Dollar, Euro, Sterling and All their Friends: The Foreign Exchange Market

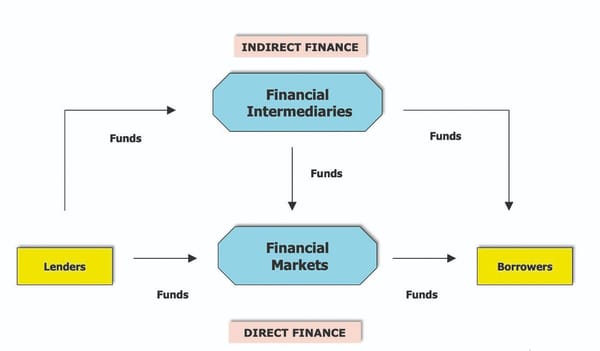

The Foreign Exchange market (Forex or FX) is an over-the-counter market in currency-pairs which is the largest and most liquid market in the world. An average of $5.1 trillion is traded every day, compared to $84 billion traded daily in equities’ markets. Like how you might trade in sterling for euros before a trip abroad, large banks and corporations trade currencies. They do this both to hedge against international currency and interest rate risks, as well as to speculate on geopolitical events and diversify portfolios. The most common currency pairs traded on the FX markets are Dollar-Euro, Dollar-Yen, and Dollar-Sterling. Additionally, popular currencies are the Swiss Franc, the Australian Dollar and the New Zealand Dollar. Note that only floating currencies are traded, not fixed currencies.

There are two main ways to make money from the foreign exchange markets. The first is to benefit from yields of different currencies. The central bank of each currency will usually set a base interest rate, which strongly determines the interest generated by saving in a money account of that currency. For instance, if the UK were to raise interest rates tomorrow from the current 1.75% to 2.25%, then this would make saving in a UK-based money account far more attractive, and so investors would rush to buy sterling and take advantage of this, which would increase the strength of the sterling.. This opportunity is the real money maker of the currency exchange markets – it allows speculators to move money to a currency which they expect to pay a higher rate of interest. Additionally, currencies are bought and sold for so-called ‘carry trades’ – hoping to profit off an increase in the value of a particular currency.

To determine whether a currency is overvalued or undervalued, forex traders will sometimes use the notion of purchasing power parity. This expresses a measure of what the exchange rate ‘should’ be based on the ratio of the cost of a basket of goods in two different countries. In the long run, exchange rates are expected to move towards rates which equalise the price of a basket of identical goods and services in any country. An entertaining simplification of this model is the Big Mac index, which compares the cost of a Big Mac in hundreds of countries, adjusted for GDP to account for the effect of cheaper labour costs in poorer countries.

The other reason that trading the currency markets is so profitable is that a high level of leverage is available, up to a magnitude of about 100:1. For instance, if you had £100 to invest in Japanese Yen, you could borrow up to £9990, and then invest £10,000 in Yen. This hugely amplifies the profits and losses which can be made through Forex trading; huge returns can be achieved from a small amount of starting capital. Moreover, the interest rates charged on foreign exchange transactions for large banks and institutions are negligible, due to the size and liquidity of the market.

Aside from the straightforward spot price on foreign exchange rates, an eclectic zoo of FX derivatives exists to hedge against, and speculate off, currency risk.

The regulators

Until 1976, foreign exchange rates had been governed by the 1944 Bretton Woods Agreement between the U.S., Canada, Western European countries, Australia and Japan. This bound each country to keep its country’s exchange rate to within 1% by tying its value to the value of gold and using the IMF to settle temporary imbalance of payments. The Jamaica Agreement tore down the Bretton Woods Agreement, increasing the instability of the financial markets for investors, and necessitating the adoption of financial derivatives to hedge against this new risk. Moreover, the advent of globalisation increased the demand for such instruments from multinational companies.

A peculiarity of the foreign exchange market is that it is very lightly regulated, with none of the clearing houses or regulatory institutions characterising other markets. Instead, trades take place off the back of credit agreements, essentially metaphorical handshakes. There is no such thing as insider trading in foreign exchange markets, it’s legitimate to trade off any information you happen to hold about countries and governments.

Role of world politics

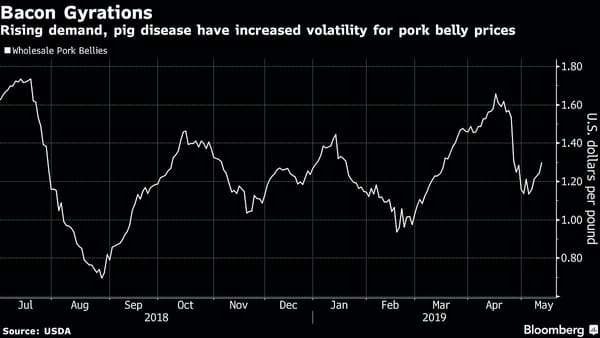

The foreign exchange market is also interesting because of how strongly it is affected by a range of macro-economic factors. For instance, the trade war between China and the US led to the dollar strengthening against the yuan. This is because of the two countries, America is a net importer of Chinese goods. The tariffs on these goods mean that less will be bought, and so the demand for the yuan is decreased. Thus, the yuan depreciates in value against the dollar (it can also be interpreted as the dollar strengthening against the yuan). It is worth noting that the effect of the base interest rate on the value of a currency is not so straightforward. A low interest rate spurs consumer confidence and growth, which is generally positive for the value of the currency. However, this is balanced by higher interest rates generating foreign investment in a country, increasing demand for the currency and thus it’s strength.