Gold: The age-old hedge we still can’t outgrow

Gold may seem like an outdated investment, but chaotic market conditions leave safety-seeking investors with few alternatives.

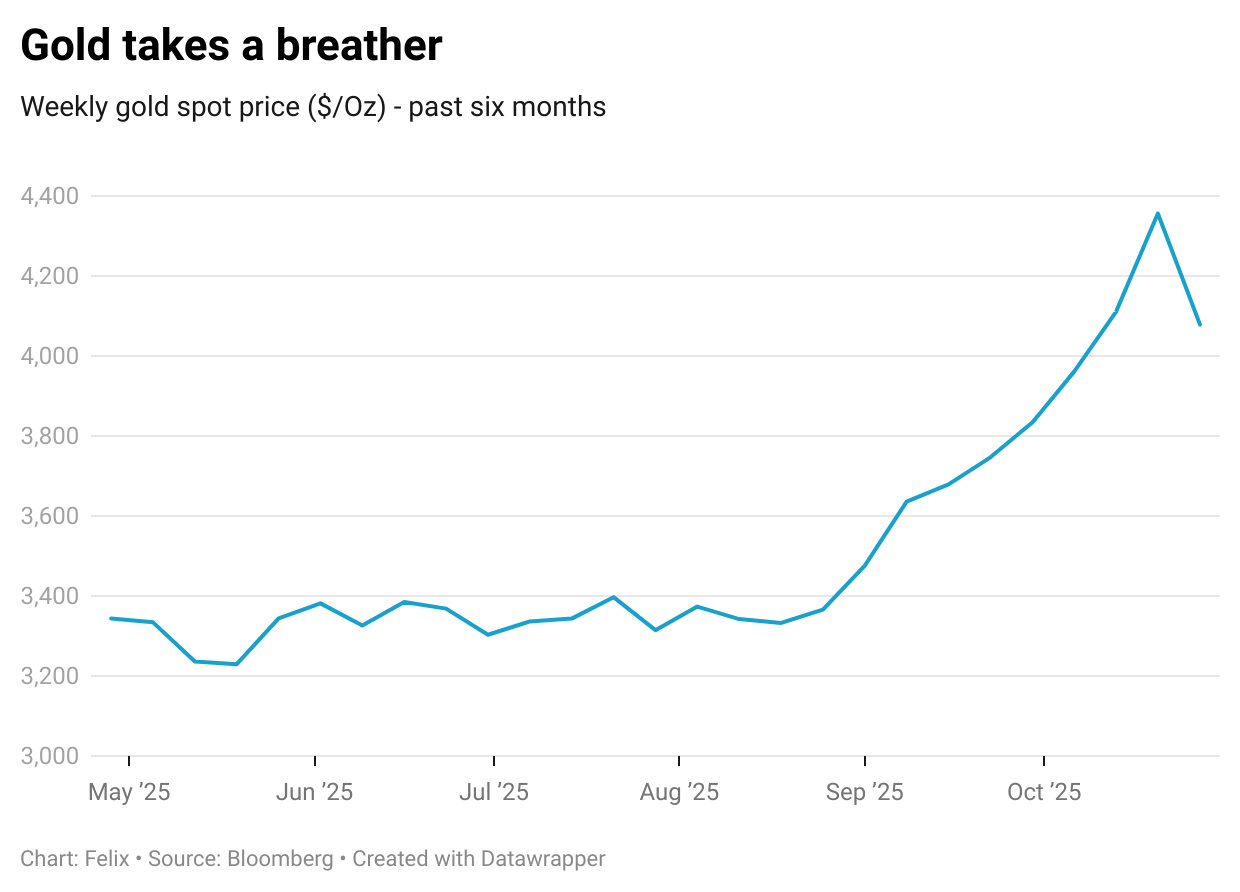

There’s a lot of talk about gold at the moment. Central banks, institutional investors, and retail buyers have been pouring money into the gold market this year. This all came to an abrupt halt on Tuesday 21st October when the gold price experienced its largest daily drop since 2020, though analysts expect the market to ultimately continue its climb after a brief correction period.

It seems strange that in our modern, increasingly digitised world, we still fly bars of shiny treasure from vault to vault around the world to give us a sense of safety. In addition, to feel extra safe, we even have to pay storage, security, and insurance fees . All of this for an asset with no productive value – in Warren Buffett’s words, “If you own one ounce of gold for an eternity, you will still own one ounce at its end.”

Unfortunately, we aren’t as evolved as we think we are. We continue to wage wars of conquest on each other, rule nations like hegemons, and panic en masse about everything going to hell. In plain terms: Persisting geopolitical uncertainty, piling government debt, Trump’s unpredictable tariff spats, inflation fears, rate cut speculation, and consequently unstable currencies (especially the traditionally “safe” US dollar) lead investors to seek a stable, liquid, and truly global asset. Amid such chaos, gold still seems to be their best bet.

Investors tend to go for gold because it is uncorrelated with riskier assets, like stocks or bonds. However, with the S&P 500 still rallying, the FT’s Ruchir Sharma wrote this week that gold and equity markets are, rather unusually, “partying together.” This can be explained by central banks’ and governments’ significant injections of cash into the market to stimulate the economy after the pandemic. Sharma says that this money is still circulating, and if Trump succeeds in pressuring the Fed to continue cutting interest rates, investors will be even more emboldened. In addition, he points to the “hyper-financialisaton” brought on by the growth of trading apps, which make it easier for everyday consumers to place their bets on markets.

Nonetheless, Sharma writes “there is no good story that too much money can’t spoil.” He is hinting at worries about a bubble forming in equity markets, largely driven by enthusiastic investment in tech companies promising to spearhead the AI revolution.

Sharma’s piece is one of many articles written this week that attempt to explain what is behind the gold market’s wild ride. Sharma’s colleague, the FT’s Katie Martin, however, thinks that all of this noise “represents a global outbreak of huge overthinking.” Times are uncertain, so investors want something that has historically proven to be resilient to uncertain times. Gold is just that, there’s no more to the story here.

Crypto evangelists (and some others, too) think that digital currencies could one day overtake gold as the “safe-haven” asset. Similar to gold, Bitcoin has a finite supply and is traded global markets that aren’t controlled by governments. However, we are still far from that being a reality – nowhere besides El Salvador treats Bitcoin as official legal tender, and digital assets remain highly volatile and unpredictable investments. Crucially, it hasn’t provided as strong of a hedge as gold to date, as nowadays its correlation with the stock market appears to have turned positive. It seems we’ll have to keep packing up our literal treasure chests in the meantime.