Precious metals and oil during the pandemic

Investment contributor Will Stoffberg explores the effect of the pandemic on metals and oil

Warren Buffett once said, “[Gold] gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility.”

So what exactly happened to gold earlier this year?

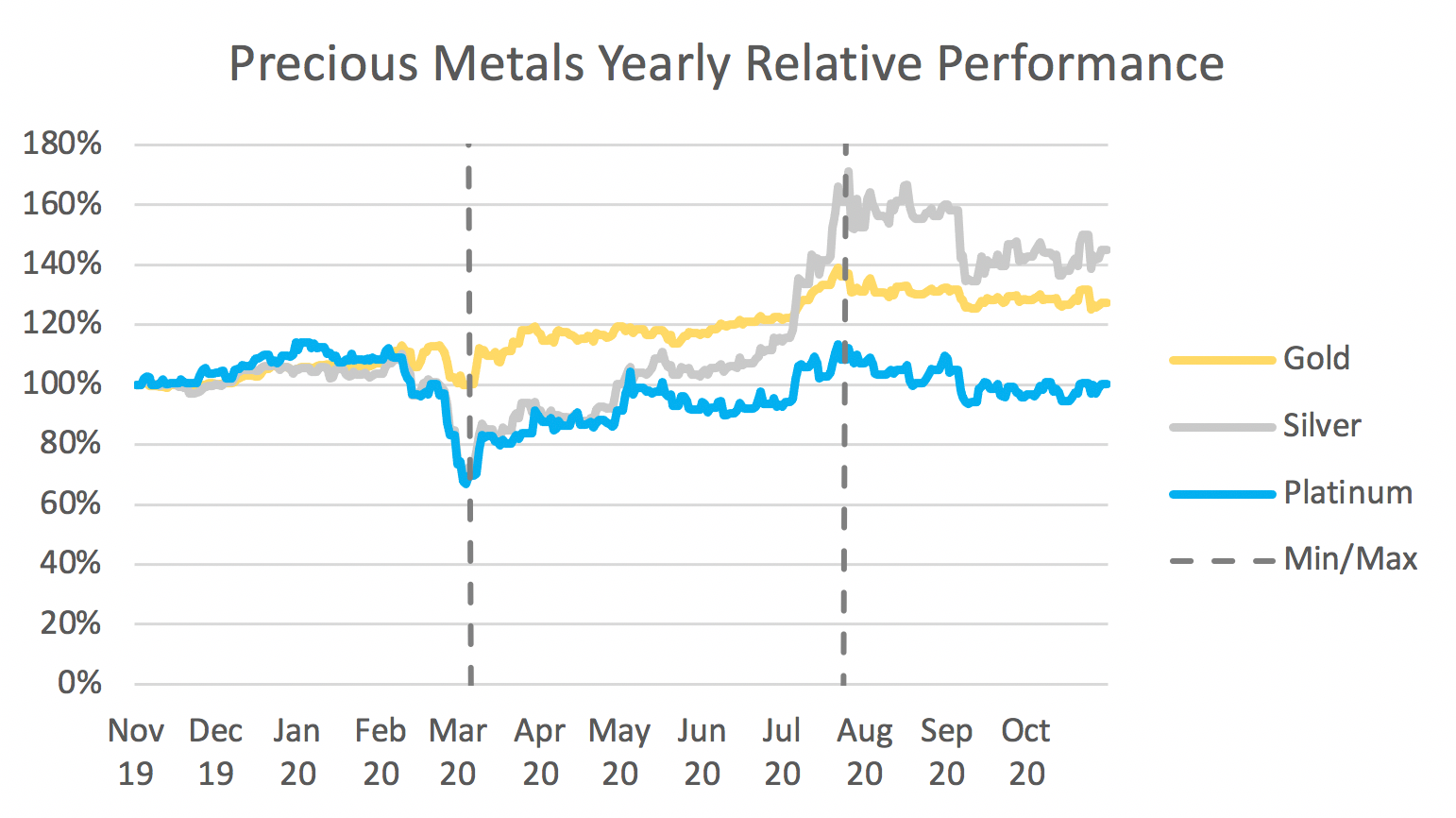

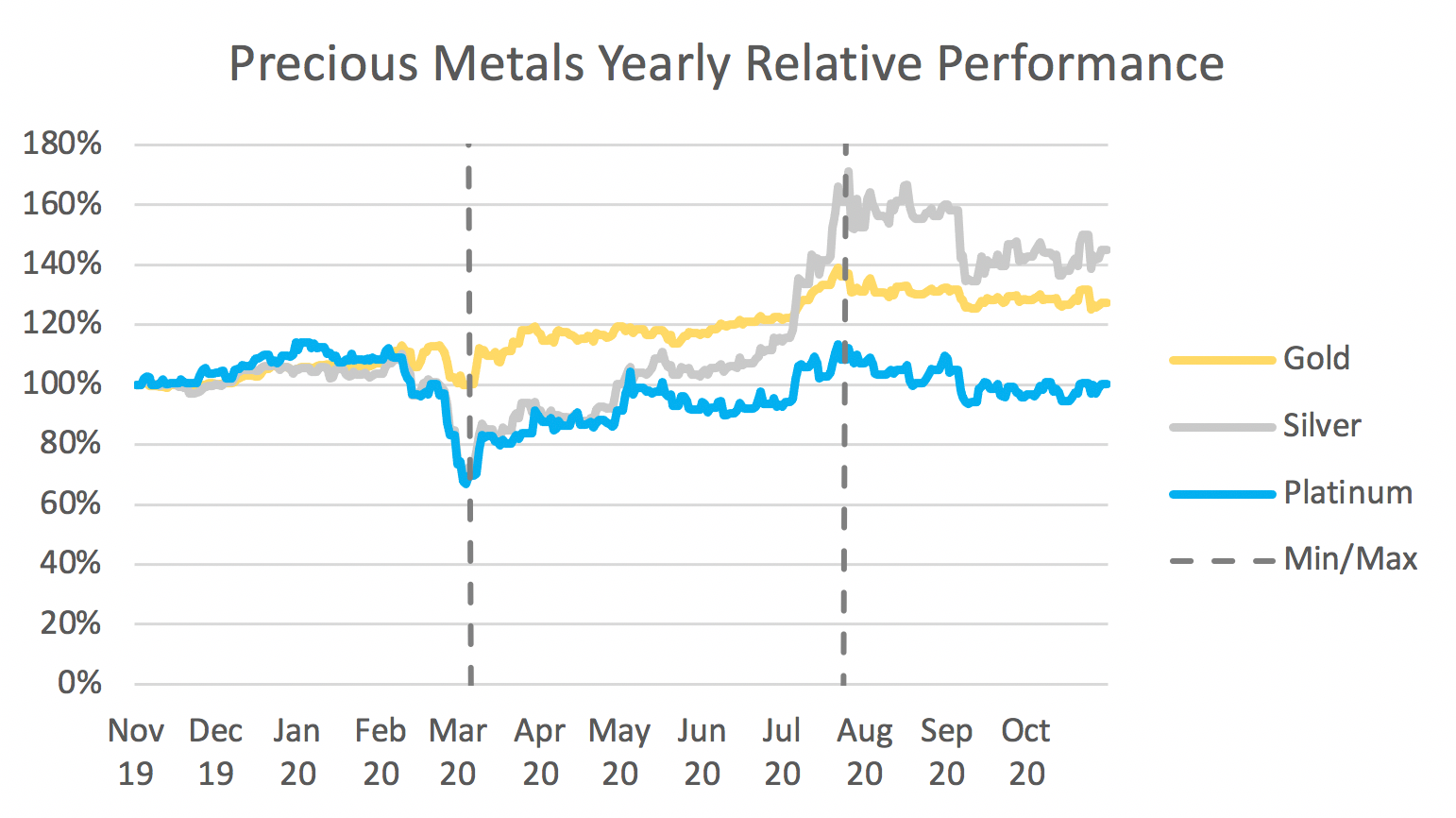

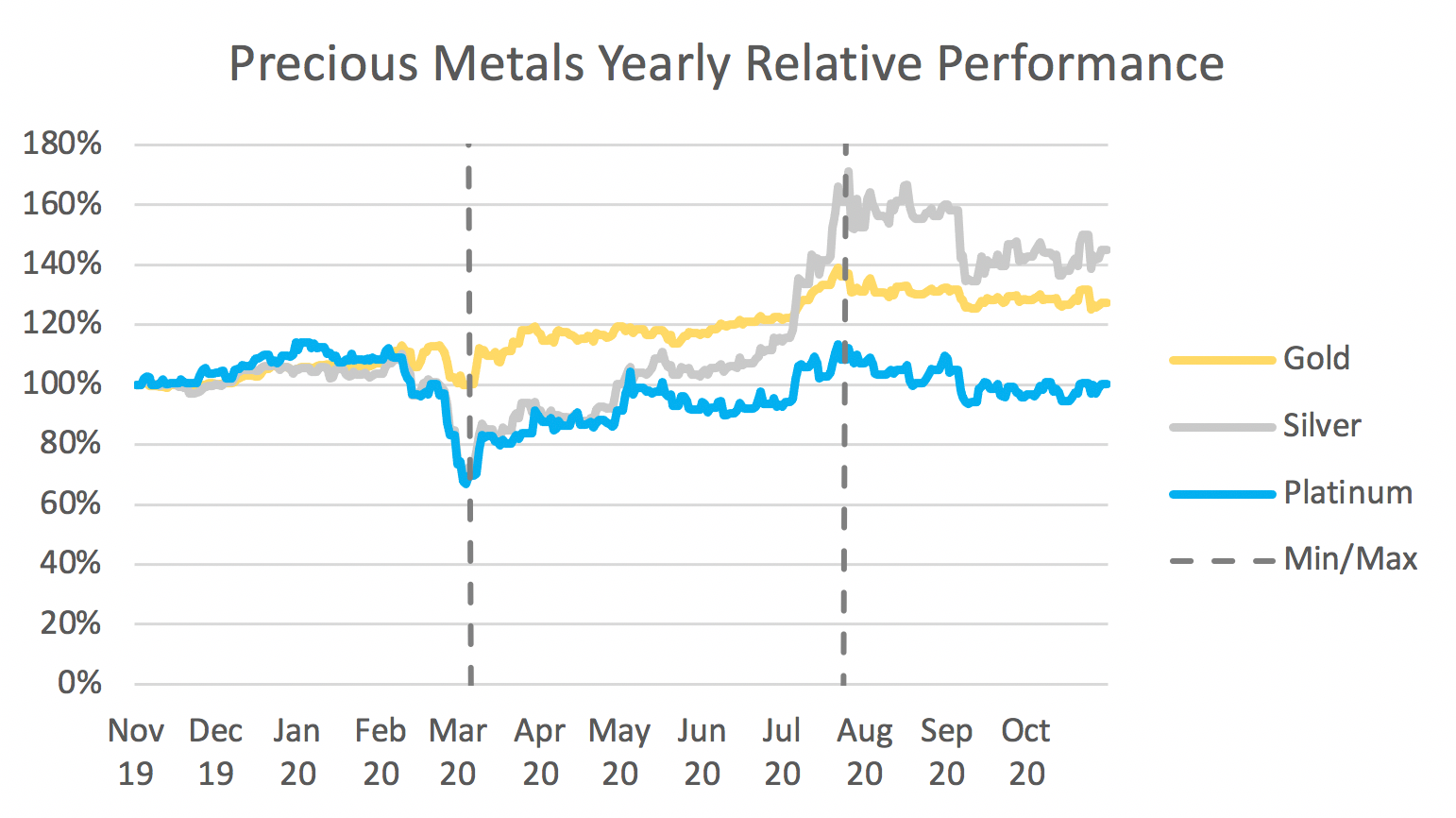

On 6th August, gold reached an all-time high of $2,067 an ounce. Soon after on 31st August, silver surpassed $28 an ounce, a seven-year high. Safe haven assets such as precious metals have been popular during the pandemic. Figure 1 shows the relative performances of gold, silver and platinum over the last year. Lows can be seen in March, just as the pandemic began taking hold and affecting markets globally, but since then have been growing, significantly so in Q3, before stabilising.

Worries about a second wave in September caused prices to fall slightly

The jump in this quarter arose due to major banks maintaining their expansionary monetary policy stances and long-term bond yields falling and approaching negative territory. While jewellery and, in the case of gold, bank purchases were down, there were record investor inflows into ETFs backed by silver and gold. Additionally, the recovery of industrial activity has led to the return in demand for silver and platinum.

Supply of precious metals was also affected. Recycling was restricted due to concerns of the virus spreading through the labour force and for similar reasons mining was disrupted. Gold mines in Mexico, Peru and South Africa were disrupted, and in the case of South Africa being the largest producer, platinum was also affected.

