From Lockdown to Heads Down: Time to Repent for Fiscal Extravagances

The UK has largely weathered the storm of the medical crisis and must now turn its attention to reintroducing a sustainable economic condition

Contact: felix.business@imperial.ac.uk

The UK has largely weathered the storm of the medical crisis and must now turn its attention to reintroducing a sustainable economic condition

Investment contributor Marios Papadopoulos explains the difference between active and passive equities and the different returns that can be expected from them

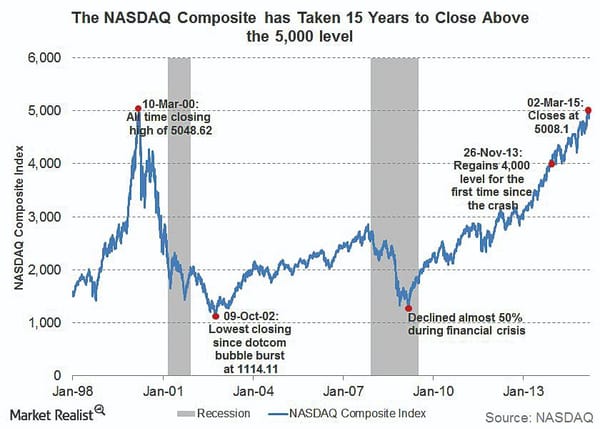

Marios Papadopoulos analyses the similarities and differences between the current tech market and the Dotcom Bubble of the late 90s

The old adage “Do not place all your eggs in one basket” is probably one of the most important things to remember when investing. It is easy for beginner investors to see gains in a particular stock and have the urge to allocate more of their funds into it, hoping

Private equity and venture capital both refer to investments by individuals or firms/institutions in companies. However, the scale of the investment and the stage of companies they invest in differ. Private equity You can think of it as equity that is held privately, either by wealthy individuals or firms.

Non-traditional banks, such as Revolut and Starling, among many others, have disrupted the banking industry. Banking had traditionally been a difficult sector for startups due to the regulations that dictated the establishment and operation of a bank. Following the 2008 financial crisis, regulatory frameworks around the world were significantly overhauled.

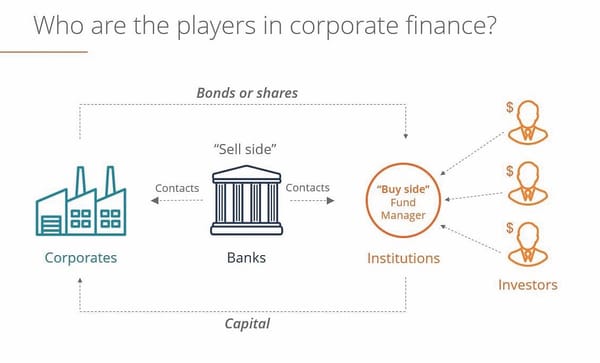

Above: Figure 1: How the buy-side and sell-side bridge the gap between corporates and investors With such a huge focus on the sell-side nowadays (both in terms of career opportunities as well as industry-related news), the other part of the global financial industry, the buy-side, is oftentimes overshadowed and forgotten.

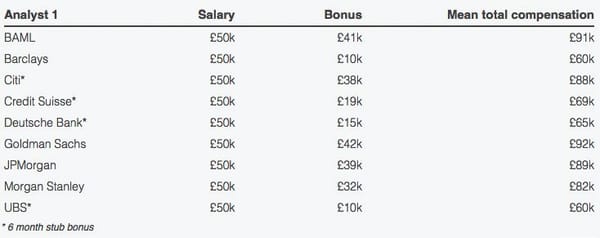

Above: Figure 1: Your friend who recently scored a full-time offer is buying the next round at the Union What are Investment banks and why should you care? Investment banks are financial institutions that provide two main services; brokerage and corporate advisory. Corporate advisory There are three main services that

If you’ve flicked past all of the puzzles and literally every other section to get to Investments, well then I know you’re probably a banker w*****. All jokes asides, if any of you have read more than 3 articles on FT or spoke to a Business School student

Cryptocurrencies are digital assets which are intended to be used as a medium of exchange. Traditionally, the supply currency can be controlled by a central bank or the government, however this is not the case with cryptocurrencies. Within this system, the safety solely lies in the hands of parties called

The Foreign Exchange market (Forex or FX) is an over-the-counter market in currency-pairs which is the largest and most liquid market in the world. An average of $5.1 trillion is traded every day, compared to $84 billion traded daily in equities’ markets. Like how you might trade in sterling

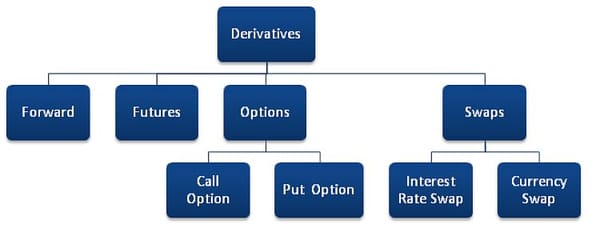

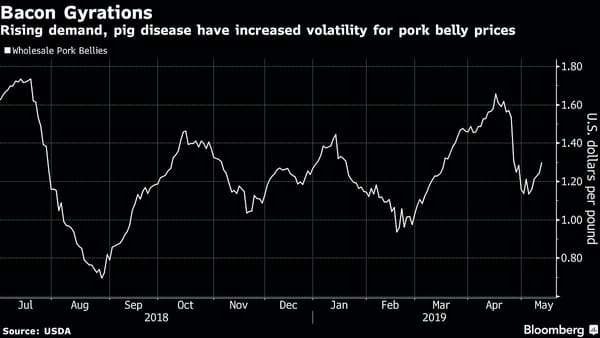

Above: Figure 1: The increasing demand for pork belly has led to large gyrations in prices Pork bellies – yes, the pork that comes from the belly of a pig, was an iconic commodity for the futures market’s representation in pop-culture. While it might be surprising that the financial market