What are Cryptocurrencies and what is Happening in this Space?

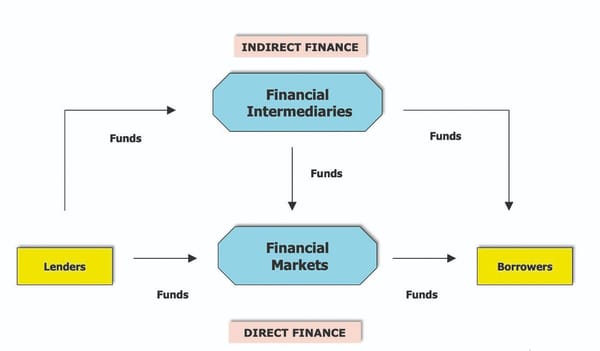

Cryptocurrencies are digital assets which are intended to be used as a medium of exchange. Traditionally, the supply currency can be controlled by a central bank or the government, however this is not the case with cryptocurrencies. Within this system, the safety solely lies in the hands of parties called miners. These people use their computers to help verify and timestamp transactions hence adding them to a record in accordance with a particular timestamping scheme. In exchange, these miners earn fees in a form of cryptocurrencies and at the same time they bear the costs of the machines, cooling systems and electricity.

Consequently, this forms a blockchain, which is a continuously growing list of records called “blocks” that are linked and secured using cryptography. For example, Bitcoin uses SHA-256 to link its blocks, a cryptographic hash function for their proof-of-work scheme. Namecoin utilises a domain name system, while Litecoin was the first to use a script as its hash function which acts as a password-based key derivation function. Each block usually has a hash pointer which connects to the previous block which also has a timestamp and transaction data. Therefore, these peer-to-peer network transactions are recorded permanently and do not disclose the identity of its users.

This results in difficulty tracking transactions compared to traditional banks where transactions can easily be tracked. With Blockchain, transactions can be performed with minimal fees using private and public keys as opposed to steeper fees often charged by traditional financial institutions.

In addition, Blockchain makes cryptocurrencies virtually impossible to manipulate as transactional data would require altering the data of the previous block, requiring the support of multiple users.

Therefore, cryptocurrencies are considered to be decentralised, meaning there is no central bank, authority or institution tasked with regulating the currency and verifying the transactions. The difficulty in tracking transactions with cryptocurrencies have resulted in it being widely used in online black markets or other nefarious activities, most notably through Silk Road which was an online market used for selling drugs. Global governments have responded differently to cryptocurrencies; for example in the West, many leaders in governments and the finance sector have criticized its use. This includes John Bogle, founder of asset-management firm Vanguard Group, who warned investors to “avoid Bitcoin like the plaque’’. Famed investor Warren Buffet has described Bitcoin as “probably rat poison squared” and a “delusion”. However, in the East, President Xi Jinping has controversially gone against the grain and is actively campaigning for China to seize the opportunity to adopt blockchain-based cryptocurrencies and plans to develop its own digital renminbi (RMB).

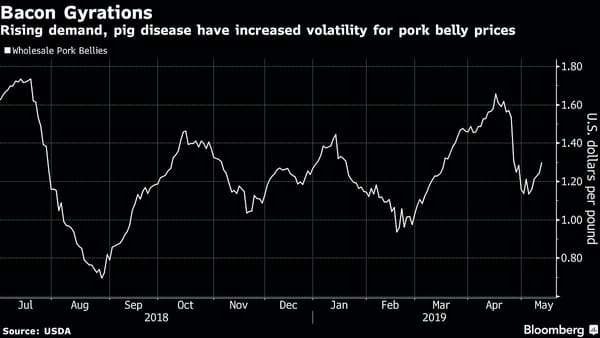

This comes as no surprise since mobile payments are widely used and accepted in China where both Alipay and Tencent are widely used. This system makes use of a unique QR code to carry out transactions. However, in many Western countries, the use of physical money is still the standard. In China, there is an estimated 45% of the population using mobile payments however in the UK, France and Germany this is only 16.9% , 13.7% and 11% respectively. It is clear that other countries are at different stages of accepting the use of technology as a safe and viable platform to make purchases, let alone adopting decentralised cryptocurrencies. In recent years, a US-based start-up called Flexa created a payment app which made it easier for consumers and sellers to trade using cryptocurrencies including Bitcoin, Ethereum and the Gemini dollar. This was expected to serve up to 30,000 stores including Starbucks, Whole Foods and Nordstrom. However, at the same time, the value of these currencies has been very volatile; between December the 15th and the 22nd 2017, Bitcoin dropped in value by £3463.6, representing a 23.4% decrease. Consequently, it is clear why retailers are not keen on accepting them as a form of payment and investors are proclaiming it to be the next big bubble. With these statements from public figures allied with unpredictable events, it has made the public and retailers apprehensive to make a move to cryptocurrencies.