The World Bank Group is predicting stable prices for gold and platinum in 2021 as the economy recovers. Silver is expected to drop around 14%.

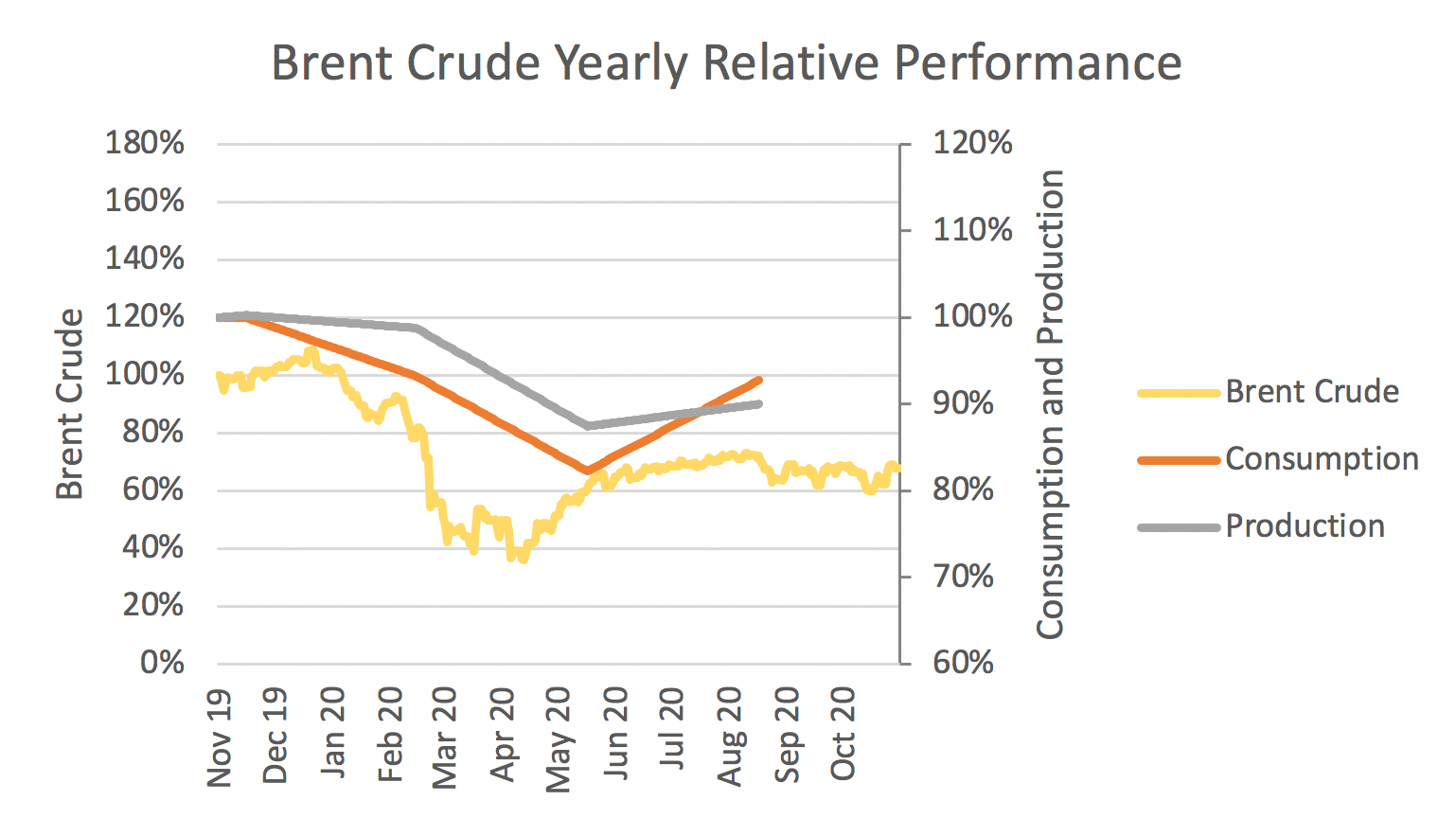

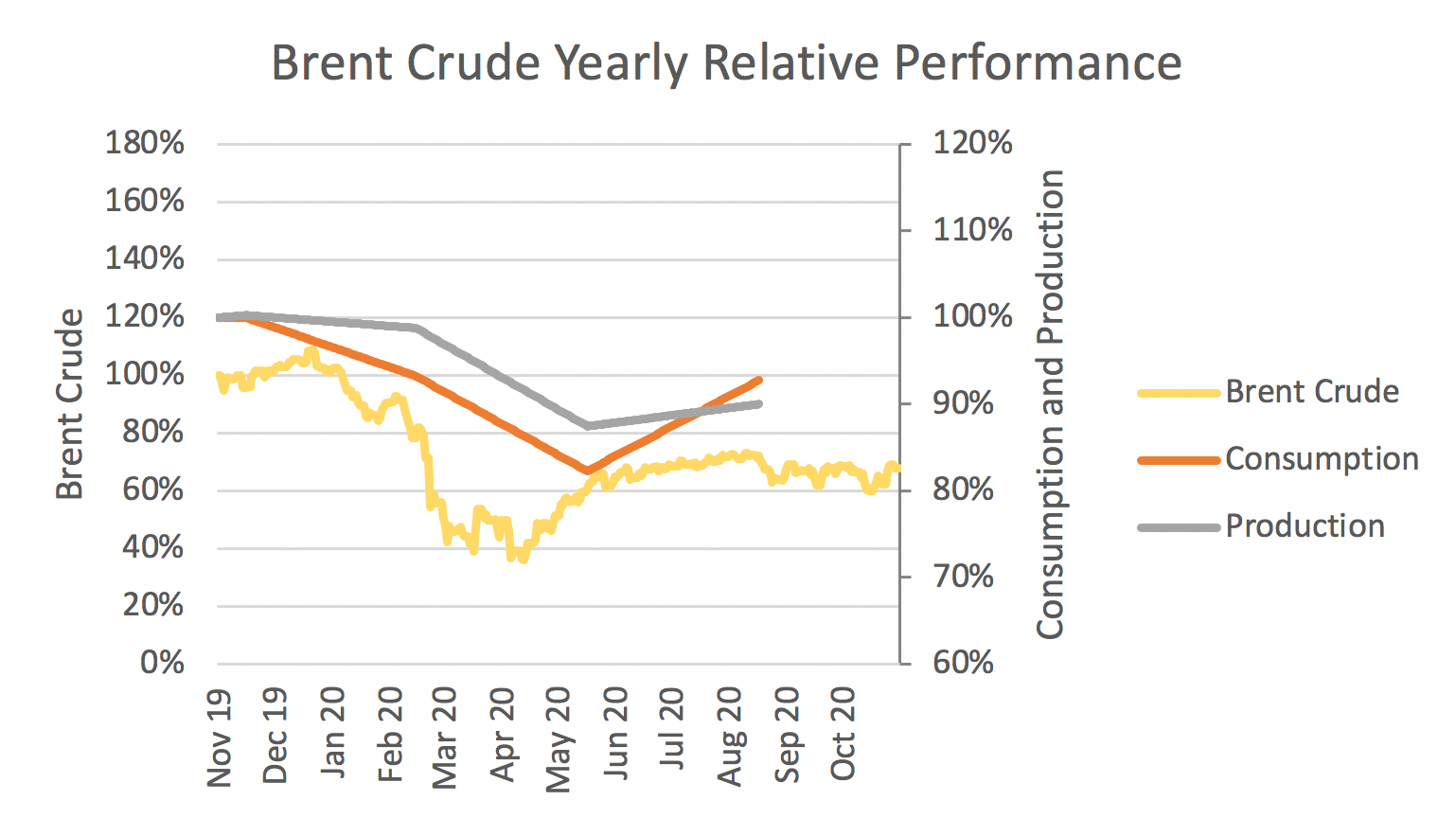

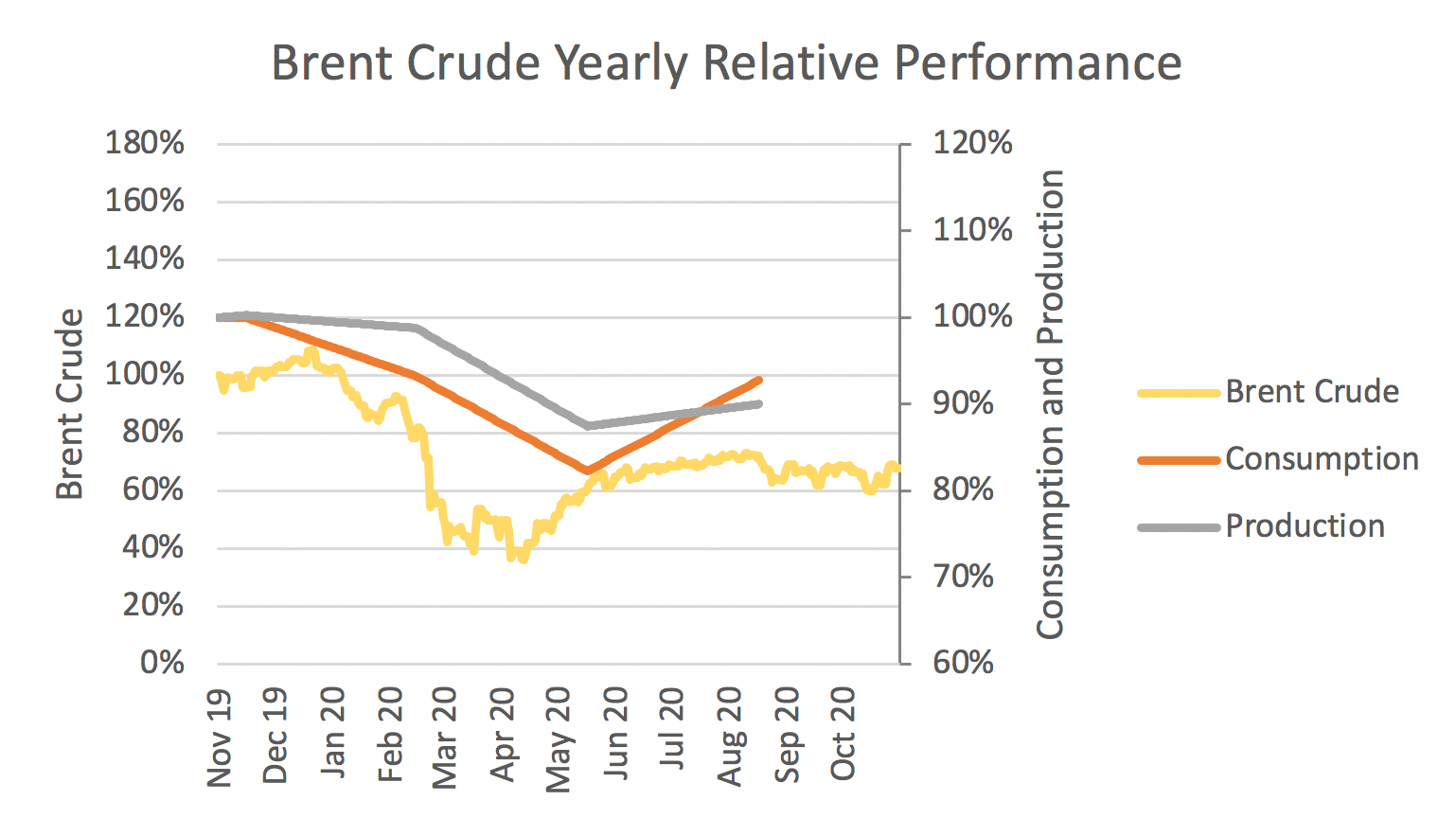

Global consumption of crude oil plummeted in 2020 Q2 by 16% as a result of COVID-19 lockdown measures, severely affecting oil prices (Figure 2). The fall in consumption was most notable in transport fuels, particularly jet fuel which fell more than 60% as a result of the collapse in air travel. Diesel consumption was the least affected given its main use is to transport goods by road and ships, but still declined by nearly a quarter.

In response to this, global oil production dropped by 12% in May. OPEC and OPEC+ collectively agreed to production cuts of 20% (9.7mb/d). Non-OPEC countries such as USA and Canada also cut production by 20%. The OPEC group increased production by 2mb/d in August and plan another increase in January 2021, depending on the rate of economic recovery.

Oil consumption has started to recover as lockdown measures are lifted. Crude oil prices were nearly 40% higher in 2020 Q3, although they remain around 30% below their pre-pandemic levels. Worries about a second wave in September caused prices to fall slightly.

Oil prices are expected to average $44/bbl in 2021, still significantly lower than their 2019 level of $61/bbl. Demand will be lower in almost all countries in 2021 than in 2019, with the notable exception of China. However, oil prices and consumption are very sensitive to economic changes and vaccine progress.