume of trades had shrunk to almost nothing.

However, bacon is back on the menu this year! Why? McDonald’s reported a 4.5% increase in comparable store sales in the first quarter in part due to bacon-related promotions such as “Big Mac Bacon” and “Quarter Pounder Bacon”. Bacon was ranked #3 (behind shellfish and barbeque) in the National Restaurant Association’s 2018 “What’s Hot Culinary Forecast” based on feedback from 700 professional chefs. Spurred by the growing popularity and the price volatility as seen in Figure 1, in May 2019 CME began to publish a new Fresh Bacon Index to provide a transparent weekly price to those across the bacon supply chain, for a better understanding on the market dynamics of bacon that is sold in the cash market.

You may wonder why the wholesale prices of pork bellies fluctuate so much? Think about the supply chain and the wider economic factors: US-China trade war and the pig-disease outbreak, which cause disruptions in price and supply.

An overview of commodities trading and a brief history

Pork bellies are an example of the commodities that can be traded on exchanges. Commodities are split into two types: hard and soft commodities.

Hard commodities are typically natural resources that must be mined or extracted such as gold and oil; whereas soft commodities are agricultural products or livestock such as corn, wheat, soybeans and pork bellies.

Trading commodities have been a long-running business – from seashells to spices, the ancient civilisations saw the ability to create and manage complex trading systems and facilitate commodity exchange as a form of economic development. Throughout the years, the basic economic principles of supply and demand behind trading commodities have not changed: disruptions in the supply chain, such as livestock-related diseases, is likely to lead to a spike in the usually stable and predictable demand; technological advances also often have significant influences on prices.

What makes commodities trading interesting is its strong connection with the economic landscape. Often it is described as the “invisible hand” that moves the market. The most straightforward example is oil – many consumers only think about oil prices in the context of how it directly impacts their wallets; in other words, how much they will end up paying at the pump as the result of price fluctuations. However, the price of oil can potentially affect many companies, directly or indirectly, simply because of the shipment of products (from where it is manufactured to the shelves). Furthermore, oil price is always a discussion point between politicians.

In addition, commodities are often the most significant exports of developing countries, and revenues obtained from them have an important effect on the economies and living standards in these countries. For example, many countries in Africa derive more than 90% of their export earnings from commodities.

How does commodities market work?

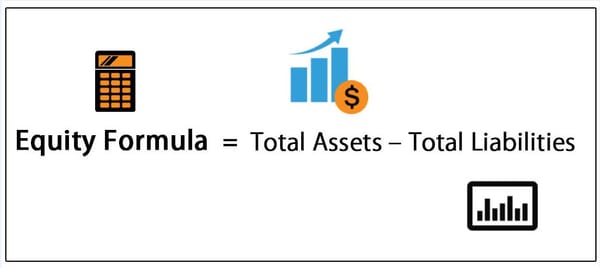

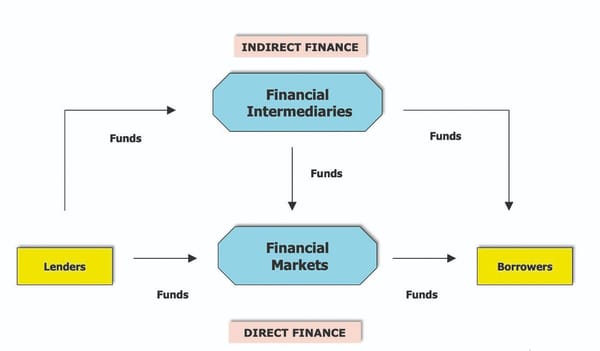

Investors can gain exposure to commodities indirectly by investing in companies that rely on commodity prices or through the purchase of mutual funds. Direct exposure to commodities would be buying into a futures contract. This is known as paper trading.

Commodities can also be traded physically – companies secure a supply of commodities from end-producers and help to market them across the geographies to a wholesaler or end-user.

They add value to the supply chain through their unique know-how in the field of transportation, financing and risk hedging.

Something interesting to think about. The commodities market is complex, and it involves many players. While we are living in the digital world, keep an eye on how blockchain can create trading opportunities for commodities.