A dinosaur on Regent Street: Coach's case on organic growth

Examining the intersection of creative bravery, D2C capabilities, and new audience acquisition.

Contact: felix.business@imperial.ac.uk

Examining the intersection of creative bravery, D2C capabilities, and new audience acquisition.

London’s loss is Milan’s gain when it comes to ultra-wealthy Europeans displaced by Brexit.

As a window of enforceability opens, the country’s most valuable assets are not oil fields or factories, but unpaid claims.

From AlphaGo to AlphaFold, AGI’s next frontier could be reshaping financial markets.

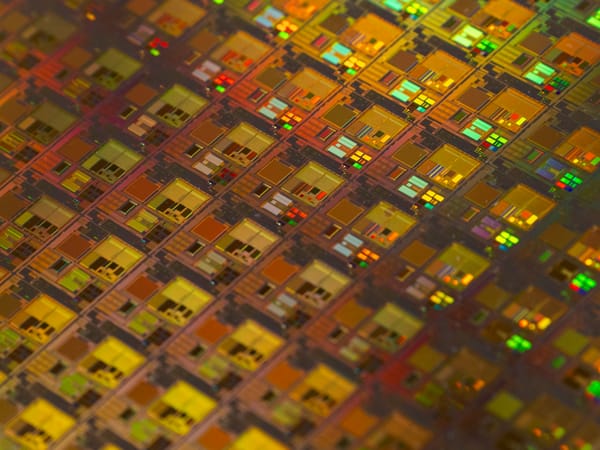

Nvidia releases blowout earnings, but markets remain hesitant

AI, convenience and cost-consciousness are the driving forces behind this shift.

As legacy systems continue to throttle global trade, the onus falls on young innovators to revolutionise the seas.

Budget noise rattles markets again

Jittery market sells AI stocks

Leaked draft of European Commission’s Sustainable Finance Disclosure Regulation (SFDR) revamp shows reform of many of its most controversial features.

Despite deep savings and years of integration, Europe still struggles to turn its financial strength into economic power.

Big tech earnings outshine Trump-Xi summit