Why Asset Diversification & Hedging is Necessary

The old adage “Do not place all your eggs in one basket” is probably one of the most important things to remember when investing. It is easy for beginner investors to see gains in a particular stock and have the urge to allocate more of their funds into it, hoping to generate even higher absolute returns. However, it could very well go south the next day.

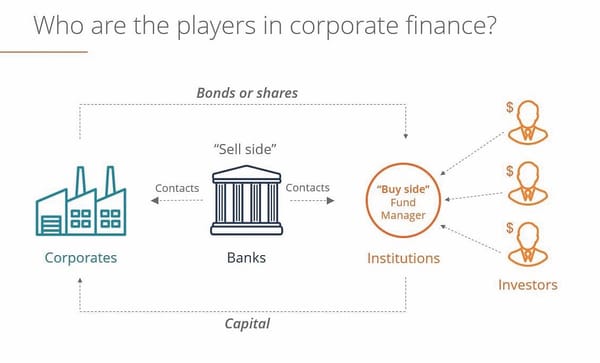

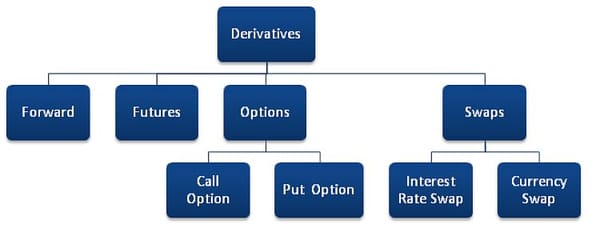

There are many financial instruments such as stocks, bonds, Indexes, exchange-traded funds (ETF), commodities and real estate investment trusts available to investors.

For this article, I will be focusing on diversifying a portfolio consisting of stocks and bonds as it is more commonly accessible for retail investors.

Stocks represents the company that you buy shares in. A company offers its shares to investors to raise money to grow its business or acquire new assets and when you buy a company’s shares, you become a shareholder of the company. Its share price will also fluctuate depending on economic, industry/company specific events.

In finance, we divide these risks (unexpected price fluctuations) into systematic and non-systematic risks.

Systematic vs Non-Systematic Risk

Non-Systematic risk is commonly referred to as company-specific risks (e.g. when the company misses its quarterly earnings target, company in financial distress etc.). These events do not affect the market on the whole. Imagine that you invested 100% of your funds into 1 stock, your gains and losses are solely dependent on the performance of the company.

Systematic risk is commonly referred to as market risk (e.g. recessions, changes in interest rates, political unrest). These events affect the overall performance of the financial markets. Now imagine that you invested your funds equally into 10 stocks instead, when there is negative company-specific news on one of the stocks, only a small portion of your portfolio is affected.

Two Portfolios to Consider

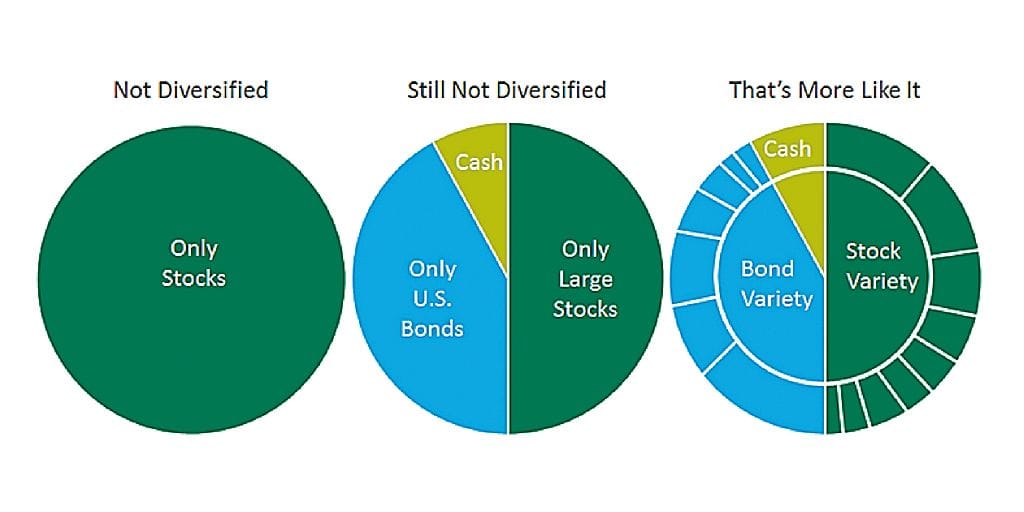

When constructing the optimal portfolio, we are trying to eliminate the non-systematic risks through asset diversification. Note that it is impossible to diversify away the systematic risks. As you can see from the graph below, as the number of firms increases, the non-systematic risk decreases and tends towards 0, leaving only the systematic risk.

From the earlier example, if you invested your funds equally into 10 stocks and there is negative company-specific news on one of the stocks, only 10% of your stock portfolio is affected, the other 90% will remain untouched. If we extrapolate this portfolio to 500 stocks, similar to the S&P500, we are able to completely eliminate all non-systematic risks.

So you might ask, if diversification is so important, why shouldn’t I just invest in an index such as the S&P500?

This strategy is indeed highly favoured by passive investors as they only need to monitor the macroeconomic performance of the country and global economy rather than monitoring each stock individually. Investors are not able to directly invest in the S&P500 but rather invest through an Exchange Traded Fund (ETF). ETFs are just a basket of securities that tracks an underlying index and is traded on an exchange. One common ETF that tracks the S&P500 is (NYSEARCA:SPY). By buying into this ETF, you expose yourself to the 500 companies that comprises the S&P500, therefore diversifying away all non-systematic risks.

For investors that are looking for returns above the market (S&P500), they should split their optimal portfolio into an active and passive portfolio, whereby the passive portfolio consists of ETFs, bonds and treasury notes. The active portion consists of stocks that they have individually picked. If executed properly, the active portion of the portfolio will be able to generate much higher returns and increase the overall returns of the entire portfolio. As with any form of active investing, due diligence is required to analyse the individual companies before buying into them.

Role of Bonds

Bonds serve as a hedge to your stock portfolio and investors consider bonds a safe haven. When the market is showing signs of weakness, investors flock to bonds and this is known as a “flight to safety”. This increase in demand pushes the bond prices upwards, offsetting the losses in your stock portfolio. As a retail investor, it is recommended to only purchase investment grade bonds, BBB rated and above. Investors are to monitor for interest rate risks, such as when the central banks increase interest rates. This means that other investors are able to seek higher returns in the market than what your bond can offer, therefore lowering the price of your bond.

Together, the active portfolio, passive portfolio and bond portfolio provides a good starting point from which you can explore the different strategies to manage the risks and maximise your reward-to-risk ratio.