Private Equity vs. Venture Capital: A Closer Look

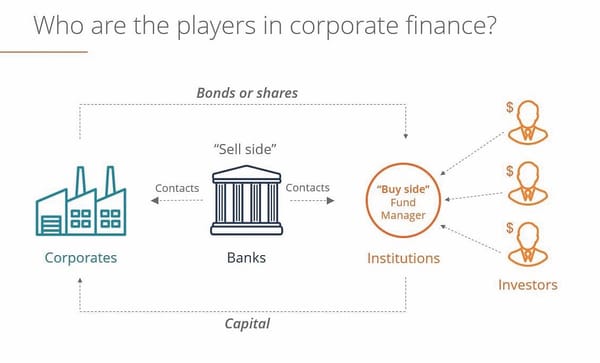

Private equity and venture capital both refer to investments by individuals or firms/institutions in companies. However, the scale of the investment and the stage of companies they invest in differ.

Private equity

You can think of it as equity that is held privately, either by wealthy individuals or firms. Where equity refers to shares/stocks and this represents the ownership of a company. These investors would purchase shares of privately held companies or public companies (companies traded on the stock exchange). The purpose of such investments is often to gain control of a company or companies and possibly sell these investments at a later stage. In the case of public companies, this might result in the de-listing of the company from the stock exchange. De-listing refers to removing the stock from being publicly traded on a stock exchange. When this happens, the delisted company would be considered a private company. What if I own stock in the company that is about to be delisted?

Well, private equity firms usual purchase a hundred per cent of the company, so it is not likely that an individual would be faced with a situation that he/she is unable to trade their shares on the exchange, due to delisting cause by private equity.

Some examples of private equity are pension funds like London CIV (London Pension Collevtive Investment Vehicle) and the private equity divisions of Rothschild & Co Merchant Banking.

Venture Capital

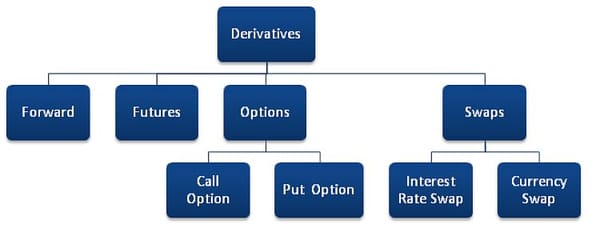

This refers to investment from firms or wealthy individuals in start-ups and small businesses. The investment is not limited to financial capital (cash), it can also be in a form of expertise, technical and non-technical. The purpose of such investments is to achieve an unsually high rate of return or ROI (Return on Investment). This refers to making significantly more money for every pound invested. For example, if you invested five pounds in a company’s stock; you would hope that your five pounds becomes five hundred pounds after selling that stock. In the case of expertise, it could be seen as trading things of significant value to the start-up or small business in return for equity.

The risk in these investments are significantly higher than private equity, but the potential upside could make such investments more lucrative. Imagine investing in Google when it was a start-up and owning ten per cent of it. It wouldn’t have cost over a thousand dollars per share, like it does now. This also brings us to the point that such investments are cheaper compared to private equity because private equity refers to investment in more established companies.

Venture capital is also an important part of the start-up ecosystem because the risk associated with a start-up is high and thus makes it difficult for start-ups to obtain loans and other debt instruments from traditional banks. However, having venture capital also introduces the influence of new shareholders to the start-up, this may or may not be desirable.

In the news: Female Founders on the rise

There have been concerns in the past that most venture firms knowing or unknowingly fund a significant majority of starts-ups foundered or co-foundered by men. This has led to concerns that there could be bias against female founders. However, in the recent years, some funds has made a move to fund more female founders or in some cases exclusively female founders. And it seems to be paying off. An article in Forbes by Elana Lyn Gross, titled “The Number of Venture Capital-Backed Companies with Female Founders Is on The Rise” highlights just that. It talks about the high returns from funding female-led start-ups. If this topic interests you, you might want to check out Melinda Gates’s Female Founders Fund.

In the news: The Private Equity Rush

In a low interest rate environment, investors are constantly on the lookout for opportunity and investments. Might private equity just be that opportunity? An article by Robin Wigglesworth, titled “Investors pay up to join the private equity rush” by Robin Wigglesworth” in the Financial Times, discusses these funds attractiveness and future downside to investing in them. He discusses the political climate in America and the potentially lower returns in the future due to high valuations and other indicators.

In the news: Private Equity about to screw non-profits?

It is no surprise that private equity investment has real societal impact and this can be extended to investments in general. An article by Karl Bode, titled “Private Equity Is Going to Ruin the.Org Domain System and Screw Nonprofits” in VICE outlines the concerns brought about when the Public Interest Registry (PIR) announced it would be bought by a private equity firm. The PIR manages the .org domain which is used by non-profits and such a buyout could lead to expensive .org domain names for non-profits.