Investment Banks: A Closer Look

Above: Figure 1: Your friend who recently scored a full-time offer is buying the next round at the Union

What are Investment banks and why should you care? Investment banks are financial institutions that provide two main services; brokerage and corporate advisory.

Corporate advisory

There are three main services that investment banks provide in corporate advisory, they are: bringing companies to market, bringing companies together and structuring products.

Bringing companies to market refers to the Initial Public Offering of company shares or IPOs. This occurs when a private company intends to raise funds by selling some equity or shares, which represent ownership of the company and it does this by employing the services of an investment banks.

Investment banks usually act as underwriters in the process, which means that they would offer to buy any un-sold shares during the IPO. Additionally, investment banks would take a cut of the funds raised by the company during it’s IPO.

What about bringing companies together? It refers to mergers and acquisitions (M&A) among companies. An investment bank would provide advise to companies looking to merge or looking to acquire another company.

Lastly, structuring products. For example, if a company requires a financial product to finance a specific project. but doesn’t know how to go about pricing and selling it, they approach the investment bank to get help designing this product and advertising it to the retail or commercial banking market.

Brokerage

Individuals familiar with investing and trading on the stock market will be familiar with this arm of the investment bank, the brokerage. The brokerage is responsible for matching the seller to the buyer in the market place , such as the London Stock Exchange. In the market place, there are a list of financial products or securities being sold, namely stocks, bonds, exchange traded funds, options and warrents to name a few.

The investment bank itself can also participate in the exchange of securities but are subjected to certain conditions. With that being said the brokerage has its own analysts that observe market trends and economic data to offer buy and sell recommendations to its clients and usually charge its clients for each trade that is made.

The invisible wall

Observant ones will realise that there can be conflicts of interest within the investment bank, since the investment bank is both a brokerage and a corporate advisory. Therefore, it is important for investment banks to separate these two divisions. These two areas are often referred to as the “front office” and the “back office”.

Salaries

If working on IPOs, analysing companies or any of the above mentioned, does not interest you, maybe salaries would. As an analyst at an investment bank, based on data from Dartmouth Partners you could possibly make 50K per annuum in your first year of joining a major investment bank.. Figure 1. shows the salary and bonus figures for the top investment banks in London for 2019.

In the news: Fossil fuel financing

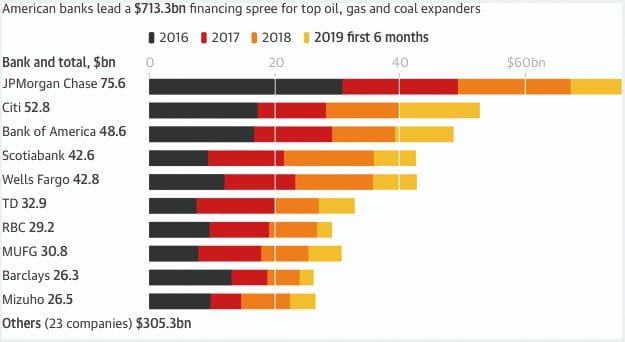

Above: Figure 2: Despite the concerning data presented here, several investment banks contacted by The Guardian are expanding quickly into renewable industries and tightening lending policies for fossil fuel projects

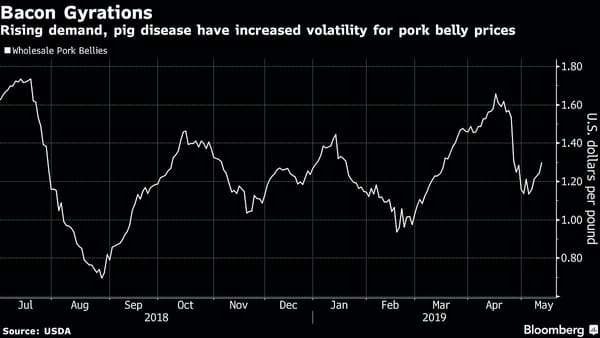

Another aspect of investment banks not mentioned above is corporate financing. This is where investment banks offer loans to large scale and/or expensive projects. For example, a recent Guardian article, titled “Top investment banks provide billions to expand fossil fuel industry”, discussed the increase in funding by investment banks on fossil fuel projects (See Figure 2).

In the news: Mental health in banks

An article by Reuters titled “Therapy in the office: banks take mental health fight in-house”. outlines that two thirds of employees in financial services experience mental illness and also discuss ways in which banks aim to make the work environments more friendly. This aspect of the career is worth exploring if you are considering a career in investment banking.

In the news: Insider trading

It was mentioned earlier in the article that investment banks need to maintain the invisible wall. An article by the financial times “Trio of investment bankers charged with insider trading” highlights this invisible wall to an extent and the bad practice in this area of the banking sector. Three investors were investigated on the grounds that they allegedly sold information to a middleman who would then pass the information on to traders to execute trades. In the article the trio were deemed to have engaged in insider trading, which happens to be a crime given the context.

What is insider trading? It refers to the use of information not disclosed to the public to make trades. However, this is an oversimplification of the term insider trading because it depends on laws governing the trade and to make matters worse, there is an illegal and legal classification to insider trading.