FIFA Ultimate Team: Investment Galore

Where can you start with a career in investment? Video games such as FIFA seem to be paving the way forward

For those just interested in just knowing how to invest and predict market trends without all the mind-bending jargon from Investopedia or Google, FUT is a good place to start.

I don’t think investment is a difficult concept to wrap your head around. No, really, I don’t think it is. I don’t think there’s anything in the world (even quantum physics) that is difficult to understand – I often just think a topic can be taught so badly that its beauty and simplicity is lost to a sea of unexplained equations, models and teachers who can’t guide their students through the basic fundamentals required to let students spread their wings and explore the topic’s boundaries – investment is no exception.

The aim of today’s article is to add some context to investment in a way that you might have not seen before and that is through video gaming. First, I’ll provide a brief background on the video game title FIFA Ultimate Team, discuss some examples of investment and how it relates to the roles available at an investment bank. Investment is a video gamer’s hidden talent, and I intend to explore some of the daily routines that you will be able to identify that are synonymous with a role in an investment bank, whether that be Goldman Sachs or J.P. Morgan.

Investment is generally seen as quite a fun responsibility to behold, and often dramatised in blockbuster films such as ‘The Big Short’ and ‘The Wolf of Wall Street’. However, often when a beginner first plants their foot into investment, they’re engulfed by countless acronyms such as EBITDA, EPS and REIT. However, if you’re a video gamer, you’ll have actually developed the fundamentals of investment rather early in your life whether that be through developing a diversified portfolio or trading specific characters, items or weapons that you collect as you play a game.

FIFA Ultimate Team (FUT) is a perfect example of where to begin crafting an appreciation for investment. Before we dive deep into the specifics, it would help to explain what FUT is and how it works. FIFA is one of the world’s best selling football simulators, letting football fans play with the real-life players that they idolise right in the comfort of their own living room. Released every year right after the start of the new football season, the biggest game mode it delivers is Ultimate Team (otherwise known as FUT, for short).

You can make your own squad from thousands of players across the world, where the objective is to arrange a squad with maximum chemistry. Chemistry is simply how well the team plays together, and is determined by player links out of a maximum rating of 10. Each player in your team is given a ‘card’ that represents their statistics, their club, their nation and their overall rating. If two cards share the same league or nation, they share a weak link. If two cards share the same club, they share a strong link and as you might guess, if two cards do not play in either the same league or nation, they share a red link.

Now, the immediate question I can sense from anyone reading so far is: how does this even relate to investment?

Well, if a card gives good links, they’ll be high in demand. Being high in demand for investment purposes equates to being expensive. Cards in FIFA are traded over the transfer market, which is pretty much a simplified stock exchange for FIFA gamers, where prices rise and fall based on demand.

