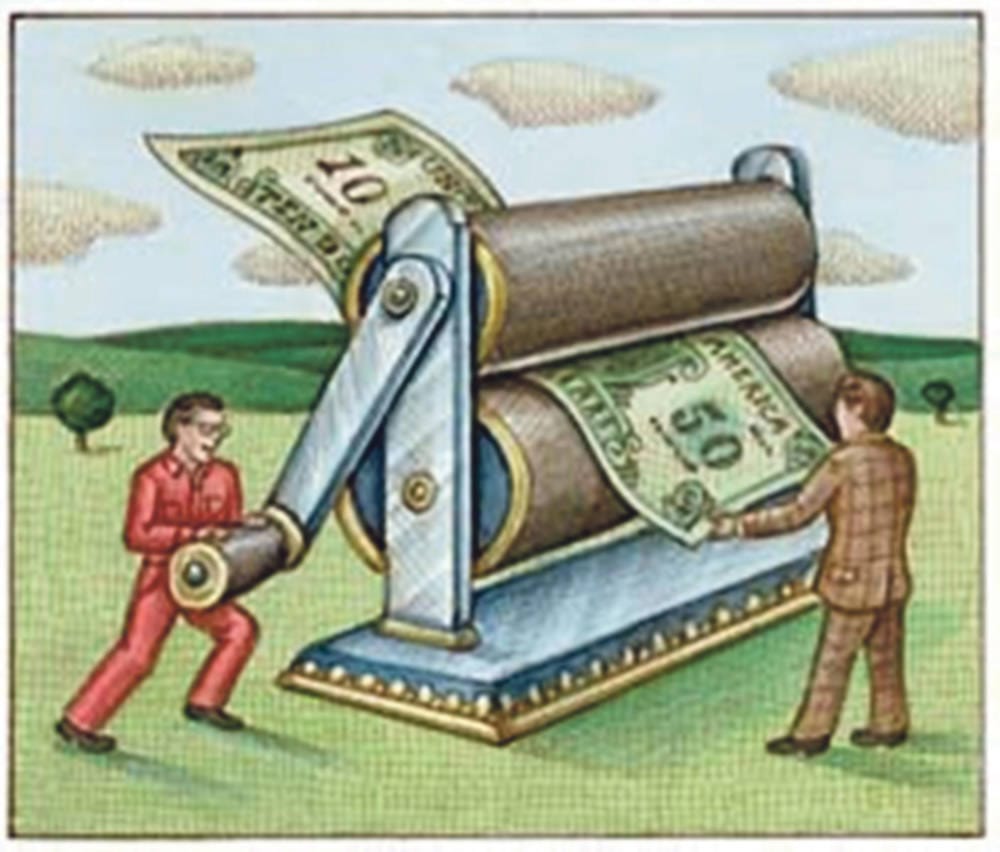

Printing money to pay debt

The U.K. need not worry about its deficit

This year will be the toughest year for the eurozone ever. Since the financial crisis in 2008, the US and Europe have suffered from a serious recession. In fact, the PIIGS (Portugal, Ireland, Italy, Greece and Spain), especially Greece and Ireland, are now at the fiscal brink, and they have called for a bailout from the EU and the International Monetary Fund (IMF).

Now we, the Europeans, should consider why they face debt woes and what the best solution to this problem is. Essentially, the European debt problem lies in the fatal defect of the eurozone, that is, only the European Central bank(ECB) can issue euros in that region. In other words, each country which joined the eurozone cannot print banknotes. Therefore, if a nation in that area accumulates large governmental debt by issuing governmental bonds, the country cannnot discharge it by printing money. Such a separation of fiscal policy with financial policy is the fundamental problem which overshadows the eurozone.

Unlike the eurozone, the UK can print money and pay the debt whenever it wants to do. George Irvin, a columnist of Guardian.co.uk, says “Every schoolboy knows (or should know) that government cannot “go broke” like a private business. As long as Britain has its own currency, it has the power to print money.” Then some readers may worry about inflation after quantitative easing, but basically inflation means not only expansion of monetary base but also an increase in income level, that, is a recovery from recession.

The other major problem regarding the present euro system is that some countries in the eurozone cannot have the benefit of devaluation. In general, a country increases its supply of money by printing banknotes, the value of them decreases, compared with that of other countries. Such a devaluation makes the country competitive in terms of export, but unfortunately the eurosystem doesn’t permit this.

In the 1990’s, Ireland’s current account balance was in surplus, but since the country launched the euro currency in 1999, it has been in deficit. In particular, during the year of the US financial crisis, the figure worsened to -5.5% of GDP. The country lost the advantage of exchange rate in terms of export because it joined the euro zone.

The same holds true for other eurozone nations. Prof. Paul Krugman, the Nobel economics prize winner in 2008, says “If Spain still had its old currency, the peseta, it could remedy that problem quickly through devaluation — by, say, reducing the value of a peseta by 20 percent against other European currencies.” If Spain readopted the peseta, it could expand its monetary base to the extent that it wants to, which would lead to a recovery of export. Iceland, whose banks went bankrupt in 2008, has a little better economic situation than Ireland does.

Even though the change of GDP in Iceland is slightly worse than that of Ireland, the employment of the former is better. Unlike Ireland, Iceland decided to let foreign lenders to its runaway banks pay bad private debts, rather than putting its own taxpayers on the line to guarantee the debts.

As the IMF notes approvingly, “private sector bankruptcies have led to a marked decline in external debt.” In addition, Iceland has also benefited from the fact that it still has its own currency; devaluation of Iceland krona, which has made the nation’s exports more competitive, has been an important factor in limiting the depth of Iceland’s slump.

Even though George Osborne, the chancellor of the exchequer, claims that Britain is close to bankruptcy, UK’s debt problem is different from that of PIIGS, and UK citizens need not worry about the nation’s deficit.