The insulin controversy in the US: a financial tug-of-war

On the rising prices of insulin in the US and the impact on both companies and patients.

Insulin, a hormone critical for diabetes management, has become a highly contentious issue in the United States due to its soaring prices. Despite its discovery over a century ago with an initial intent to keep it affordable from its discoverers, the cost of insulin has escalated dramatically in recent years.

Price surge

Insulin was discovered in 1921 by Dr Frederick Banting and Charles Best. Their patent for insulin was sold to the University of Toronto for just $1, reflecting their commitment to making it affordable. Over the past two decades, insulin prices have increased by over 600%. A vial of Humalog, which cost about $21 in 1996, now exceeds $300 in some states. A study by the Health Care Cost Institute found that between 2012 and 2016, the average price of insulin nearly doubled, from $2,864 per year to $5,705 per year for patients with type 1 diabetes. According to the American Diabetes Association, approximately 7.4 million Americans with diabetes rely on insulin. For many, these rising costs are unsustainable and can lead to dangerous practices like insulin rationing.

Key players in the insulin market

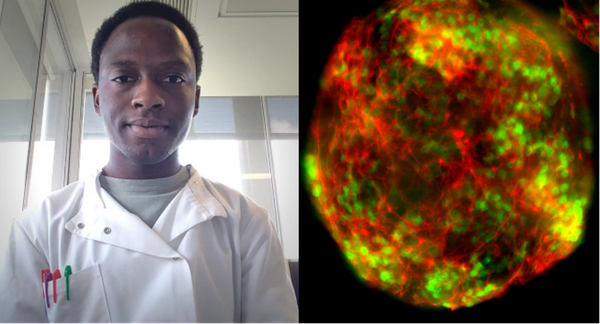

The insulin market in the US is dominated by three major pharmaceutical companies: Eli Lilly, Novo Nordisk, and Sanofi. These companies have been at the centre of the pricing controversy, with critics accusing them of exploiting their market power to

maximise profits. While these companies argue that high prices are necessary to fund research and development, the financial benefits they reap suggest a more complex picture. According to a 2019 Senate Finance Committee report, Eli Lilly, Novo Nordisk, and Sanofi spent significant amounts on lobbying efforts to influence legislation related to drug pricing – further entrenching their market power.

Pharmacy Benefit Managers (PBMs) and Health Insurance Companies

Pharmacy Benefit Managers (PBMs) play a critical intermediary role in the pharmaceutical supply chain. They negotiate prices between drug manufacturers and insurance companies, ostensibly to secure lower costs for consumers. However, PBMs have been criticised for their opaque pricing mechanisms and rebate structures, which can contribute to higher out-of-pocket costs for patients. Health insurance companies are also key players in the insulin pricing controversy. They determine the formulary, or the list of medications covered by insurance plans, and negotiate with PBMs and pharmaceutical companies to set prices. Insurers benefit from the current system by passing on higher costs to consumers through higher premiums, deductibles, and co-pays.

Impact on patients

The financial strain on patients is perhaps the most devastating aspect of the insulin pricing controversy. Many diabetics face monthly costs of hundreds or even thousands of dollars for insulin, forcing some to ration their doses or forego the medication entirely. This can lead to severe health complications including diabetic ketoacidosis, hospitalisation, and even death.

A 2018 study published in JAMA Internal Medicine found that 25% of diabetic patients reported using less insulin than prescribed due to cost concerns. This statistic underscores the severe impact of high insulin prices on patient health. Additionally, a survey by the non-profit organisation T1International revealed that nearly one in four Americans with diabetes have rationed insulin due to its high cost.

Addressing the insulin crisis requires comprehensive reforms to increase transparency, promote competition, and prioritise patient access to affordable medication. Only through concerted efforts can the original vision of Banting and Best – making insulin accessible to all who need it – be realised in today’s healthcare landscape. The current system’s complexity and the significant financial interests at stake make this a challenging issue to resolve, but the health and lives of millions of Americans depend on finding a sustainable solution.