Exposed: Imperial’s FFI partners don’t care about a green transition

Felix investigates whether the seven fossil fuel companies selected during the first round of the Imperial Zero Index assessment really have a “strong strategic intent to decarbonise.”

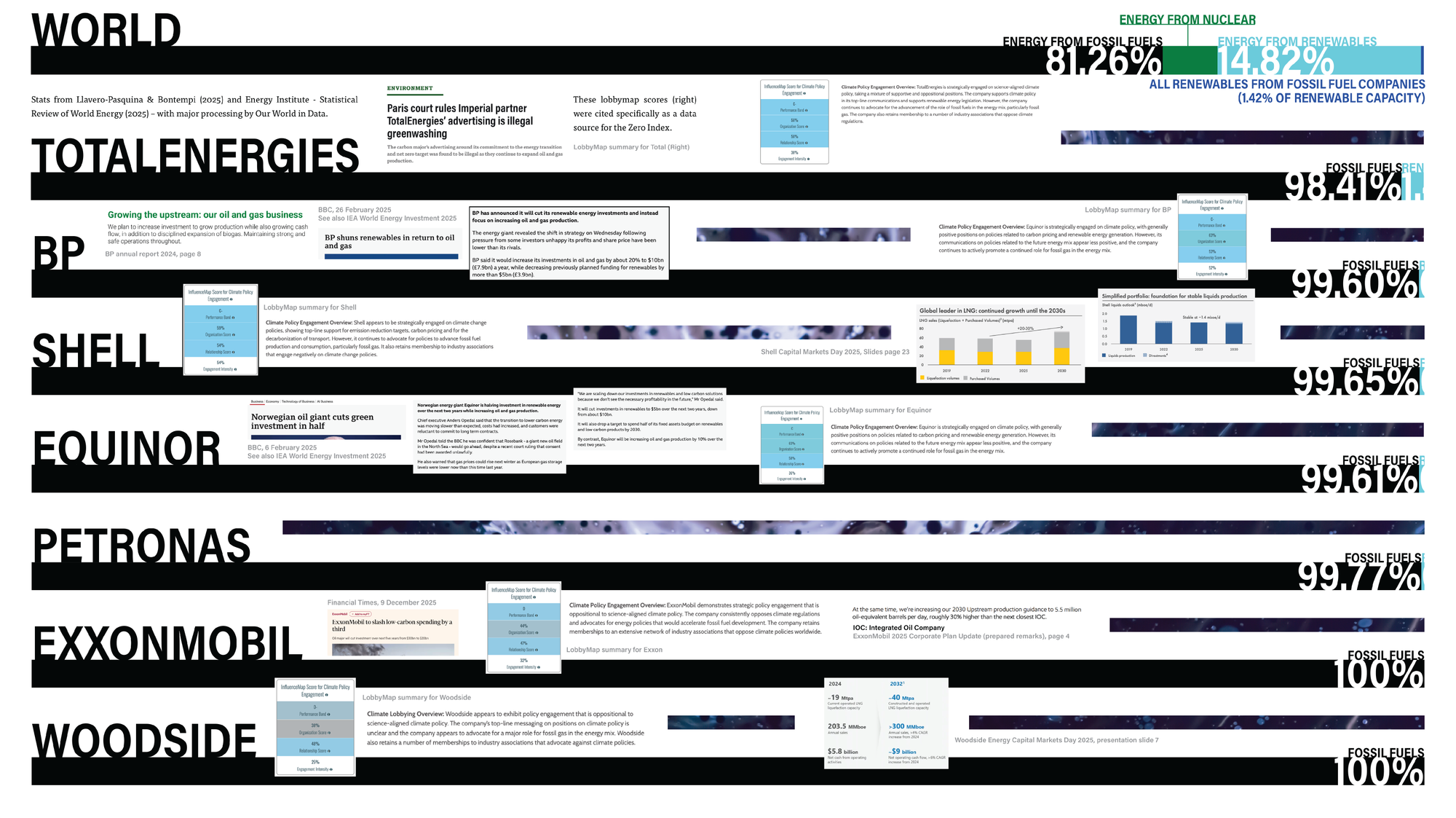

Last year Imperial released the first round of assessments under its Imperial Zero Index (IZI). The Index scores fossil fuel companies on their sustainability and commitment to Net Zero by 2050. Imperial has committed to only work with companies that meet a certain unspecified threshold. Seven companies met the criteria for the Index: TotalEnergies, BP, Shell, Equinor, Petronas, ExxonMobil, and Woodside Energy.

