From PSY to GameStop: Irrational Exuberance

In 1996, former Fed chairman Alan Greenspan popularised the term “Irrational Exuberance”, describing the unfounded market optimism that lacks a real foundation of fundamental valuation but instead rests on psychological factors.

One key lesson we can take from this is being wary of a herd mentality, and always sticking to your long term investment strategy as opposed to trading.

Economist Robert J Shiller, an author of a book with the same title, defines a bubble as “a social epidemic that involves extravagant expectations for the future.” As a strong proponent of the study of behavioural finance, he forecasted the financial crisis of 2008. However, he says that the hallmarks of a classic bubble aren’t present today, such as the talk of a “new era” for the economy. In this article, I hope to explore some examples of behavioural finance in action as well as some techniques in understanding your own biases and protecting yourself against them.

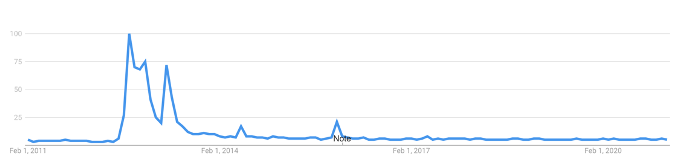

To begin I’d like to bring your attention to DI Corporation, a South Korean semiconductor company. Between 2012 and 2013, the CEO, Park Won-ho saw an 800% increase in the share price of his stock. Doing a fundamentals earnings analysis at the time, we can see no significant change in the company vision or its financials. Economists Andy Kim and Ho Sung Jung published a paper revealing that the performance of its shares can be attributed to the “investor recognition hypothesis.” Essentially, it argues that investors are more likely to buy and sell stocks that they know about. DI Corp came into the eyes of the public thanks to the CEO’s son releasing his hit single ‘Gangnam Style,’ weeks since the stock skyrocketed. And a second peak appeared after he released ‘Gentlemen’ in April 2013. Compare the ticker prices with the Google Trends looking at the popularity of PSY in the US below:

As you can see, the popularity meant that DI Corp’s stock price still ended higher on average than it was after PSY’s fame diminished. This is because of sustained increased demand from foreign investors, particularly from the US. Looking back at the rise, this is a classic example of 2 biases: familiarity and disposition bias. Familiarity bias dictates that investors tend to invest in what they know, whether that be domestic companies or famous tech companies - a good way to protect yourself against losses through this avenue is diversifying your portfolio properly, spreading your risk is crucial. Disposition bias says that investors think they are right when prices rise and are reluctant to accept their mistakes in the case of a loss - riding DI corp at its highest point would have proved fatal without protecting yourself against potential windfalls with stop-loss orders or suitable hedges.

One key lesson we can take from this is being wary of a herd mentality, and always sticking to your long term investment strategy as opposed to trading. With GME shares rallying 18% this Monday as well as the incredible rally in late January, we can see that short-seller mark-to-market losses have now reached 5.1 billion USD according to S3 Partners. Last month we read about GME’s short squeeze - when a rising stock price forces people who had sold the stock short to buy back those shares, driving stock prices higher. However, because of the potential for this, some investors who short stocks don't simply sell a stock, but rather they cover their shorts by buying long, offsetting, out-of-the-money call options (contracts that allow them to buy GME at a higher-than-average price but below the price which it shot up to in late January). This forces the market maker on the opposite side of that options trade to buy more shares to hedge, which in turn causes the stock to rise more. When asked about this, Dan Egan, an MD focusing on investor psychology said “Nobody has been saying GameStop is a great stock, they are just systematically looking at stocks with high short interest and trying to screw hedge funds. They are not fighting over fundamentals. This started as, let’s screw the hedge funds, but this has gone beyond that. Once the stock started going way up, it attracted momentum traders and the FOMO crowd.”

This ‘FOMO crowd’ is a perfect example of regret aversion; Regret aversion refers to how investors’ anticipation of a particular regret in the future impacts their decision making in the present. This bias is exacerbated in communities like Reddit where screenshots of profits showed users what they were missing out on. Furthermore, while it’s easier to understand the institutional investors’ short position, the retail investors’ long position is less motivated by fundamental analysis. Individuals are trading based on current events, in the hopes that current stock price rallies will extend into the future. Finally, humans tend to feel twice the pain from a loss than the pleasure from an equivalent gain. This again leads investors to hold and avoid ‘locking in’ their losses which is a dangerous game to play. While I do not necessarily believe GameStop is a bad stock to invest in, I believe you should be able to justify your investment in it with fundamentals as opposed to predicting how the rest of the public will affect prices.

In conclusion, it is important to be aware of your biases when managing a personal portfolio, especially in a social media fuelled economy where it’s easy to trade impulsively. I will leave you with a quote from Robert J. Shiller's Irrational Exuberance, “In the future, we will surely have even bigger such bubbles, each built up around its new and different new era story, and we will have to invent new names for them.”