A take on active vs passive equities

Investment contributor Marios Papadopoulos explains the difference between active and passive equities and the different returns that can be expected from them

An active investment strategy requires, as the name suggests, an individual, usually a portfolio manager, to make decisions about buying and selling shares on a daily basis. Given the constant fluctuations in equity prices, especially in uncertain economic times such as this one, an active approach can exceed the stock market’s average returns. In order for this method to succeed, thorough analysis and knowledge in particular market sectors is essential. That is the reason why a portfolio manager usually works with a team of analysts responsible for predicting which asset’s price will change and when. An undeniable advantage of this approach is the flexibility that it offers. Active investment managers can buy equity from promising companies, which have either recently entered the market or have undergone changes which made them more competitive, at a moment’s notice.

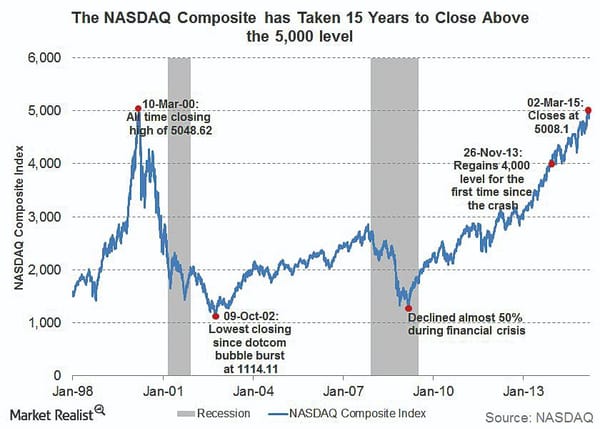

In contrast, passive investing aims for a long-term profitability, which means selling and buying equity occurs rarely. This stems from the buy-and-hold philosophy, which is opposed to attempting to predict the market’s next move. There are two main ways of investing passively. The first is to invest in and retain blue chip stocks. Those companies’ stock is deemed relatively safe because they have a strong reputation for remaining profitable, even during periods of recession. However, purchasing an index fund, which is a type of security that tracks a major stock market index, such as the Dow Jones Industrial Average, is the most prevalent strategy.

Different mathematical methodologies are used to create different market indices

A market index is defined as a hypothetical investment portfolio which includes companies in a particular sector, such as software and energy. The existence of multiple indices is attributed to the different mathematical methodologies used to create an index. Each methodology calculates the index’s values by weighing parameters such as stock price and market capitalization differently. Index funds track the market’s trajectory by selling equity from firms no longer included in the index and purchasing stock entering the index. This strategy results in a significantly lower number of transactions occurring compared to active investing.

The key benefit is the reduction in fees and risk. Given that no team is required to manage the portfolio, there are no labour costs associated with the analysts’ salaries and transaction fees are lower due to fewer transactions happening. Risk is lowered because owning a miniscule piece of stock from thousands of consistently profitable firms results in the accumulation of returns over a long time period. However, as historical trends have shown, the decrease in risk leads to smaller returns, which tend to be close to the market average. The buy and hold mentality of passive investing suggests that index funds may be slower to sell under-performing stock than active investors.

The debate between active and passive investing will not be settled- and there’s no reason for it to be concluded since their advantages can be combined in a single strategy. This turbulent year, which will be marked by COVID-19 and its effects on the global economy and the US Presidential election, has caused prolonged uncertainty but also created potential new opportunities.

In particular, a Joe Biden victory would prove beneficial to the renewable sector due to his proposed plan of a $2 trillion investment in building clean energy infrastructure. The US’ stance on the Climate Paris accord emission targets would also shift, which would make investing in green companies enticing.