Imperial has shared the full methodology for the Index, as well as their data sources. What’s missing is any explanation of the weighting of the different metrics, what score needed to be met, or how any of the companies actually performed. This is a critical gap in the transparency of an otherwise rigorous process. The Index itself states that perhaps “those wishing to calculate the IZI2025 metrics for themselves will need to secure their own access to this data.”

Felix has taken up a portion of this work and conducted our own investigation into what these companies with a “strong strategic intent to decarbonise” have been up to over the last year. We also reached out to interested and involved students and staff as well as all the companies approved by the Index. The list of people on the Socially Responsible Engagement Monitoring Panel (SRIEM panel) on Imperial’s website is – so far as we can tell – out of date, and so we did our best to reach out to as many members as possible. Not a single person from the panel, student or staff, nor Imperial Communications responded to any of our requests for comment.

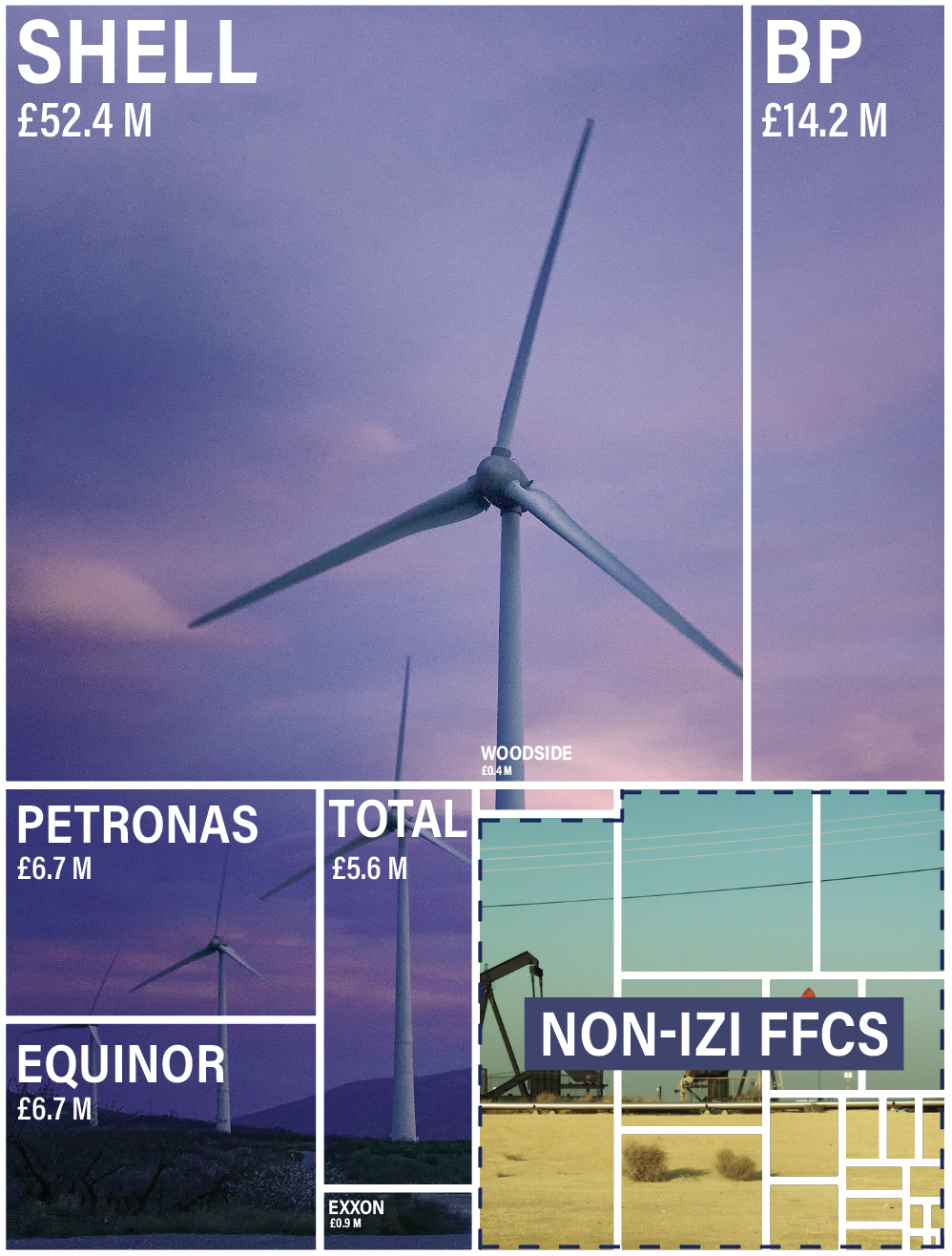

Despite their marketing and the clear trend in global energy use, fossil fuel companies (FFCs) are investing less and less in renewables and low carbon energy. In 2024, the most recent year for which we have data, FFCs invested 25% less in low carbon energy than in 2023 according to the latest IEA World Energy Investment report (low carbon energy is ambiguously defined but usually includes renewables, nuclear, bioenergy, and hydrogen). This investment is expected to fall by a further 10% this year.

The IEA report calls out how major partners of Imperial have reduced their targets, “Around 60% of low-emissions investment by the oil and gas industry in recent years has come from four companies: BP, Equinor, Shell and TotalEnergies (which each spent around 15-25% of their total budgets on low-emissions energy). With the exception of TotalEnergies, these companies announced large revisions to their previous targets on low-emissions spending. For example, BP reduced its target for the share of low-emissions technologies in its total capital budget in 2030 from 50% to 10-15%; Shell reduced its 2030 target from 15-20% to 10%; and Equinor cut its planned share of low-emissions spending for 2025 from 30% to 13%, and dropped its previous target to invest 50% by 2030.” However, another IEA report on the Oil and Gas Industry in Net Zero Transitions explains why this isn’t a big deal. FFCs provide only 1% of investment in clean energy globally. “Most oil and gas companies are watching energy transitions from the sidelines,” the report states.

