More on US market indexes

This is because a New York Post tweet was taken down as it looked like a hacked tweet. On the other hand, Tammy Baldwin, Wisconsin Democrat senator, said “I believe the Republicans have called this hearing in order to support a false narrative fabricated by the president to help his re-election prospects, the tech companies here today need to take more action, not less.” Outside of political debate, the hearing served as an evaluation of Section 230 of the 1996 Communications Decency Act, a law that gives tech platforms immunity from being sued over user-generated content. Speaking to Section 230, Mark Zuckerberg called on Congress to “update the law to make sure it’s working as intended”. On the other hand Jack Dorsey said that eroding the foundation of Section 230 could collapse how we communicate on the internet, leaving only a small number of giant and well-funded technology companies.”

This would be a terrible situation for tech companies worldwide if not dealt with carefully. Furthermore, the hearing could result in additional pressure on companies to more carefully censor political ads which could have an impact on the election. However, the latest polling average puts Biden ahead of Trump nationally but again this does not guarantee a Democrat victory.

At the same time, the Department of Justice received bipartisan political support in filing an antitrust suit against Google (and similar things are happening in the EU). Google was accused of anti-competitive practices. Ironically after the news hit, shares of Google’s parent company Alphabet Inc. climbed 1.4%.

US ELECTIONS ARE NOT PRETTY FOR MARKETS

Why did this happen? Firstly, the lawsuit was already expected by investors and it was ‘priced in’ to the share price. There is also speculation that the lawsuit won’t hurt Google’s revenues from its leadership in search advertising. Mark Shmulik, an analyst at Sanford C. Bernstein, told investors on Tuesday that the firm sees limited risk” to Google from the suit. However, it could also end much worse for Google if it gets split up into separate, smaller companies such as Maps, Search, Youtube, Android OS and Chrome.

In conclusion, these are truly volatile times and especially for tech stocks which are renowned for their high beta values (standard deviation from the mean share price), and this can be seen also in VIX (Chicago Board Options Exchange’s CBOE Volatility Index (this reflects stock market’s expectation of volatility based on S&P 500 index options)) reaching high values of almost 40. The aforementioned fall in NASDAQ could be due to the worse-than-expected earnings released by many companies. Be sure to keep following the markets closely through the remainder of the election period, as very interesting things will undoubtedly happen.

Major stock indexes play a huge role in investment as we saw with Ant Group’s suspended IPO earlier this week, with so much demand among institutional investors as Chinese investors saw them as a must-have. Had the IPO not been suspended following a call from Chinese regulators, the stock price would have shot up further. lowing public trading on the indexes.

I’m too embarrassed to ask - what is a market index?

A market index effectively follows the performance of a basket of stocks, using a collection of numbers which are representative of different components’ weighted values.

Here, the kinds of components can consist of shares, commodities and bonds. However, investors often follow different market indexes to track market movements due to the fact that market index numbers are able to indicate the rates of both GDP growth and inflation.

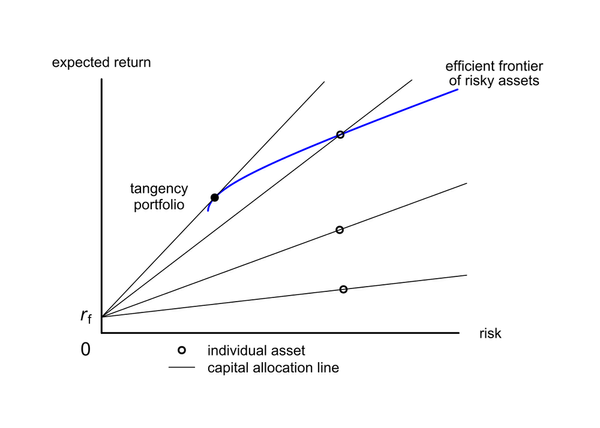

Major market indexes that investors are familiar with include the Dow Jones, Industrial Average, NYSE Composite Index, Financial Times Stock Exchange Index and Nikkei Stock Average. Market indexes are used by investors as a basis for portfolio or passive index investing, in that they are treated as benchmarks so then alpha returns can be tracked relatively to show profits or deficits. Constructing individual indexes would depend on the relevant party yet most fund managers utilise weighted average mathematics via several constituents. In recent times, many sustainable investments funds employing ESG (environmental, social and governance) factors have made the shift to track more environmentally friendly indexes such as the MSCI (Morgan Stanley Capital International) ESG indexes.