From impulse to intention: How Gen Z is redefining Black Friday shopping

AI, convenience and cost-consciousness are the driving forces behind this shift.

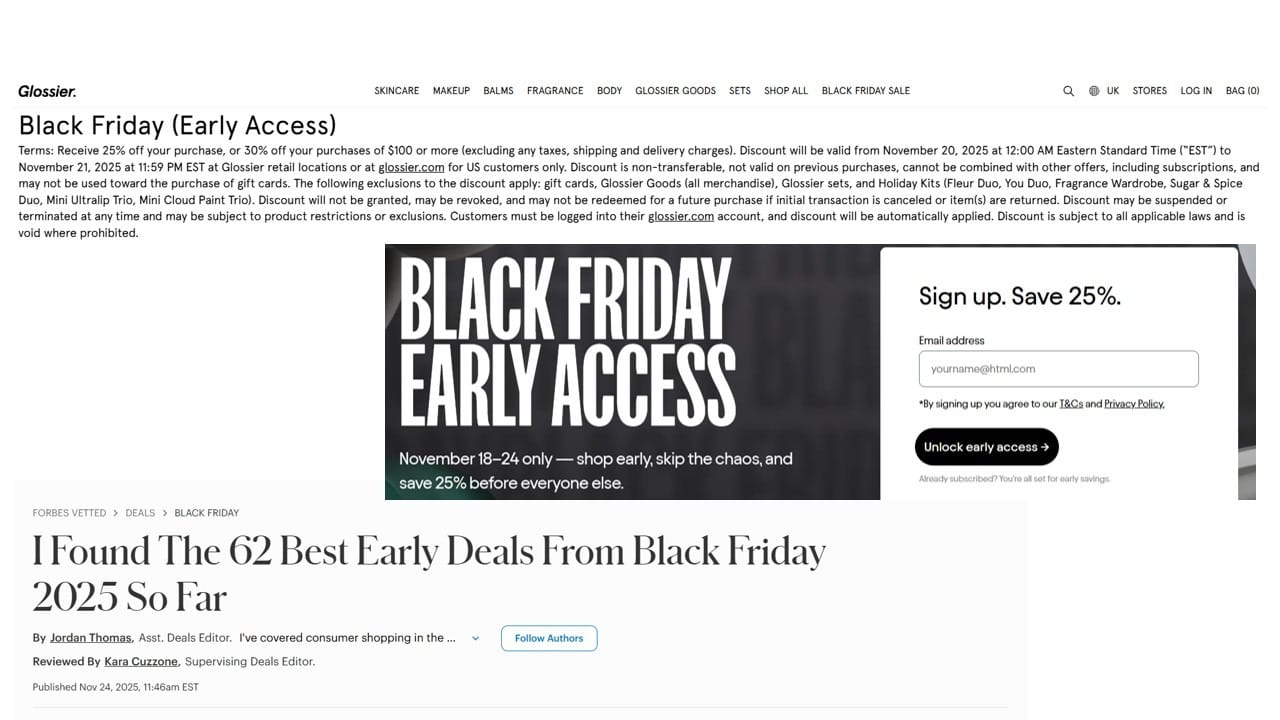

Gone are the days of those TV scenes showing people camping outside stores at 4 a.m. and wrestling strangers for the last half-priced espresso machine. This doesn’t mean consumers have stopped chasing deals, they’ve simply changed the battlefield. Black Friday remains both a retail and psychological event, still fuelled by the thrill of scarcity but increasingly shaped by smarter, more strategic and creative ways to save. And in 2025, no one is playing this game better than Gen Z.

Two-thirds of consumers planned to start their holiday shopping before Black Friday

According to the 2025 Deloitte Holiday Retail Survey, younger generations, particularly Gen Z, are shaping how and when holiday shopping happens. They’re not only the most deal-hungry group (with 95% seeking promotions), but they’re also redefining the channels where they discover products: turning to social media (74%) and AI tools (43%), as their primary shopping guides. Their growing use of Gen AI for price comparisons, product vetting, and deal prediction marks a shift in how consumers approach this event. Impulse no longer dominates this event; now, caution, practicality, a demand for maximum convenience, a sense of prioritisation, and an omnichannel experience are the drivers.

Holiday shopping is no longer a race for the biggest discount but a deliberate search for the right product at the best value, and these consumers not only take the proper time to compare deals, but they also prefer to close the purchase as soon as they believe they’re getting optimal value, even if that happens well before the official Black Friday date. McKinsey Senior Partner Emily Reasor highlights in the episode “Holiday shopping 2025: US consumers hunt for early deals” on McKinsey on Consumer & Retail, “Some of the latest data from ConsumerWise showed that two-thirds of consumers planned to start their holiday shopping before Black Friday. That’s a pretty staggering figure. Originally, Black Friday was the kickoff of holiday shopping, and now the majority of consumers are saying, ‘I’m going to start that process well before then.’”

The economic squeeze on this digitally native, AI-empowered generation is impossible to ignore. Gen Z’s average expected holiday spend has dropped by 34% year over year (2025 Deloitte Holiday Retail Survey). With budgets tightening, holiday shopping becoming more intentional, and better-informedthan-anyone AI tools, brands now face a critical question: how will they earn their slice of Gen Z’s carefully planned, valuedriven spending? And more importantly, are strategies like Black November and early-access events enough to capture a generation that shops early, compares relentlessly, and prioritises true value over flashy discounts?

Black Friday is increasingly shaped by smarter, more strategic ways to save

Fellow retail strategists: stepping into this new landscape requires brands to evolve in ways that go far beyond timing or discount mechanics. To stand out with a generation guided by precision, purpose, and digital fluency, retailers must shift from selling products to curating clarity. This means helping Gen Z navigate the experience through simplified choice architectures, fewerbut-better product assortments, and metadata-rich listings that make evaluation effortless for both humans and algorithms. In a marketplace defined by smarter shoppers with smarter tools, differentiation comes from elevating the experience, not amplifying the noise.