The amount of clean energy FFCs generate is similarly low, as the largest 250 own just 1.4% of global renewable capacity according to Llavero-Pasquina & Bontempi (2025). Exxon and Woodside, two of Imperial’s partners, don’t generate any energy from renewables at all. Total, the best of the bunch, produces just 1.6% of its energy from renewables.

Alongside all this rolling back of targets and continued low investment in renewables, Imperial’s partners are planning to produce more and more oil and gas. In the most extreme case, Woodside, plans to increase annual sales by about 50% and double their constructed and operated liquified natural gas liquefaction capacity. In the same vein, Exxon wants to produce 30% more oil and gas than the next largest FFC by 2030, at 5.5 million barrels of oil equivalent per day.

LobbyMap scores FFCs by how aligned they are with net-zero. These scores were used as part of the IZI, but none of the companies scored better than a C. LobbyMap specifically noted that these companies were aligned at a high level with net zero but remained part of industry associations that worked against net zero or otherwise continue to advocate for the expansion of oil and gas in the energy mix. Given the IZI methodology mostly relies upon reports from the FFCs, it might be hard to assess the trustworthiness of the claims made or the targets set in the reports. FFCs have a history of deceiving the public on their climate policy: famously, Shell claimed to support a carbon price, but a lobbyist has admitted this was just a smokescreen. Just this year Total was found to have conducted illegal greenwashing.

The IZI commits to only work with these companies “on programmes related to a sustainable energy transition, leveraging our research and education to support FFCs as they seek to revise their businesses.” However, “programmes related to the sustainable energy transition” is broad and could mean anything from solar panels on oil rigs to improving the efficiency of gas extraction.

It is not the job of students and staff at Imperial to conduct the IZI assessments for themselves to verify the results, especially when so much detail is lacking on how the metrics were scored and what threshold needed to be met. These assessments were just the College’s first attempt, so hopefully future assessments will be more transparent.

Woodside Energy did not comment on our specific questions but referred us to their Climate Transition Action Plan and 2023 Progress Report. The other FFCs we reached out to did not comment.