In the news

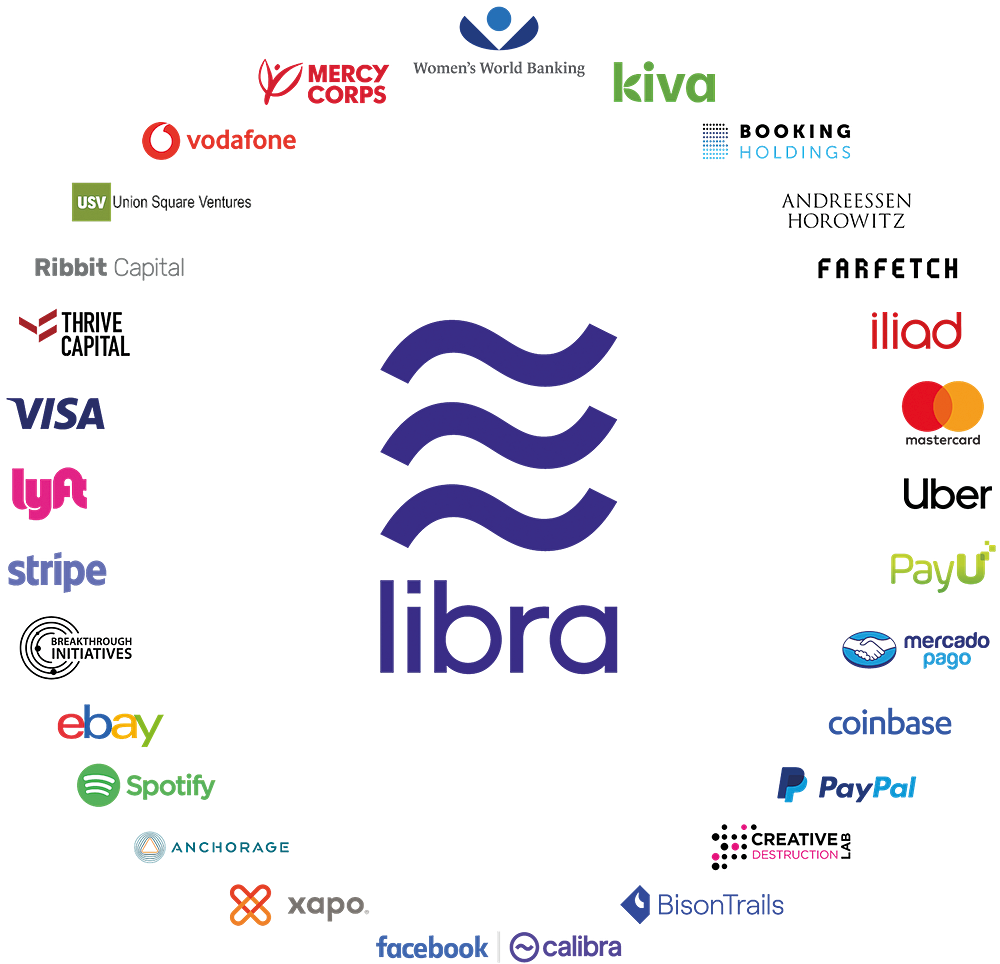

On the 18th of June 2019, Facebook publicly announced that they are working on Libra, a cryptocurrency, with 28 partnering companies. Facebook launched this project to produce a global cryptocurrency payment system which was safe, reliable and easy to use. But growing concerns regarding Facebook’s recent scandals regarding Cambridge Analytica and the way in which they handle users’ data has led to extreme push back by regulators and authority figures. Amid ongoing scrutiny, a quarter of partnering companies have walked out on the project. Notably, PayPal left the partnership on the 4th of October and this triggered several companies to leave the partnership the following week. This begs the question; will we now ever accept cryptocurrencies?