Implications of a hawkish shift by the ECB

What has the president of the European Central Bank, Christine Lagarde, been up to? Hye Oh discusses below

So, what’s been going on here? Let’s first talk about current Eurozone Inflation!

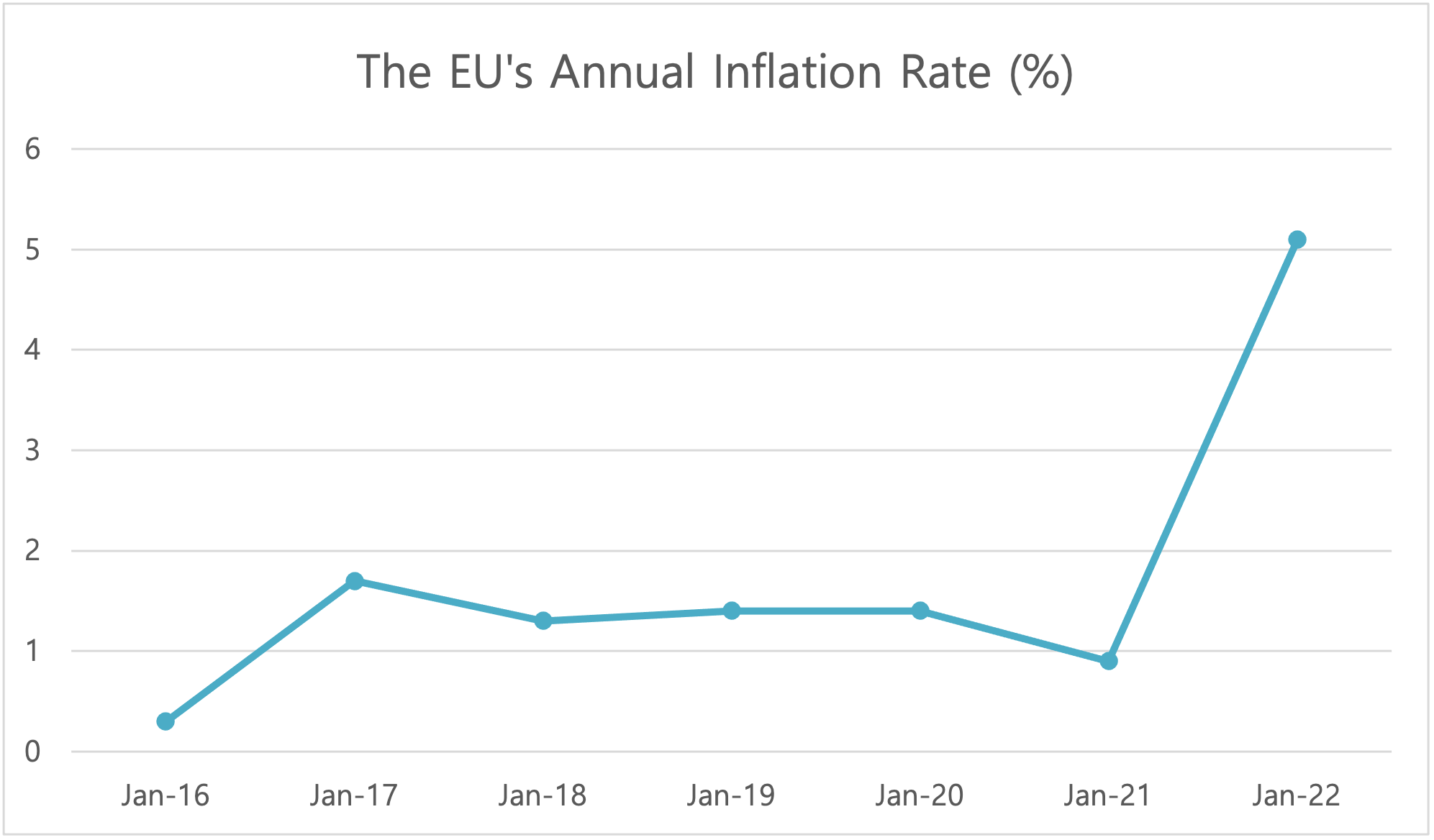

The European Central Bank (ECB) has executed 1.85 trillion euro quantitative easing policies to recover the European economy since Covid-19. It has been reported that the monetary policies were successful at reaching its target inflation rate of 2 per cent and at lubricating the eurozone’s monetary flows. However, recently, it is also reported that the European economy’s inflation rate has exceeded its ideal target rate.