Julia Mitra, Ethics and Environment Officer for the Union, told Felix “My opinion is that it is clear that these companies have not in the past decades and are still not moving towards renewables in any significant capacity.”

She continued: “We can’t know what is in accordance with the IZI criteria without the thresholds being published; this was requested in my union paper because I feel that it is impossible to understand the assessment without those values so I hope they will be published following the secondary review as requested - Nico [Union President] will be in this meeting and has a union mandate to request this.”

Julia passed a paper through the Union Council last term requesting “information on company scoring and threshold values, which will provide clarity as to how Imperial is enacting engage for change, and which categories might be particularly lax”, “disengagement from Total specifically due to the recent greenwashing court case requir[ing] them to remove Net Zero claims from their website and advertising, which means it no longer passes the IZI gateway [of Net Zero by 2050],” and that “the union takes the stance that social impact/justice should be considered in company engagement assessments as well.”

Dr Mike Tennant, Centre for Environment Policy and Vice-Dean for Education in Faculty of Natural Sciences, told Felix “With regards to the construction of the index, I believe the colleagues who helped to construct this are some of the best-informed people to do so. Measuring and tracking emissions, complemented with a measure of lobbying activities from the inclusion of InfluenceMap, give a partial and reasonable approximation of a company’s performance and commitment towards net zero.

“However, we must also judge companies by their actions. Shell announced that it would be exploring opportunities in Venezuela, and BP this week wrote off $4 bn of renewable assets. These aren’t actions of companies that are committed to reducing their exposure to fossil fuels. Their behaviour is driven by the market, which, over time, will override any moral sentiment that their leadership may have.

“Imperial’s response, rather than blanket divestment and consequent lack of lobbying power, should be that it ramps up its research and teaching into renewable energy. Disrupting and displacing the fossil fuel sector will be the best use of our talents in tackling climate change and associated problems.”

Dr Nigel Forrest, Co-convener of the Environmental Technology MSc at the Centre for Environmental Policy, explained “It’s well known that FFCs have an appalling record on climate change including deception, denial, and delay. Some of the FFCs approved by IZI 2025 have been leading actors in these types of actions and I have seen nothing to make me believe they have fundamentally changed and are now genuinely committed to meaningful climate change action or are even moving in this direction. Quite the opposite actually with several of the listed companies supporting Trump’s Venezuelan oil grab, BP buckling to shareholder pressure to renege on its renewables strategy, and Equinor being the major partner in developing the UK’s biggest undeveloped oil field, Rosebank.

“The IZI is rigorous in terms of the indicators, how they will be measured, and specification of data sources. However, it is vague on the criteria details, such as, I. Commitment to Net Zero requiring a ‘commitment to reduce Scope 3 emissions’ but without specifying by how much. Scope 3 emissions are of course, the huge elephant in the room. Or for III. Lobbying Position, it is not clear what performance band a company must attain to satisfactorily show that they are actively lobbying for positive climate action. It also appears, when you look at LobbyMap’s assessment of these companies, that many have highly ambiguous lobbying activities, where they lobby in support of climate action at a high level but actively work against in the details. Even were these criteria more clearly and simply specified, is ‘commitment’ enough? And when it comes to IV. Corporate Strategy, there is a huge amount left to interpretation when evaluating whether there is a ‘consistent transition from a fossil fuel company to an increasingly sustainable “energy company”’ taking place as no thresholds or rates of change are specified. There is also a huge get out clause in this category for reduction in exploration activities in that it only considers ‘new exploration activities outside of countries where hydrocarbons have already been discovered.’ I’m not sure how many countries this would leave but probably very few that have a possibility of hydrocarbons. Finally, although the sources are specified, where are the data and results of the assessment? I couldn’t find them. They are either buried so deeply that they cannot be found or else they are not published. It seems like we are supposed to go to all the sources, compile the data, and do our own assessment. This is not very transparent. Why not just publish?

“Overall, I find that the IZI leaves a lot to be desired. While it has a solid foundation, it needs to be much more transparent. It needs to be clearer about exactly how criteria are evaluated (not just measured) and it needs to be more convincing about how criteria actually tell us that an FFC is making real progress to transitioning to a sustainable energy company.”