Asset Management: A Closer Look

Above: Figure 1: How the buy-side and sell-side bridge the gap between corporates and investors

With such a huge focus on the sell-side nowadays (both in terms of career opportunities as well as industry-related news), the other part of the global financial industry, the buy-side, is oftentimes overshadowed and forgotten. Therefore, the aim of this article is to introduce the reader to the buy-side world, specifically to asset management firms and hedge funds.

What do they do?

So what do asset management firms do? Exactly what the name suggests: they assist their clients (which can both be corporate and individual) with investing into various mutual funds (i.e. a collection of different assets) according to the clients’ needs and goals.* That is a pretty vague definition, isn’t it? Well, this directly follows from the fact that (as we will see later) the range of services provided by different types of asset management firm varies a lot, and thus it is difficult to fully describe what this industry entails in just a couple of words. The profit that asset management firms make arises as a result of a percentage fee from the total assets under its management (also called AUM - the total market value of all the assets that a firm holds).

Is this Wealth Management?

It is also worth mentioning the difference between asset and wealth management industries – both are often confused and are wrongly used interchangeably. Although the exact definition of each of those business units highly depends on the structure of a specific financial institution, the general purpose of the field of wealth management is to supply high net worth individuals (HNWIs) with the full range of financial services, ** which could potentially range from providing custodian services to forming the individual investment solutions based on their needs. In other words, asset management is just one part of more wider wealth management services for HNWIs.

Let’s begin our analysis with the most widely used parameter for splitting the funds in two groups: whether their assets are managed on an active or passive basis.

Active Funds

Active funds are constantly overseen by portfolio managers and the allocation of their assets can vary on a regular basis according to how the market conditions are viewed by the funds’ managers. They can be further split up in two other sub-types:

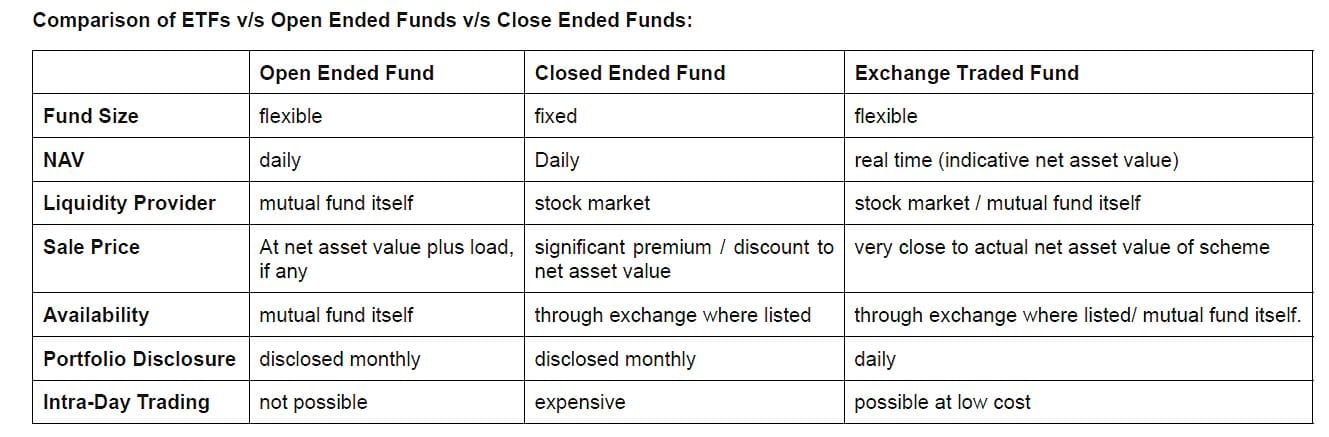

- Open-ended funds: the number of shares are unlimited, they are sold to and redeemed from investors directly by the fund manager.

- Close-end funds: there is a specific number of shares issued in the beginning by a fund manager, which is unchanged, and all the shares are sold and bought only in the market (not through the issuer).

Above: Figure 2: A comparison of the active open-ended and close-ended funds and the passive ETFs

Passive Funds

Passive funds on the other hand, just track a market index or a market segment (e.g. S&P 500, FTSE100, MSCI), its asset allocation does not vary through time. The most common form of a passive fund are the exchange-traded funds (ETFs) which represent a basket of various securities and trade exactly like stocks.

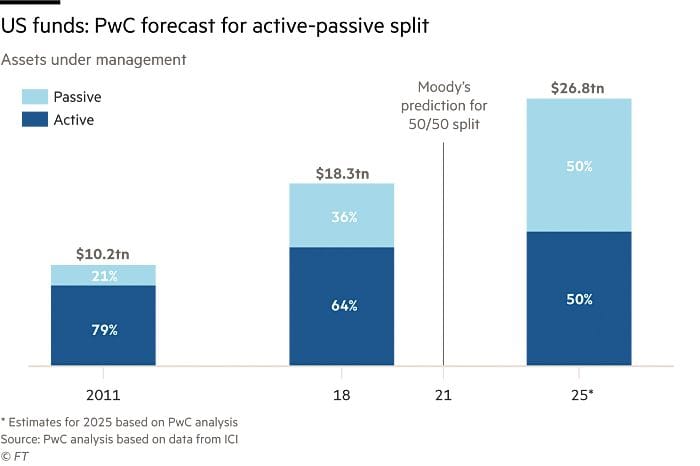

To observe the differences in greater details please refer to the table provided in Figure 2. Generally, passive funds are more popular in the periods of bull (i.e. growing) market, while passive funds experience an upturn in the bear (i.e. falling) market. However, with the recent large-scale popularisation of ETFs this trend could change in the years to come as illustrated in Figure 4.

Above: Figures 3 and 4:

Top-10 asset managers in the world by total assets under management command assets that number in the trillions

The year 2021 is predicted by this source to be a year of an even split between passive and active investing in US funds

In addition to that, funds can also be split up according to asset classes that they invest in. The most common types of assets used include: equity (i.e. stocks), government bonds, corporate debt, commodities and private equity. They can also vary according to the region of investment (usually split between well-established economies and emerging markets). It is also very common to mix various assets together and thus form hybrid funds (which are formed based on the level of risk that investors are willing to take).

Alongside with “typical” investment managers, there are several special types that we look into below.

First of all, are the well-recognised hedge funds. Hedge funds are a special type of asset management firm that use high-risk investment strategies for obtaining the largely above-average returns. Unlike other asset management firms, they are much less regulated, and thus could employ the strategies unavailable for other organisations. At the same time, due to high risk associated with their activities, hedge funds are not allowed to advertise themselves and are only opened for accredited investors.

Another type of alternative investment managers are private equity firms. They earn their profits by buying shares within privately-owned companies. A special form of private equity – venture capital firms invest in early stage companies and assist them with the initial development.

Overall, working in the asset management industry is definitely a challenging, yet very rewarding experience, and it’s definitely worth considering it as an option on any stage of one’s career.

Disclosure: The author of this article is not attributed to any of the asset management firms listed above and is not planning to invest into them in the next 48 hours.

*Not to be confused with custodian services, which are responsible for managing (i.e. holding) the assets on behalf of their clients.

**The exact definition may vary, but the minimum amount required for using the wealth management services is usually at least 1,000,000 dollars.