As the figure above shows, in January 2022, the EU has reached the highest inflation rate, 5.1%, in six years, exceeding the ECB’s expectations. The overheating has resulted from quantitative easing. Even though the ECB has insisted to freeze interest rates at low levels until next year with a comment “every reason not to act as quickly or as ruthlessly”, it is predicted that persistently high inflation will push the ECB to raise their interest rates within this year.

So, what factors have driven inflation upwards?

Driving Factors of High Inflation

Energy prices in the eurozone sharply climbed nearly 30 per cent in early 2022. Europe has faced volatility in its energy markets. For example, European benchmark natural gas prices surged 30 per cent in early 2022 due to a cold winter, low gas inventories, and Russia’s limited supply to Europe. Colder weather has driven the increased demand for heating. Also, Europe is significantly dependent on Russia, which supplies close to 40 per cent of the EU’s natural gas and a third of crude oil. The heavy supplies from Russia via two major pipelines passing through Poland and Ukraine have been threatened by the border crisis between Russia and Ukraine, resulting in cost-push inflation and shrunken household budgets.

The EU’s supply chain is also critically dependent on China. The pandemic has led to disruptions in global supply chains. China has continued a zero-Covid policy leading to demand and logistics volatility during the Chinese New Year. Europe lacks Capex in production and shipping capacities. Especially, metals (basic metals and fabricated metals) and automotive sectors (motor vehicles, trailers and semi-trailers, and transport equipment) were hit the hardest due to a 10 per cent drop in Chinese exports to the EU. Also, the global trade of goods has been reduced by logistic bottlenecks caused by shipping congestions. To sum up, with the volatility in trade flows, consumer spending on durable goods and shortages of inventories repeated in a vicious cycle, giving birth to high inflation.

The outbreak of the omicron variant of coronavirus has weakened the labour market, causing possible wage increases in workforce sectors. The jump in infection rates exacerbated consumer spending such as international travel but triggered spending for consumer durables. Overall, the consumer spending drop was far less than the first outbreak of coronavirus as people feel less afraid of it due to its lower death rate and vaccinations. Furthermore, China’s first Omicron cases were reported last December. The new cases boosted the zero-Covid strategy, engendering disruptions on the EU’s supply chain.

Market Signals For the Hawkish Movement

There are market movements that indicate the possible rates increase in the eurozone. In January 2022, Germany, France, and Spain’s inflation rates exceeded expectations at 5.7, 3.3, and 6.1 per cent respectively, oppressing the dovish stance of the ECB. In addition, the EU’s unemployment rate hit a record low of 7 per cent last December signalling less supply of labour than the demand for it. This can lead to rising wage inflation in tight labour markets.

Furthermore, expectations of rates rise precipitated bond securities selling in the eurozone market. This is because the interest rates and the bond prices are in an inverse relationship. To illustrate, if current interest rates or bond yields were to rise, then the price of pre-existing bonds will fall down to attract investors who can potentially deposit their money to the banks which will enable them to offer higher rates of returns. Germany’s 10-year government bond yield, which is the benchmark of the currency bloc, rose to 0.313 per cent in February for the first time in three years. Also, Germany’s 2-year borrowing costs steeply surged to minus 0.248 per cent in February, hitting a record high in six years. The increased bonds’ yields reflected high inflation and expectations of the potential rise in the ECB rates.

Finishing Words

Just a few weeks ago, the ECB president Christine Lagarde emphasized that the EU economy would stabilize and the inflation would fall off before the end of this year. However, in early February, the head of the ECB refused to rule out a potential interest rate rise this year reversing their stance. If soaring inflation and supply chain disruptions continue, the ECB is likely to turn to a hawkish stance this year.

Hye Oh is a writer for the Investment Society’s Writers’ Team.