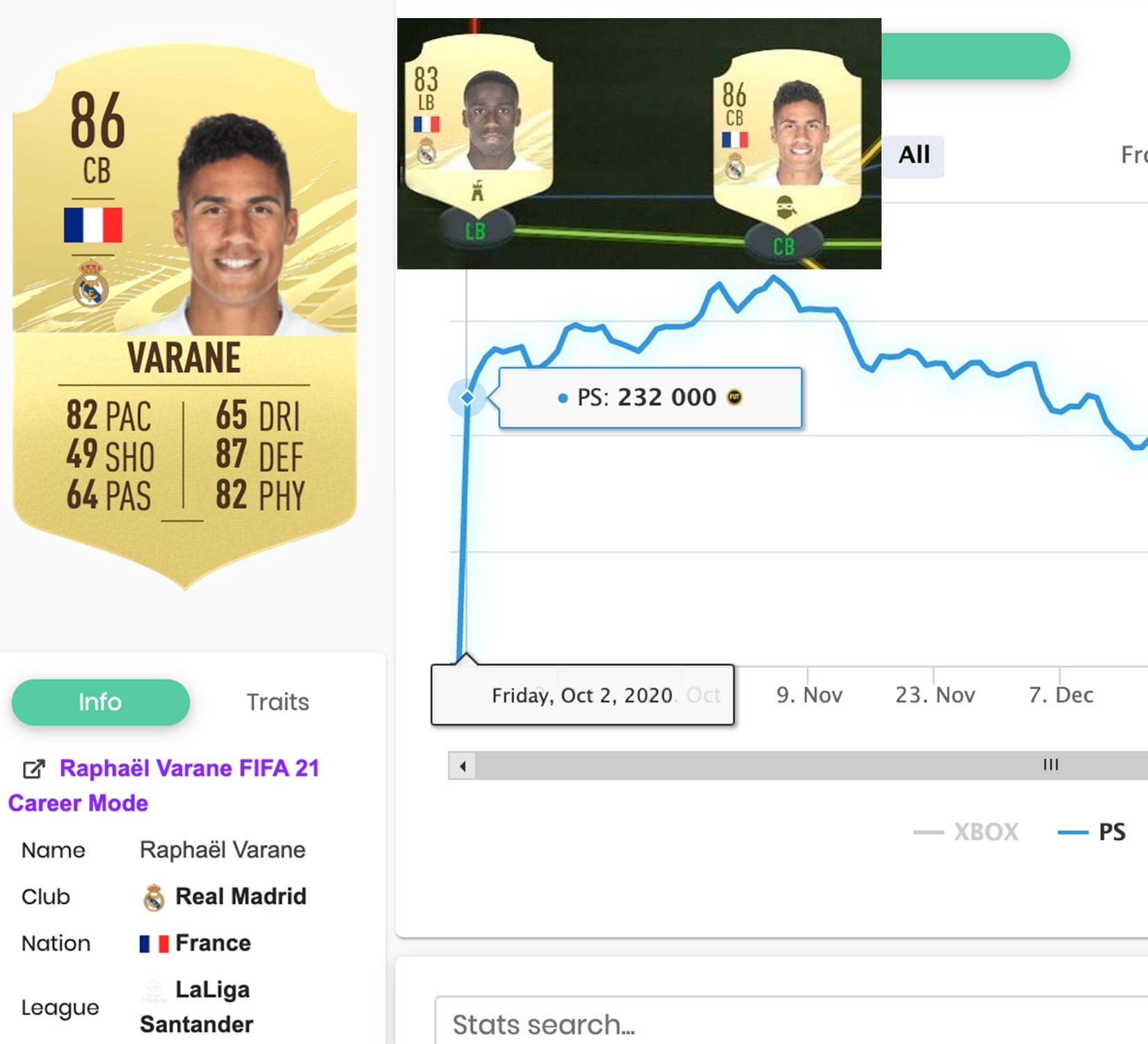

An example will serve this purpose well! The most represented nation in the game is France (not really a surprise, they currently are holders of the World Cup). If you want a good defender with good links (for your modest budget of say... 500,000 coins), you’d therefore want to find a French defender with good attributes such as sprint speed and defensive skill. In FIFA, there’s one man who fits the bill – Raphaël Varane of Real Madrid.

In FIFA 21, he shot up in price because of demand. His price started at 232,000 FIFA coins and rose over 28 days to peak at 336,000 coins - the demand in his card drove up the price. Likewise, his French compatriot Ferland Mendy, who would share a strong link with Varane given they play in the same club and are both French, shot up from 81,403 to 143,220 FIFA coins. Being able to work out which items will be in high demand and making the move to buy them early, before selling them at a higher price later in the future makes you money. Selling Varane at the prices above gives a pre-tax profit of 113,000 [336,000 – 232,000]. EA Sports, the publishers of the game, charge a 5% tax for each sale made. Therefore, on completion of the deal, you would walk away with 107,350 when the maths is all said and done [113,000 × 0.95].

Another example might paint the picture clearer, with real-life context. When PSG’s Neymar placed a strong performance against Montpellier on January 22nd, he received an in-form (IF) card. Naturally, to provide Neymar with strong links in order to maximise his chemistry, another PSG player’s card price will rise due to increased demand from the gamers. On the day of Neymar’s updated IF card, Mbappé’s price went from 910,000 to 934,000 coins as a result of the small increase in demand. Pocketing the difference, you could walk away with 22,800 coins [(934,000 – 910,000) × 0.95] if you bought Mbappé a day before the IF release.

So, what have we learnt?

We can simulate some microcosm of a worldwide economy on a video game made up of trading a bunch of footballers and see how price and demand varies with real-life events. This entire simulation that I’ve guided you through is the basis of a fund manager in an asset management firm.

In the article, I guided you through a couple of investments of your own on FUT where you were the fund manager, handling a cash reserve of most likely around 500,000 coins, which was made up from you and your friend’s progress in winning online FIFA tournaments. You as the fund manager are responsible for the cash reserve that you have, and if you lose all the money through terrible investment strategies that go awry, your friend might not be your friend for much longer.

For instance, if Cristiano Ronaldo is due to get a new card variation, as a fund manager managing a portfolio, it would be advised to sell any current versions of Ronaldo that you own before an imminent price fall occurs. Failure to foresee and react to market trends means you could lose a lot of money (often called capital loss), and probably any progress you made trying to build a fortune on your portfolio.

FUT really does serve as a micro-economy to develop and test your beginner skills for investment. Foreign Exchange (Forex) trading and stock trading definitely are much more sophisticated and require fast fingers to execute transactions at breakneck speed, but for those just interested in just knowing how to invest and predict market trends without all the mind-bending jargon from Investopedia or Google, FUT is a good place to start. The skills you pick up from playing a video game do apply to other areas of finance and investment, whether that may be managing a portfolio of your own or trading in other commodities.